Question

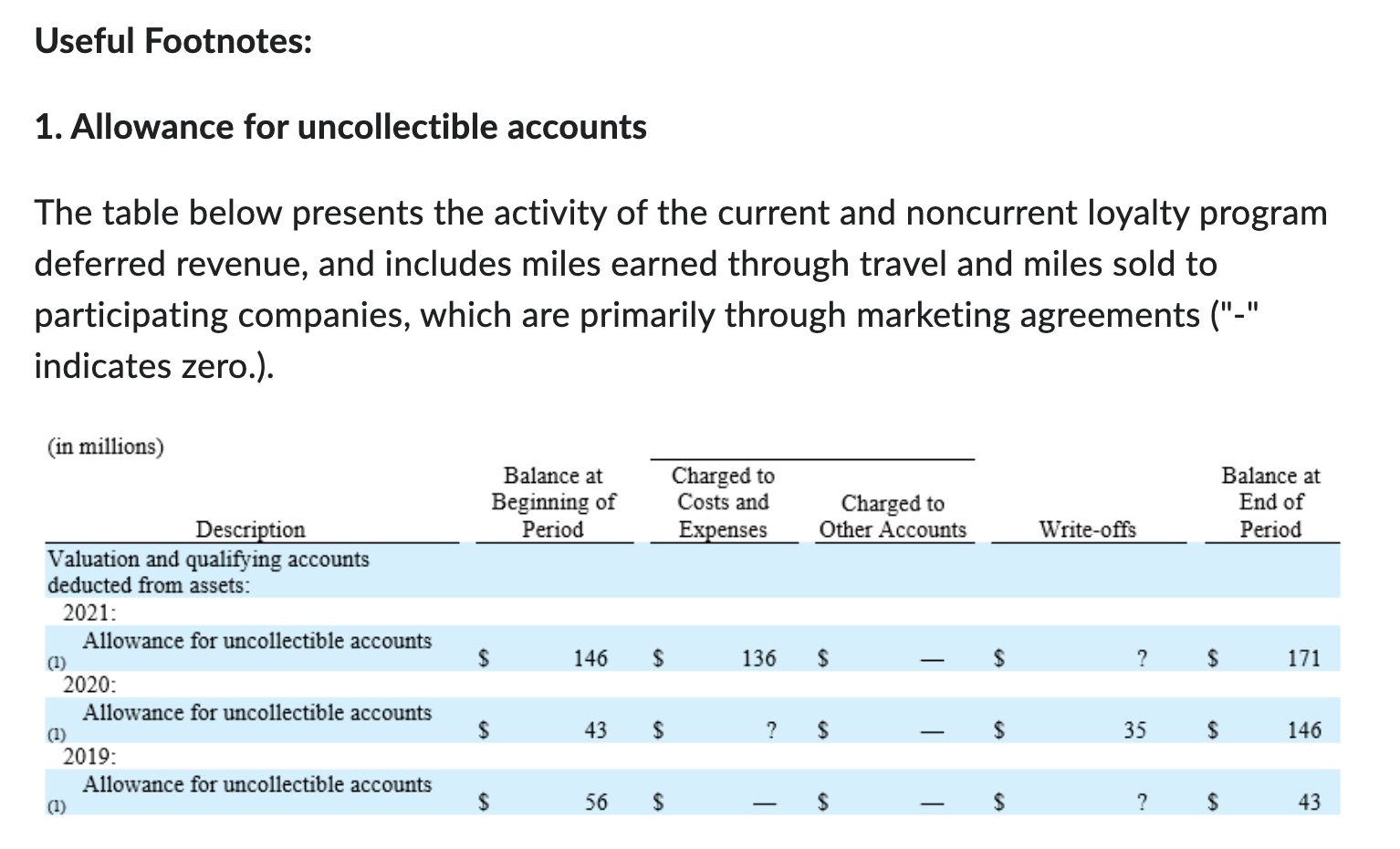

a) Go to the footnote about the allowance for uncollectible accounts. What is the amount of the write-offs of allowance for uncollectible accounts during 2021?

a) Go to the footnote about the allowance for uncollectible accounts. What is the amount of the write-offs of allowance for uncollectible accounts during 2021?

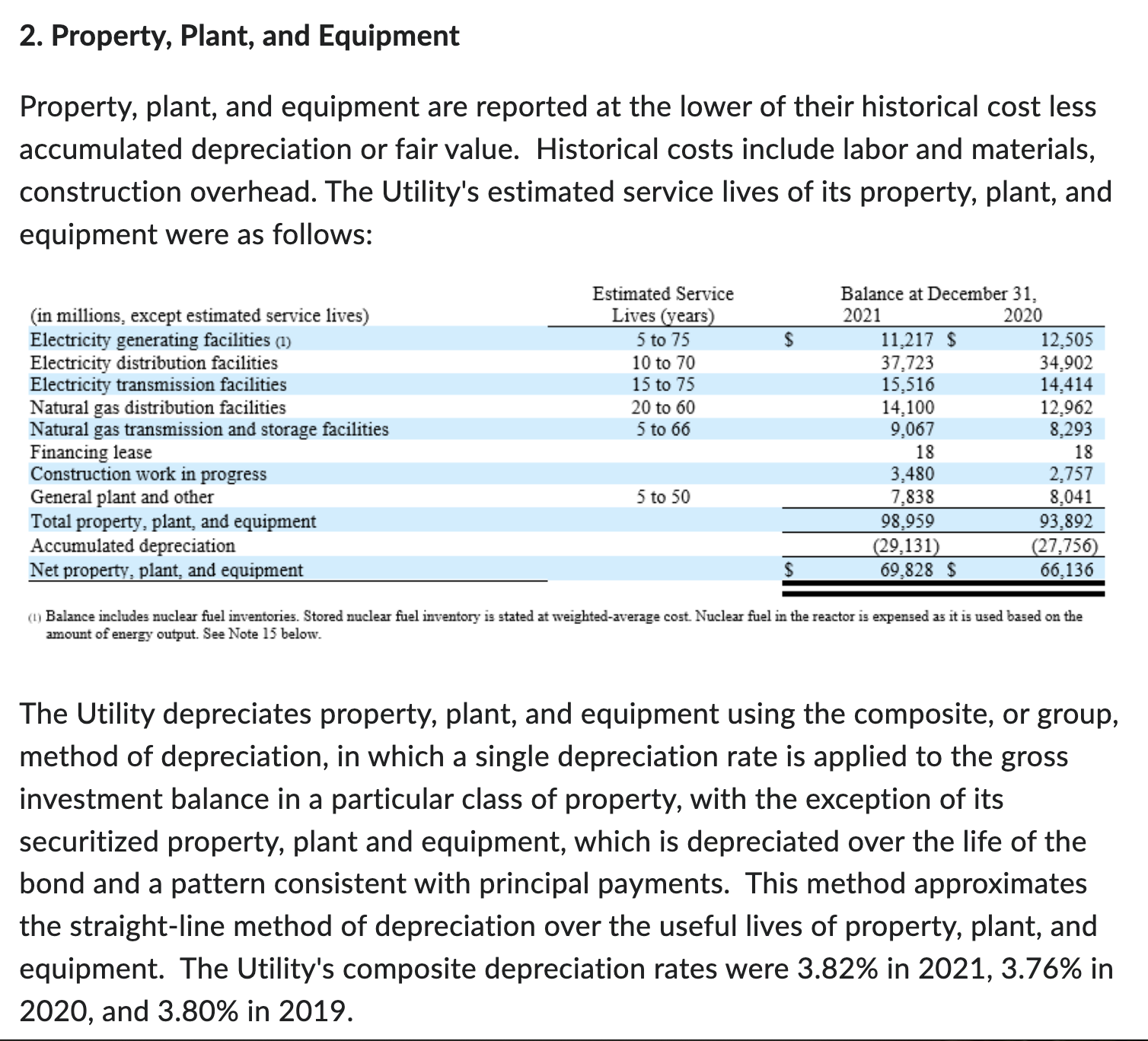

b) Go to the balance sheet and the footnote about property, plant, and equipment. What is the amount of the depreciation & amortization expenses in 2021?

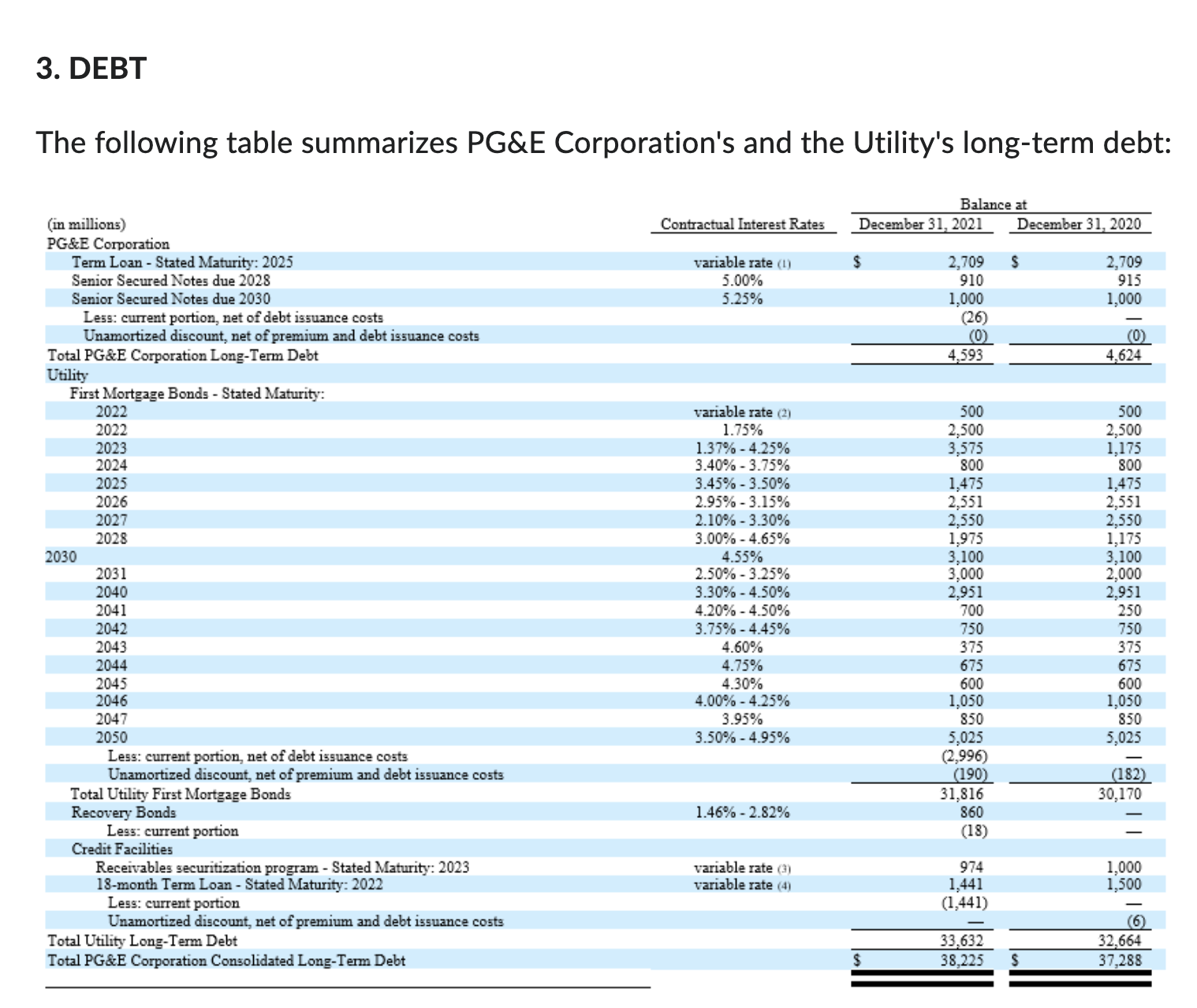

c) Go to the footnote about debt. Pay attention to the Senior Secured Note due 2028 with a coupon interest rate of 5%. Is the note issued at premium, par, or discount? Was the market interest rate of this note higher or lower than 5% at the time of this note's issuance?

Pacific Gas & Electric agreed in April 2022 to pay $55 million in penalties and costs to settle civil cases brought by prosecutors over wildfires across six Northern California counties. The victims are estimated to receive the compensation from this year on. PG&E has also pushed to raise electricity rates to pay for damage rather than collecting from shareholders and risking their bankruptcy. That would allow the companies to continue normal operations without bankruptcy.

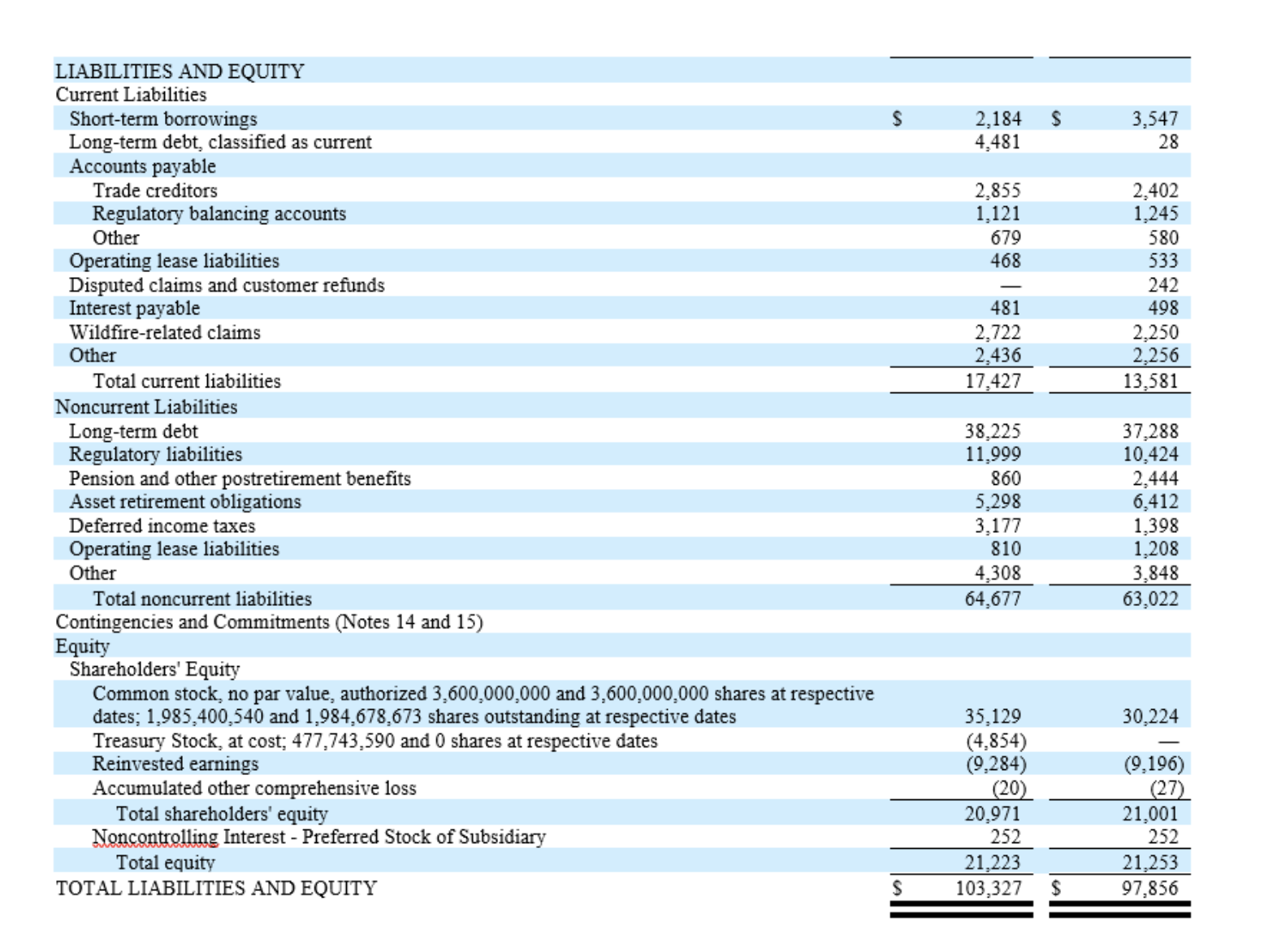

d) Calculate the current ratio of PG&E in 2021

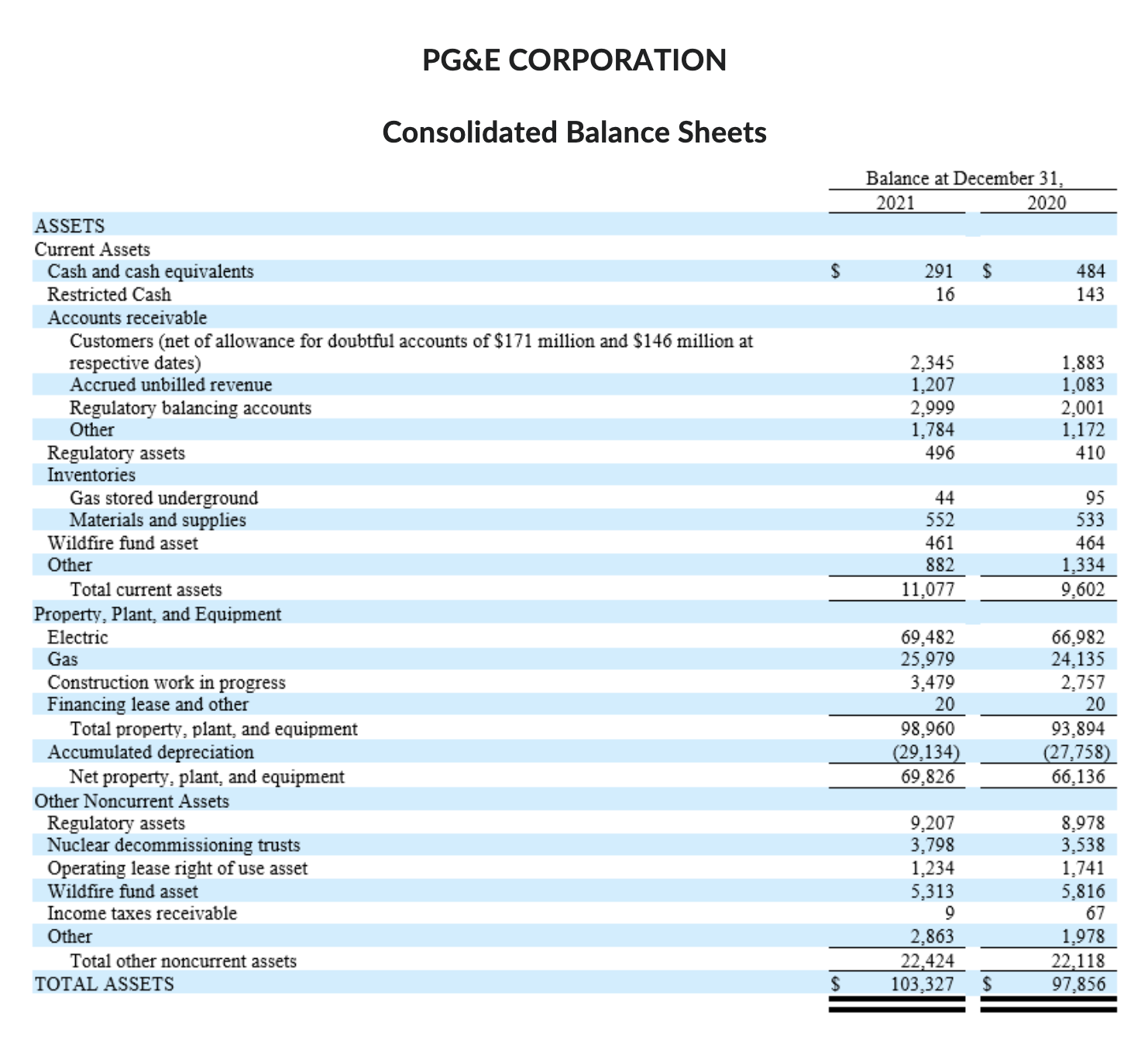

Consolidated Balance Sheets LIABILITIES AND EQUITY Current Liabilities Useful Footnotes: 1. Allowance for uncollectible accounts The table below presents the activity of the current and noncurrent loyalty program deferred revenue, and includes miles earned through travel and miles sold to participating companies, which are primarily through marketing agreements ("-" indicates zero.). 2. Property, Plant, and Equipment Property, plant, and equipment are reported at the lower of their historical cost less accumulated depreciation or fair value. Historical costs include labor and materials, construction overhead. The Utility's estimated service lives of its property, plant, and equipment were as follows: (1) Balance includes nuclear fuel inventories. Stored nuclear fuel inventory is stated at weighted-average cost. Nuclear fuel in the reactor is expensed as it is used based on the amount of energy output. See Note 15 below. The Utility depreciates property, plant, and equipment using the composite, or group, method of depreciation, in which a single depreciation rate is applied to the gross investment balance in a particular class of property, with the exception of its securitized property, plant and equipment, which is depreciated over the life of the bond and a pattern consistent with principal payments. This method approximates the straight-line method of depreciation over the useful lives of property, plant, and equipment. The Utility's composite depreciation rates were 3.82% in 2021,3.76% in 2020, and 3.80% in 2019 The following table summarizes PG\&E Corporation's and the Utility's long-term debt: Consolidated Balance Sheets LIABILITIES AND EQUITY Current Liabilities Useful Footnotes: 1. Allowance for uncollectible accounts The table below presents the activity of the current and noncurrent loyalty program deferred revenue, and includes miles earned through travel and miles sold to participating companies, which are primarily through marketing agreements ("-" indicates zero.). 2. Property, Plant, and Equipment Property, plant, and equipment are reported at the lower of their historical cost less accumulated depreciation or fair value. Historical costs include labor and materials, construction overhead. The Utility's estimated service lives of its property, plant, and equipment were as follows: (1) Balance includes nuclear fuel inventories. Stored nuclear fuel inventory is stated at weighted-average cost. Nuclear fuel in the reactor is expensed as it is used based on the amount of energy output. See Note 15 below. The Utility depreciates property, plant, and equipment using the composite, or group, method of depreciation, in which a single depreciation rate is applied to the gross investment balance in a particular class of property, with the exception of its securitized property, plant and equipment, which is depreciated over the life of the bond and a pattern consistent with principal payments. This method approximates the straight-line method of depreciation over the useful lives of property, plant, and equipment. The Utility's composite depreciation rates were 3.82% in 2021,3.76% in 2020, and 3.80% in 2019 The following table summarizes PG\&E Corporation's and the Utility's long-term debtStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started