Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A group of Canadian investors purchased the interests o the members of a Texas partnership that owned a large apartment building. After a year,

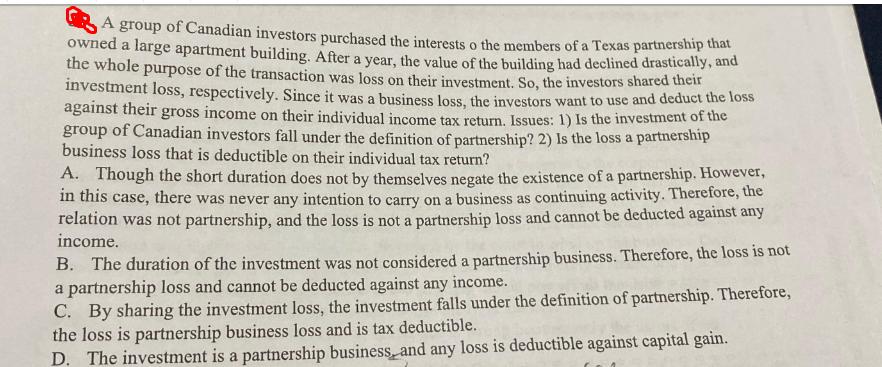

A group of Canadian investors purchased the interests o the members of a Texas partnership that owned a large apartment building. After a year, the value of the building had declined drastically, and the whole purpose of the transaction was loss on their investment. So, the investors shared their investment loss, respectively. Since it was a business loss, the investors want to use and deduct the loss against their gross income on their individual income tax return. Issues: 1) Is the investment of the group of Canadian investors fall under the definition of partnership? 2) Is the loss a partnership business loss that is deductible on their individual tax return? A. Though the short duration does not by themselves negate the existence of a partnership. However, in this case, there was never any intention to carry on a business as continuing activity. Therefore, the relation was not partnership, and the loss is not a partnership loss and cannot be deducted against any income. B. The duration of the investment was not considered a partnership business. Therefore, the loss is not a partnership loss and cannot be deducted against any income. C. By sharing the investment loss, the investment falls under the definition of partnership. Therefore, the loss is partnership business loss and is tax deductible. D. The investment is a partnership business, and any loss is deductible against capital gain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image you provided shows a multiplechoice question that focuses on taxrelated implications of a transaction involving a group of Canadian investor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started