Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A global investment firm has approached your company for advice on where they should site a concentrating solar thermal power plant. They have identified

![(iii) [4 marks] Retail electricity prices are 36 US ¢/kWh (for Konstanz, Germany) and 40 US ¢/kWh( for Geraldton, Australia).](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2020/08/5f48e90806aa7_1598475733692.jpg)

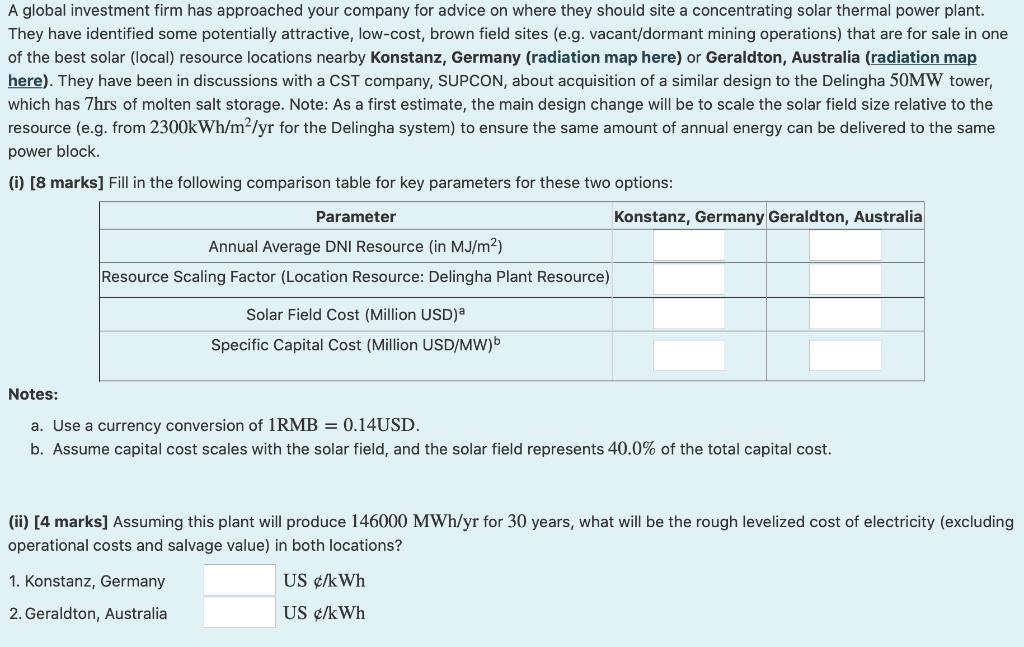

A global investment firm has approached your company for advice on where they should site a concentrating solar thermal power plant. They have identified some potentially attractive, low-cost, brown field sites (e.g. vacant/dormant mining operations) that are for sale in one of the best solar (local) resource locations nearby Konstanz, Germany (radiation map here) or Geraldton, Australia (radiation map here). They have been in discussions with a CST company, SUPCON, about acquisition of a similar design to the Delingha 50MW tower, which has 7hrs of molten salt storage. Note: As a first estimate, the main design change will be to scale the solar field size relative to the resource (e.g. from 2300kWh/m/yr for the Delingha system) to ensure the same amount of annual energy can be delivered to the same power block. (i) [8 marks] Fill in the following comparison table for key parameters for these two options: Parameter Annual Average DNI Resource (in MJ/m) Resource Scaling Factor (Location Resource: Delingha Plant Resource) Solar Field Cost (Million USD)a Specific Capital Cost (Million USD/MW)b Notes: a. Use a currency conversion of 1RMB = 0.14USD. b. Assume capital cost scales with the solar field, and the solar field represents 40.0% of the total capital cost. 1. Konstanz, Germany 2. Geraldton, Australia Konstanz, Germany Geraldton, Australia (ii) [4 marks] Assuming this plant will produce 146000 MWh/yr for 30 years, what will be the rough levelized cost of electricity (excluding operational costs and salvage value) in both locations? US /kWh US /kWh (iii) [4 marks] Retail electricity prices are 36 US /kWh (for Konstanz, Germany) and 40 US /kWh ( for Geraldton, Australia). Based upon the plant LCOE for these locations, is it likely that your company will be able to obtain a free market price (e.g. no government subsidies) for the power purchase agreement which exceeds the LCOE (noting that wholesale prices are typically ~50% of retail prices)? 1. Konstanz, Germany (No answer given) 2. Geraldton, Australia (No answer given) (iv) [1 marks] Would you recommend for your company to do a more detailed feasibility study in either location? 1. Konstanz, Germany (No answer given) 2. Geraldton, Australia (No answer given)

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Question i Fill in the following comparison table for key parameters for these two options Parameter Konstanz Germany Geraldton Australia Annual Average DNI Resource in MJm 179 171 Resource Scaling Fa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started