Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Given that Ron and Anne have taxable income of only $23,000 (all ordinary) before considering the tax effect of their asset sales, what is

a. Given that Ron and Anne have taxable income of only $23,000 (all ordinary) before considering the tax effect of their asset sales, what is their gross tax liability for 2022 assuming they file a joint return?

b. Given that Ron and Anne have taxable income of $403,000 (all ordinary) before considering the tax effect of their asset sales, what is their gross tax liability for 2022 assuming they file a joint return?

Answer A and B please!

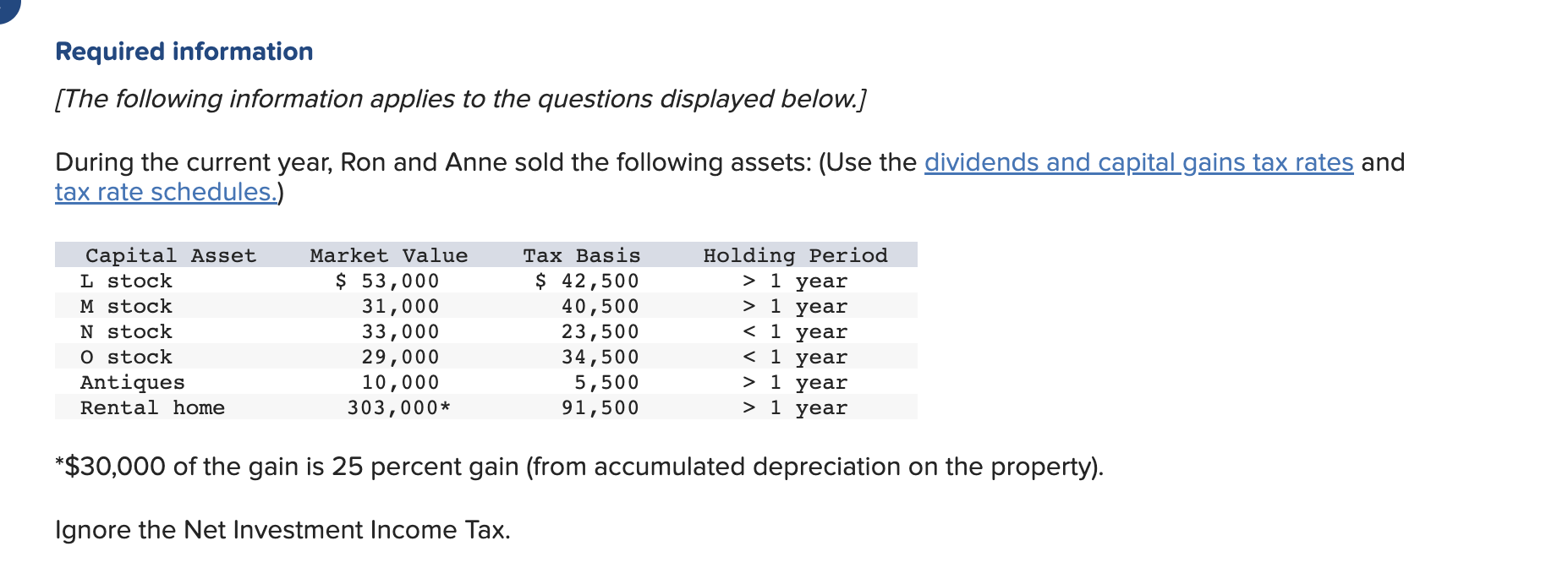

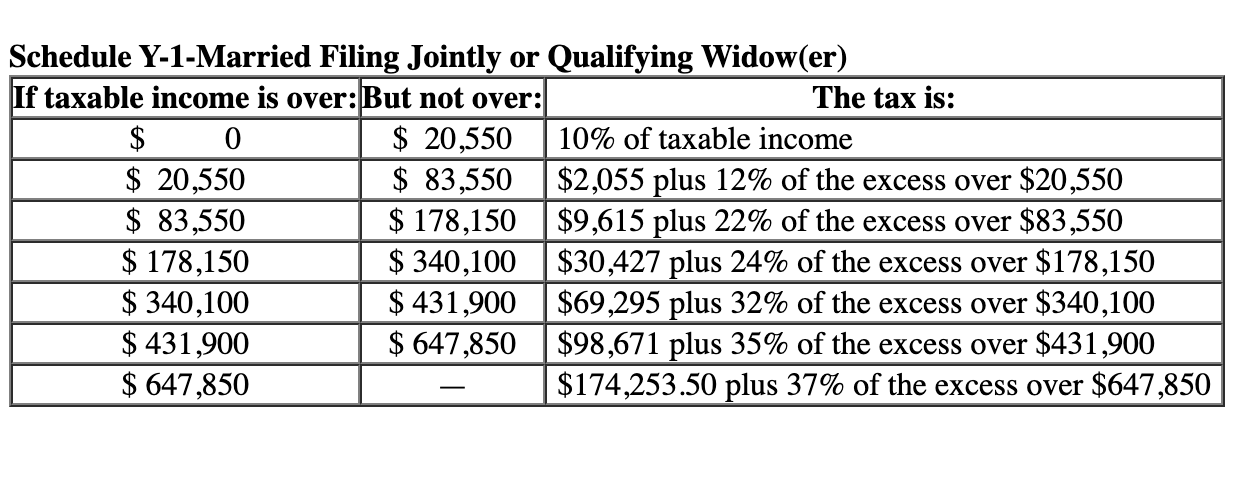

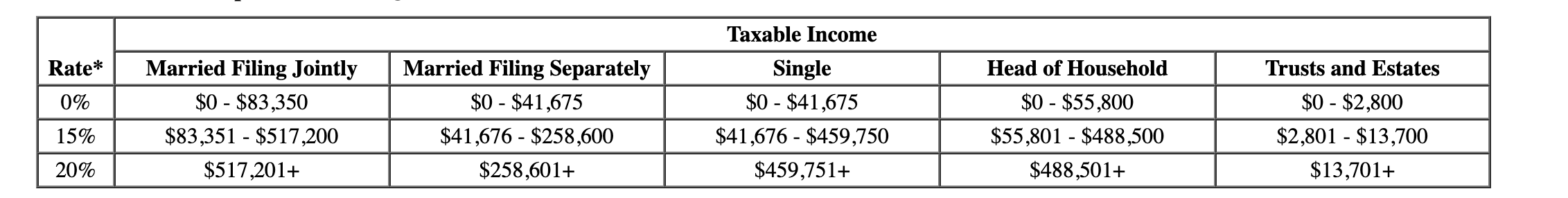

Required information [The following information applies to the questions displayed below.] During the current year, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and tax rate schedules.) $30,000 of the gain is 25 percent gain (from accumulated depreciation on the property). Ignore the Net Investment Income Tax. Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) \begin{tabular}{|c|c|l|} \hline If taxable income is over: & But not over: & The tax is: \\ \hline$ & $20,550 & 10% of taxable income \\ \hline$20,550 & $83,550 & $2,055 plus 12% of the excess over $20,550 \\ \hline$83,550 & $178,150 & $9,615 plus 22% of the excess over $83,550 \\ \hline$178,150 & $340,100 & $30,427 plus 24% of the excess over $178,150 \\ \hline$340,100 & $431,900 & $69,295 plus 32% of the excess over $340,100 \\ \hline$431,900 & $647,850 & $98,671 plus 35% of the excess over $431,900 \\ \hline$647,850 & & $174,253.50 plus 37% of the excess over $647,850 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow{2}{*}{ Rate* } & \multicolumn{5}{|c|}{ Taxable Income } \\ \cline { 2 - 6 } & Married Filing Jointly & Married Filing Separately & Single & Head of Household & Trusts and Estates \\ \hline 0% & $0$83,350 & $0$41,675 & $0$41,675 & $0$55,800 & $0$2,800 \\ \hline 15% & $83,351$517,200 & $41,676$258,600 & $41,676$459,750 & $55,801$488,500 & $2,801$13,700 \\ \hline 20% & $517,201+ & $258,601+ & $459,751+ & $488,501+ & $13,701+ \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started