Question

A group of friends have formed a new business called Fashion Clothing, an online and mail order clothing business, in which they have invested 200,000

A group of friends have formed a new business called Fashion Clothing, an online and mail order clothing business, in which they have invested 200,000 of their own capital. They intend to manufacture and sell quality clothes. They have set the business up and are selling direct to the final consumer, using a combination of aggressive marketing across a range of different media and also with the use of an automated web site that accepts online orders. To support this, they also have a department of telephone sales and support staff ready to help customers. The sales staff work in teams and receive a basic salary plus commission for each successful sale. By the start of July 20X5, they have spent 150,000 on tangible non-current assets, and they currently have the remaining 50,000 in their business bank account.

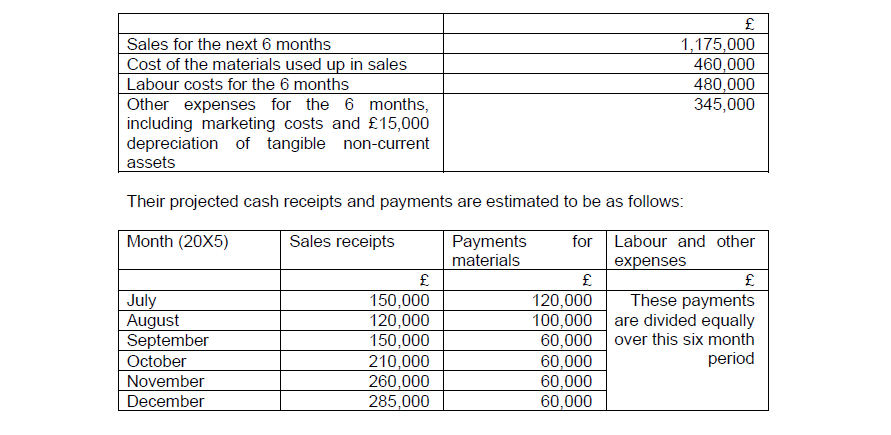

They provide you with the following forecasted figures for their first 6 months of trading:

In addition to the above, they expect to have to pay a tax bill of 20,000 in December 20X5. All transactions will go through their business bank account. Required: (a) Prepare an opening statement of financial position at the start of July 20X5. (5 marks) (b) Prepare a monthly cash flow forecast, showing the bank balance at the end of each of the 6 months and indicating what level of overdraft facilities the friends need to negotiate with their bank manager. (18 marks) (c) Explain what additional expense they should take into account as a result of needing the financial assistance (overdraft) referred to in (b). (2 marks)

Sales for the next 6 months Cost of the materials used up in sales Labour costs for the 6 months Other expenses for the 6 months, including marketing costs and 15,000 depreciation of tangible non-current assets 1,175,000 460,000 480,000 345,000 Their projected cash receipts and payments are estimated to be as follows: Month (2035) Sales receipts July August September October November December f 150,000 120,000 150,000 210,000 260,000 285,000 Payments for materials 120,000 100,000 60,000 60,000 60,000 60,000 Labour and other expenses f These payments are divided equally over this six month periodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started