Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Gross earnings for Kathryn:_____________ b. FICA (Use the rate of 6.2%)_____________ c. Medicare (use the rate of 1.45%):___________ d. Federal withholding (use the percentage

a. Gross earnings for Kathryn:_____________ b. FICA (Use the rate of 6.2%)_____________ c. Medicare (use the rate of 1.45%):___________ d. Federal withholding (use the percentage method):________________ e. State Disability insurance (use an SDI rate of 1%):______________ f. Total of other deductions: ____________________ g. NET pay: ___________________

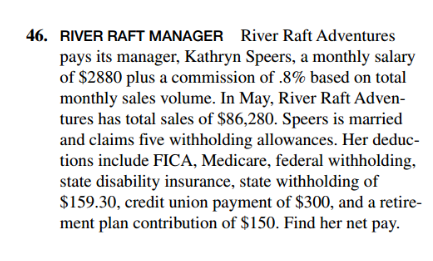

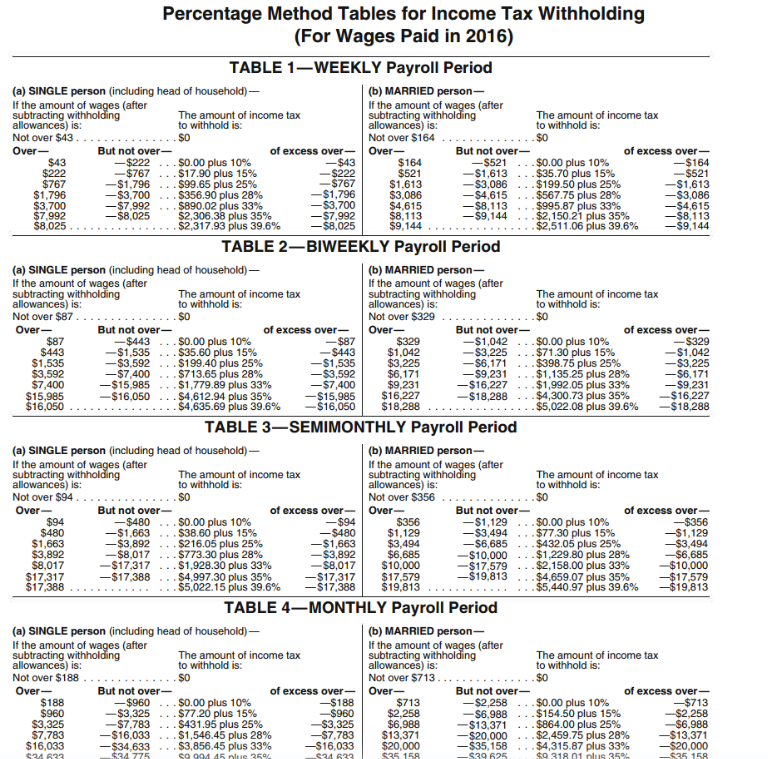

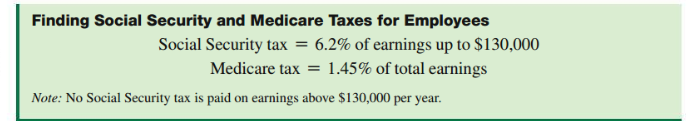

46. RIVER RAFT MANAGER River Raft Adventures pays its manager, Kathryn Speers, a monthly salary of $2880 plus a commission of .8\% based on total monthly sales volume. In May, River Raft Adventures has total sales of $86,280. Speers is married and claims five withholding allowances. Her deductions include FICA, Medicare, federal withholding, state disability insurance, state withholding of $159.30, credit union payment of $300, and a retirement plan contribution of $150. Find her net pay. Percentage Method Tables for Income Tax Withholding (For Wages Paid in 2016) TABLE 1-WEEKLY Payroll Period (a) SINGLE person (including head of household)- TABLE 3-SEMIMONTHLY Payroll Period (a) SINGLE person (including head of household)- TABLE 4-MONTHLY Payroll Period (a) SINGLE person (including head of household) - (b) MARRIED person- If the amount of wages (after Finding Social Security and Medicare Taxes for Employees Social Security tax =6.2% of earnings up to $130,000 Medicare tax =1.45% of total earnings Note: No Social Security tax is paid on earnings above $130,000 per year. 46. RIVER RAFT MANAGER River Raft Adventures pays its manager, Kathryn Speers, a monthly salary of $2880 plus a commission of .8\% based on total monthly sales volume. In May, River Raft Adventures has total sales of $86,280. Speers is married and claims five withholding allowances. Her deductions include FICA, Medicare, federal withholding, state disability insurance, state withholding of $159.30, credit union payment of $300, and a retirement plan contribution of $150. Find her net pay. Percentage Method Tables for Income Tax Withholding (For Wages Paid in 2016) TABLE 1-WEEKLY Payroll Period (a) SINGLE person (including head of household)- TABLE 3-SEMIMONTHLY Payroll Period (a) SINGLE person (including head of household)- TABLE 4-MONTHLY Payroll Period (a) SINGLE person (including head of household) - (b) MARRIED person- If the amount of wages (after Finding Social Security and Medicare Taxes for Employees Social Security tax =6.2% of earnings up to $130,000 Medicare tax =1.45% of total earnings Note: No Social Security tax is paid on earnings above $130,000 per yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started