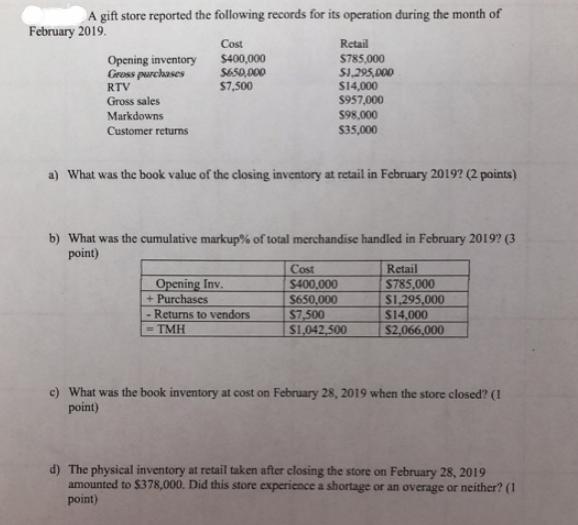

Question: A gift store reported the following records for its operation during the month of February 2019. Cost $400,000 S650,000 S7,500 Retail Opening inventory Gross

A gift store reported the following records for its operation during the month of February 2019. Cost $400,000 S650,000 S7,500 Retail Opening inventory Gross purchases RTV Gross sales S785,000 S1,295,000 S14,000 $957,000 S98,000 $35,000 Markdowns Customer returns a) What was the book value of the closing inventory at retail in February 2019? (2 points) b) What was the cumulative markup% of total merchandise handled in February 2019? (3 point) Cost Retail Opening Inv. + Purchases $400,000 $650,000 $7,500 S1,042,500 $785,000 S1,295,000 $14,000 $2,066,000 Returns to vendors - TMH c) What was the book inventory at cost on February 28, 2019 when the store closed? (1 point) d) The physical inventory at retail taken after closing the store on February 28, 2019 amounted to $378,000. Did this store experience a shortage or an overage or neither? (1 point)

Step by Step Solution

3.50 Rating (163 Votes )

There are 3 Steps involved in it

a Calculation of ending inventory at retail method Particulars Cost Retail value Cost to Retail Cal... View full answer

Get step-by-step solutions from verified subject matter experts