Answered step by step

Verified Expert Solution

Question

1 Approved Answer

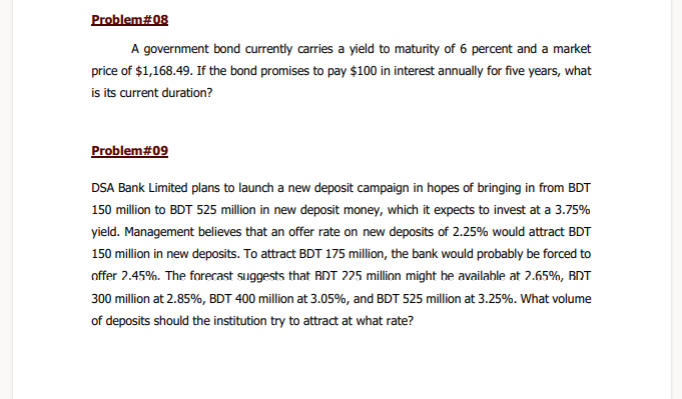

A government bond currently carries a yield to maturity of 6 percent and a market price of ( $ 1,168.49 ). If the bond promises

A government bond currently carries a yield to maturity of 6 percent and a market price of \\( \\$ 1,168.49 \\). If the bond promises to pay \\( \\$ 100 \\) in interest annually for five years, what is its current duration? Problem\\#09 DSA Bank Limited plans to launch a new deposit campaign in hopes of bringing in from BDT 150 million to BDT 525 million in new deposit money, which it expects to invest at a \3.75 yield. Management believes that an offer rate on new deposits of \2.25 would attract BDT 150 million in new deposits. To attract BDT 175 million, the bank would probably be forced to nffer \2.45. The forerast suggests that RDT 225 millinn might he availahle at \2.65, RDT 300 million at \2.85, BDT 400 million at \3.05, and BDT 525 million at \3.25. What volume of deposits should the institution try to attract at what rate

A government bond currently carries a yield to maturity of 6 percent and a market price of \\( \\$ 1,168.49 \\). If the bond promises to pay \\( \\$ 100 \\) in interest annually for five years, what is its current duration? Problem\\#09 DSA Bank Limited plans to launch a new deposit campaign in hopes of bringing in from BDT 150 million to BDT 525 million in new deposit money, which it expects to invest at a \3.75 yield. Management believes that an offer rate on new deposits of \2.25 would attract BDT 150 million in new deposits. To attract BDT 175 million, the bank would probably be forced to nffer \2.45. The forerast suggests that RDT 225 millinn might he availahle at \2.65, RDT 300 million at \2.85, BDT 400 million at \3.05, and BDT 525 million at \3.25. What volume of deposits should the institution try to attract at what rate Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started