Answered step by step

Verified Expert Solution

Question

1 Approved Answer

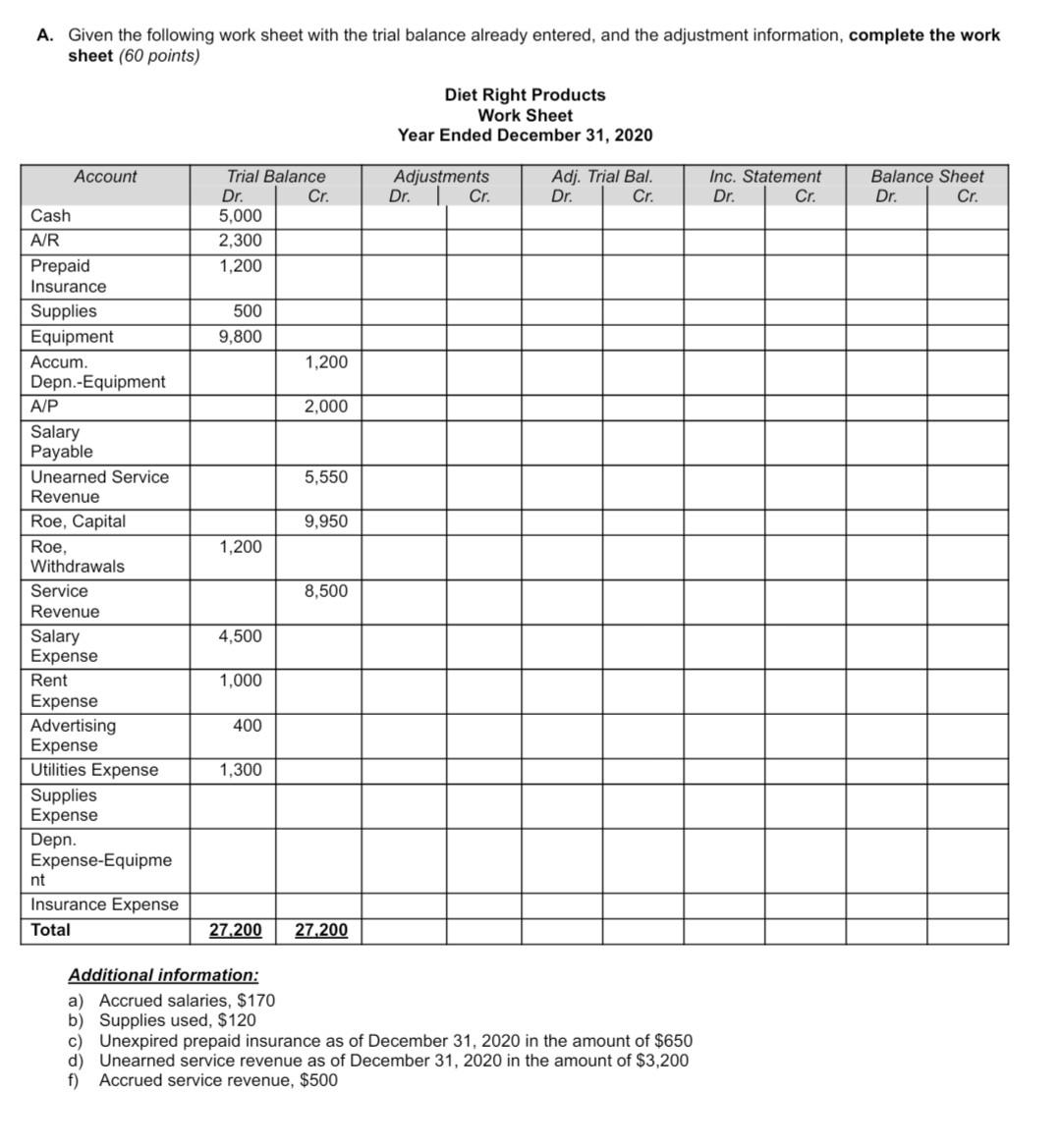

A. Given the following work sheet with the trial balance already entered, and the adjustment information, complete the work sheet (60 points) Diet Right Products

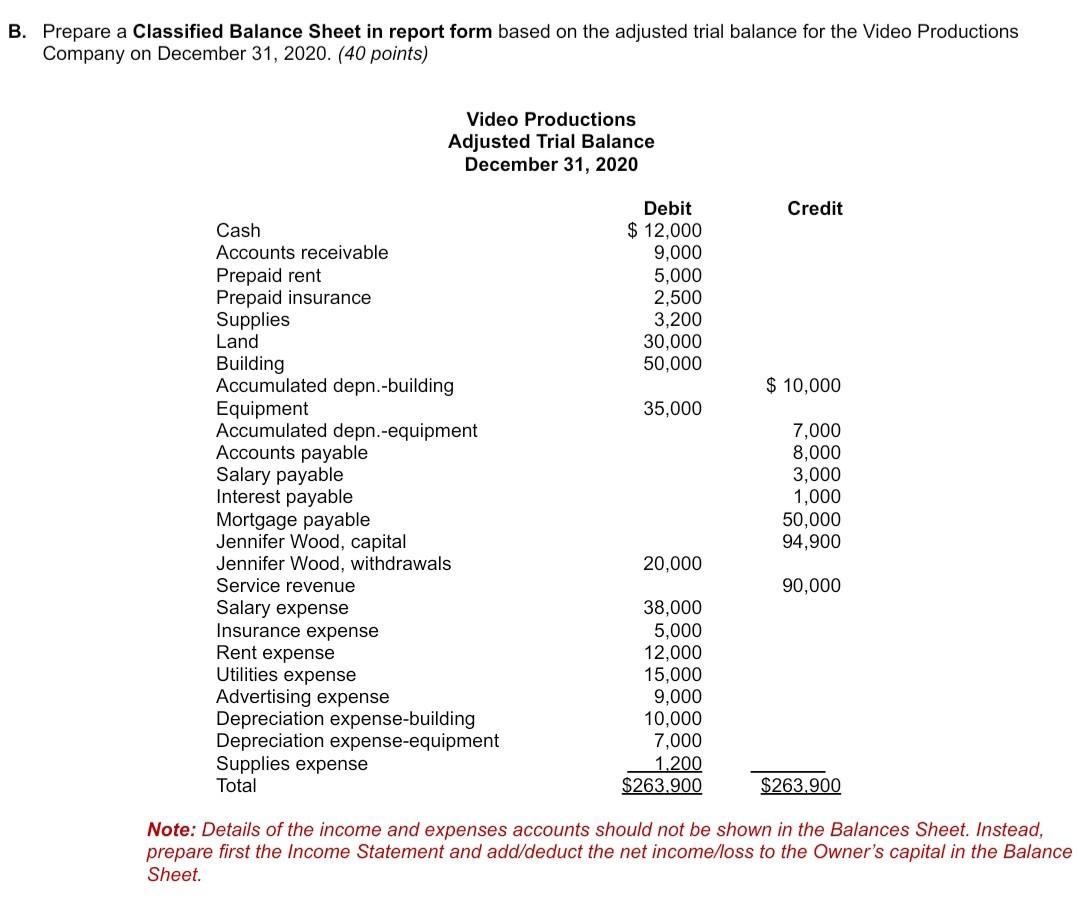

A. Given the following work sheet with the trial balance already entered, and the adjustment information, complete the work sheet (60 points) Diet Right Products Work Sheet Year Ended December 31, 2020 Account Adjustments Dr. Cr. Adj. Trial Bal. Dr. Cr. Inc. Statement Dr. Cr. Balance Sheet Dr. Cr. Trial Balance Dr. Cr. 5,000 2,300 1.200 500 9,800 1,200 2,000 5,550 9,950 1,200 Cash A/R Prepaid Insurance Supplies Equipment Accum. Depn.-Equipment A/P Salary Payable Unearned Service Revenue Roe, Capital Roe, Withdrawals Service Revenue Salary Expense Rent Expense Advertising Expense Utilities Expense Supplies Expense Depn. Expense-Equipme nt Insurance Expense Total 8,500 4,500 1,000 400 1.300 27.200 27.200 Additional information: a) Accrued salaries, $170 b) Supplies used, $120 c) Unexpired prepaid insurance as of December 31, 2020 in the amount of $650 d) Unearned service revenue as of December 31, 2020 in the amount of $3,200 f) Accrued service revenue, $500 B. Prepare a Classified Balance Sheet in report form based on the adjusted trial balance for the Video Productions Company on December 31, 2020. (40 points) Video Productions Adjusted Trial Balance December 31, 2020 Credit Debit $ 12,000 9,000 5,000 2,500 3,200 30,000 50,000 $ 10,000 35,000 Cash Accounts receivable Prepaid rent Prepaid insurance Supplies Land Building Accumulated depn.-building Equipment Accumulated depn.-equipment Accounts payable Salary payable Interest payable Mortgage payable Jennifer Wood, capital Jennifer Wood, withdrawals Service revenue Salary expense Insurance expense Rent expense Utilities expense Advertising expense Depreciation expense-building Depreciation expense-equipment Supplies expense Total 7,000 8,000 3,000 1,000 50,000 94,900 20,000 90,000 38,000 5,000 12,000 15,000 9,000 10,000 7,000 1.200 $263.900 $263.900 Note: Details of the income and expenses accounts should not be shown in the Balances Sheet. Instead, prepare first the Income Statement and add/deduct the net income/loss to the Owner's capital in the Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started