Answered step by step

Verified Expert Solution

Question

1 Approved Answer

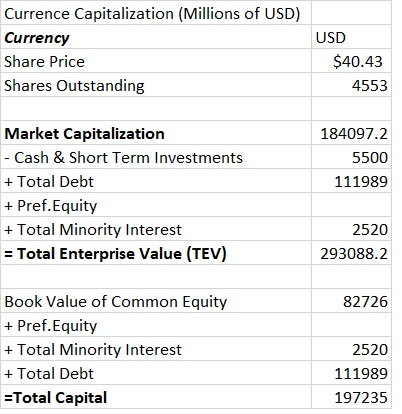

a) Given the data above, what is your guess for the value of the offer that an acquirer would have to make in order to

a) Given the data above, what is your guess for the value of the offer that an acquirer would have to make in order to buy Company Z?

b) If the deal is paid in cash, how much debt would the acquirer need for the deal?

c) How would you expect this deal to be financed?

d) Would an LBO (Leveraged Buy Out)deal be feasible in this case?

Currence Capitalization (Millions of USD) Currency Share Price Shares Outstanding USD $40.43 4553 184097.2 5500 111989 Market Capitalization - Cash & Short Term Investments + Total Debt + Pref. Equity + Total Minority Interest = Total Enterprise Value (TEV) 2520 293088.2 82726 Book Value of Common Equity + Pref. Equity + Total Minority Interest + Total Debt =Total Capital 2520 111989 197235Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started