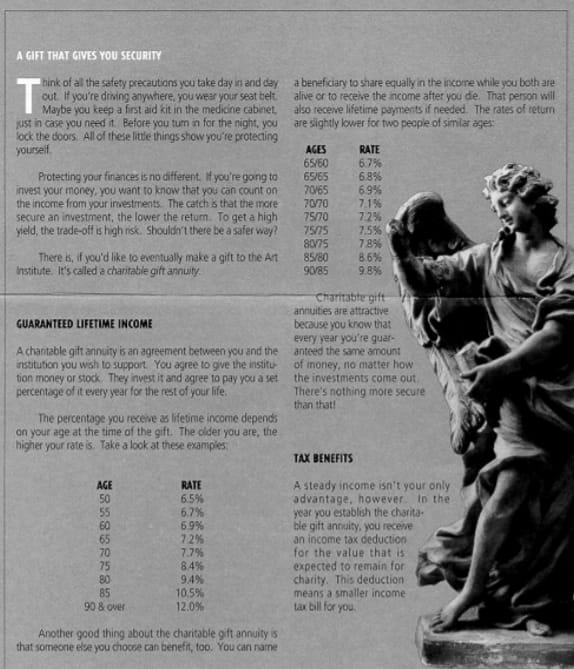

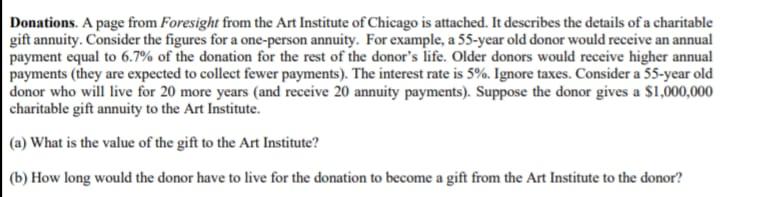

. A GIFT THAT GIVES YOU SECURITY hink of all the safety precautions you take day in and clay a beneficiary to share equally in the incorre while you both are out if you're driving anywhere you wear your seat belt alive or to receive the come after you de. That person wil Maybe you keep a first aid kit in the medicine cabinet also receve lifetime payments if needed. The rates of return ist in case you need it . Before you tum in for the night, you are slightly lower for two people of similar ages: ock the doors. All of these little things show you're protecting yourself AGES RATE 65/60 6.7% Protecting your finances is no different. If you're gong to 65/65 6.896 invest your money, you want to know that you can count on 7065 69% the income from your investments. The catch that the more 70/70 7.196 secure an investment, the lower the retum. To get a high 75770 72% yield, the trade-off is high risk. Shouldn't there be a safer way? 75775 7.5% 80775 789 There is, if you'd like to eventually make a gift to the Art 85/80 8.6% Institute. It's called a charitable gift annuty 90/85 9.8% Charitable gift annuities are attractive GUARANTEED LIFETIME INCOME because you know that every year you're guar A chantable gift annuity is an agreement between you and the anteed the same amount institution you wish to suport. You agree to give the institus of money, no matter how tion money or stock. They invest it and agree to pay you a set the investments come out percentage of it every year for the rest of your life. There's nothing more secure than that! The percentage you receive a lifetime income depends on your age at the time of the gift. The older you are, the higher your rate is. Take a look at these examples TAX BENEFITS AGE 50 55 60 65 70 75 80 85 90 8 over RATE 6.5% 6.7% 6.9% 72% 7.7% 8.4% 949 10.5% 12.0% A steady income isn't your only advantage, however, in the year you establish the charita ble gift annuity, you receive an income tax deduction for the value that is expected to remain for charity. This deduction means a smaller income Lax bill for you Another good thing about the charitable gift annuity is that someone else you choose can benefit, too. You can name Donations. A page from Foresight from the Art Institute of Chicago is attached. It describes the details of a charitable gift annuity. Consider the figures for a one-person annuity. For example, a 55-year old donor would receive an annual payment equal to 6.7% of the donation for the rest of the donor's life. Older donors would receive higher annual payments (they are expected to collect fewer payments). The interest rate is 5%. Ignore taxes. Consider a 55-year old donor who will live for 20 more years and receive 20 annuity payments). Suppose the donor gives a $1,000,000 charitable gift annuity to the Art Institute. (a) What is the value of the gift to the Art Institute? (b) How long would the donor have to live for the donation to become a gift from the Art Institute to the donor