Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A great deal of discretion is vested in the executor. All the following decisions or elections can be the responsibility of the executor, EXCEPT: (Topic

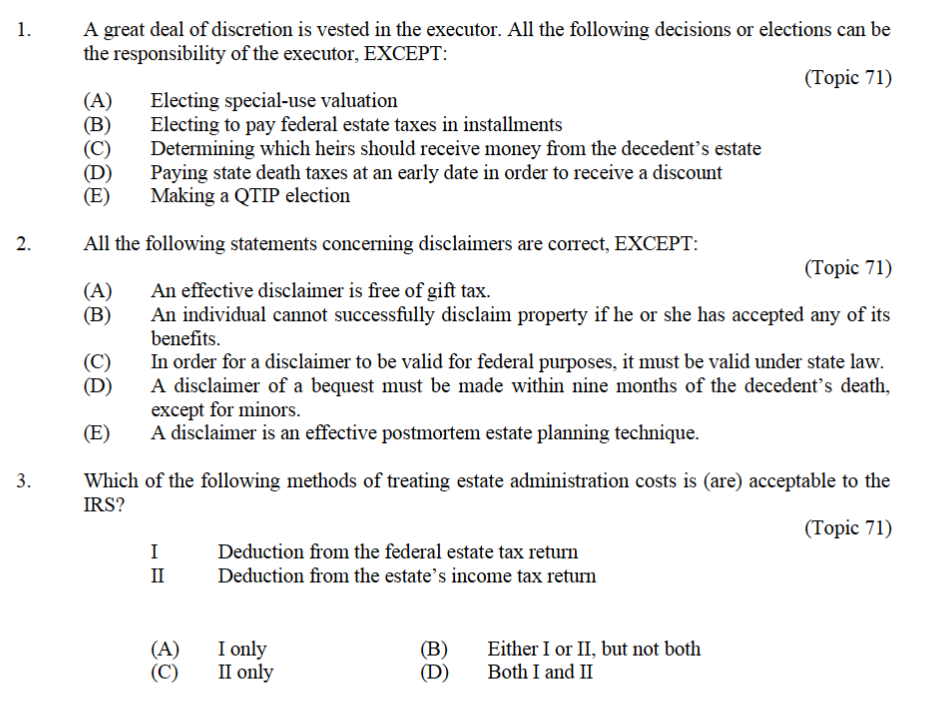

A great deal of discretion is vested in the executor. All the following decisions or elections can be the responsibility of the executor, EXCEPT: (Topic 71) (A) Electing special-use valuation (B) Electing to pay federal estate taxes in installments (C) Determining which heirs should receive money from the decedent's estate (D) Paying state death taxes at an early date in order to receive a discount (E) Making a QTIP election All the following statements concerning disclaimers are correct, EXCEPT: (Topic 71) (A) An effective disclaimer is free of gift tax. (B) An individual cannot successfully disclaim property if he or she has accepted any of its benefits. (C) In order for a disclaimer to be valid for federal purposes, it must be valid under state law. (D) A disclaimer of a bequest must be made within nine months of the decedent's death, except for minors. (E) A disclaimer is an effective postmortem estate planning technique. Which of the following methods of treating estate administration costs is (are) acceptable to the IRS? (Topic 71) I Deduction from the federal estate tax return II Deduction from the estate's income tax return (A) I only (B) Either I or II, but not both (C) II only (D) Both I and

A great deal of discretion is vested in the executor. All the following decisions or elections can be the responsibility of the executor, EXCEPT: (Topic 71) (A) Electing special-use valuation (B) Electing to pay federal estate taxes in installments (C) Determining which heirs should receive money from the decedent's estate (D) Paying state death taxes at an early date in order to receive a discount (E) Making a QTIP election All the following statements concerning disclaimers are correct, EXCEPT: (Topic 71) (A) An effective disclaimer is free of gift tax. (B) An individual cannot successfully disclaim property if he or she has accepted any of its benefits. (C) In order for a disclaimer to be valid for federal purposes, it must be valid under state law. (D) A disclaimer of a bequest must be made within nine months of the decedent's death, except for minors. (E) A disclaimer is an effective postmortem estate planning technique. Which of the following methods of treating estate administration costs is (are) acceptable to the IRS? (Topic 71) I Deduction from the federal estate tax return II Deduction from the estate's income tax return (A) I only (B) Either I or II, but not both (C) II only (D) Both I and Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started