Question

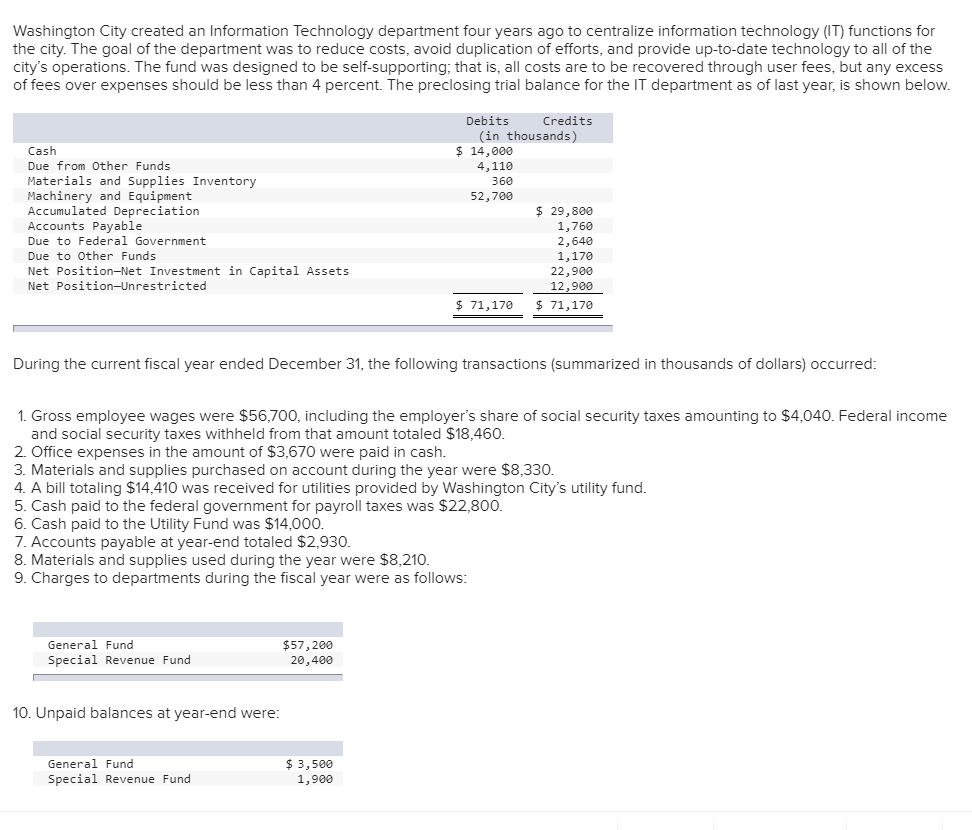

A Gross employee wages were $56,700, including the employers share of social security taxes amounting to $4,040. Federal income and social security taxes withheld from

-

A

Gross employee wages were $56,700, including the employers share of social security taxes amounting to $4,040. Federal income and social security taxes withheld from that amount totaled $18,460.

-

B

Office expenses in the amount of $3,670 were paid in cash.

-

C

Materials and supplies purchased on account during the year were $8,330.

-

D

A bill totaling $14,410 was received for utilities provided by Washington Citys utility fund.

-

E

Cash paid to the federal government for payroll taxes was $22,800.

-

F

Cash paid to the Utility Fund was $14,000.

-

G

Accounts payable at year end totaled $2,930.

-

H

Materials and supplies used during the year were $8,210.

-

I

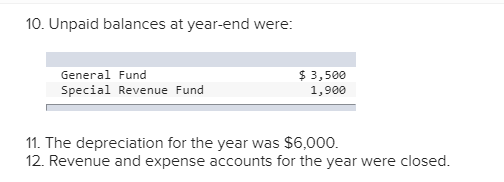

Record the billing to departments.

-

J

Record the cash received from other funds.

-

K

The depreciation for the year was $6,000.

-

A

Record the closure of revenue and expense accounts.

-

B

Record the operating loss for the year.

-

C

Record the transfer of depreciation expense to the asset account.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started