Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A good friend recently inherited some bonds with a face value of P100,000 from her dear grandmother. She told you that her grandmother's wish

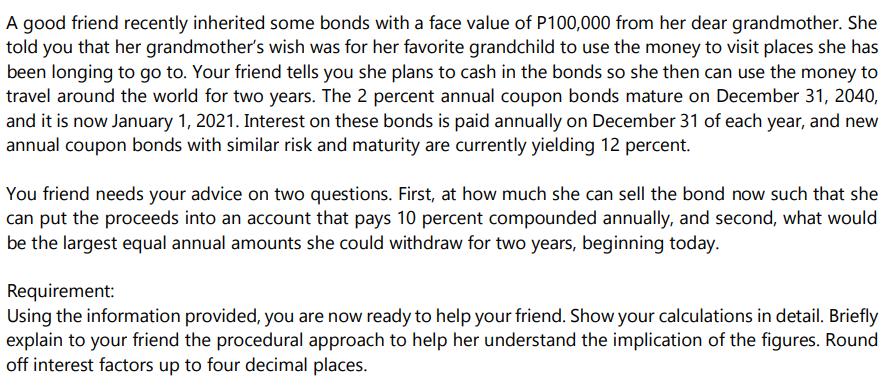

A good friend recently inherited some bonds with a face value of P100,000 from her dear grandmother. She told you that her grandmother's wish was for her favorite grandchild to use the money to visit places she has been longing to go to. Your friend tells you she plans to cash in the bonds so she then can use the money to travel around the world for two years. The 2 percent annual coupon bonds mature on December 31, 2040, and it is now January 1, 2021. Interest on these bonds is paid annually on December 31 of each year, and new annual coupon bonds with similar risk and maturity are currently yielding 12 percent. You friend needs your advice on two questions. First, at how much she can sell the bond now such that she can put the proceeds into an account that pays 10 percent compounded annually, and second, what would be the largest equal annual amounts she could withdraw for two years, beginning today. Requirement: Using the information provided, you are now ready to help your friend. Show your calculations in detail. Briefly explain to your friend the procedural approach to help her understand the implication of the figures. Round off interest factors up to four decimal places.

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 FV 2 PMT 3 RATE 4 NP...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started