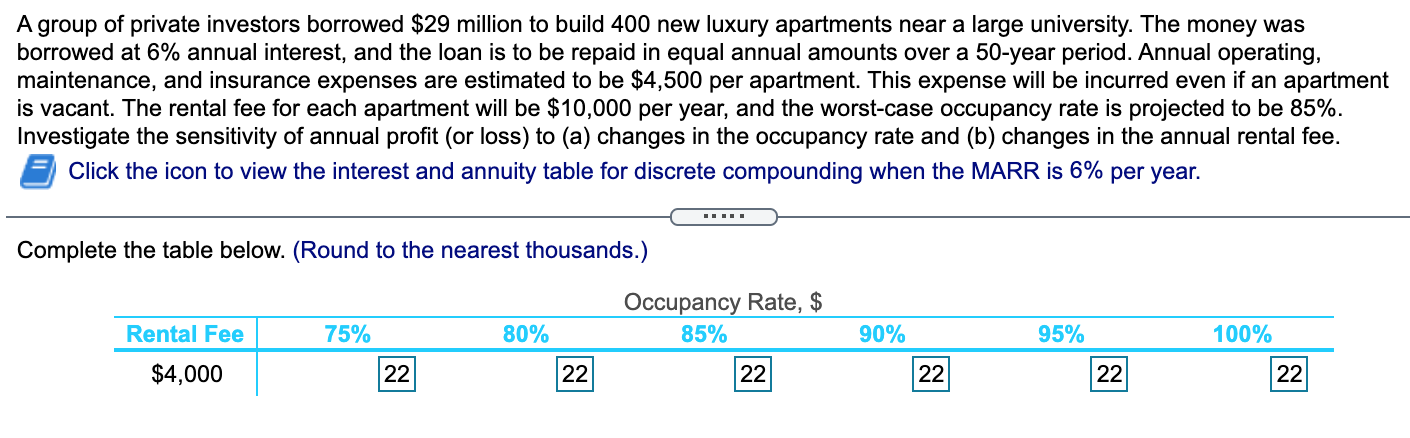

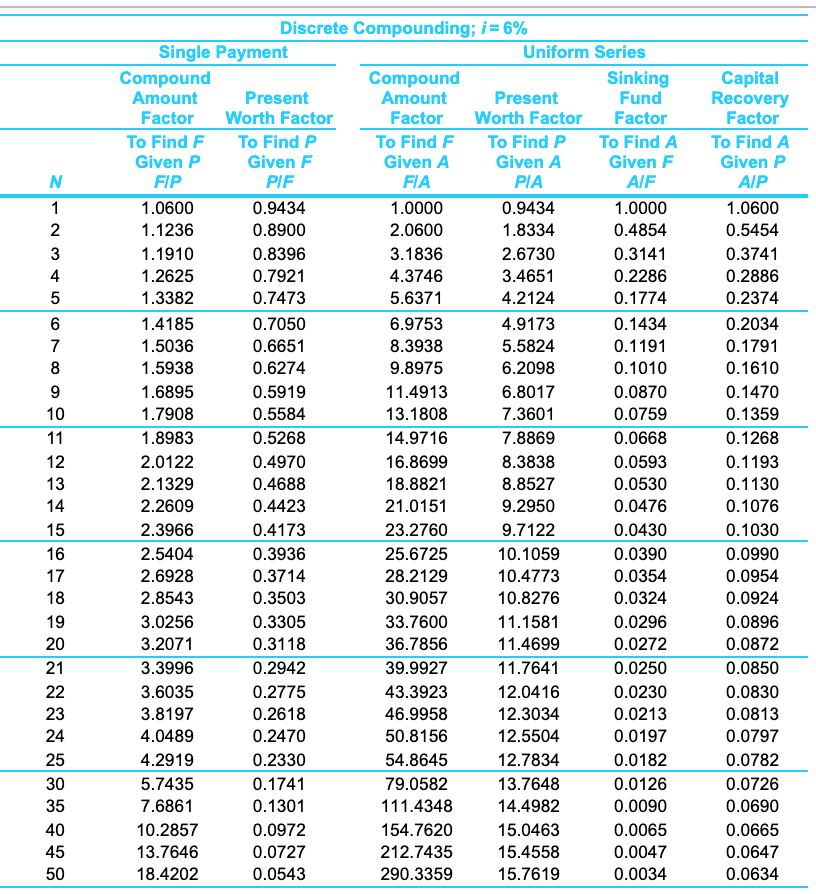

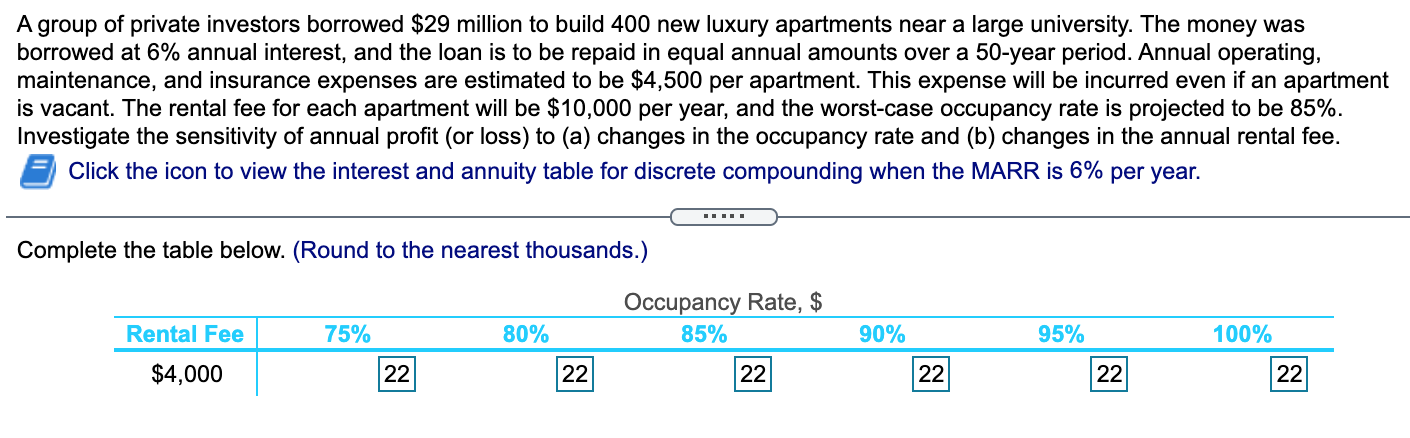

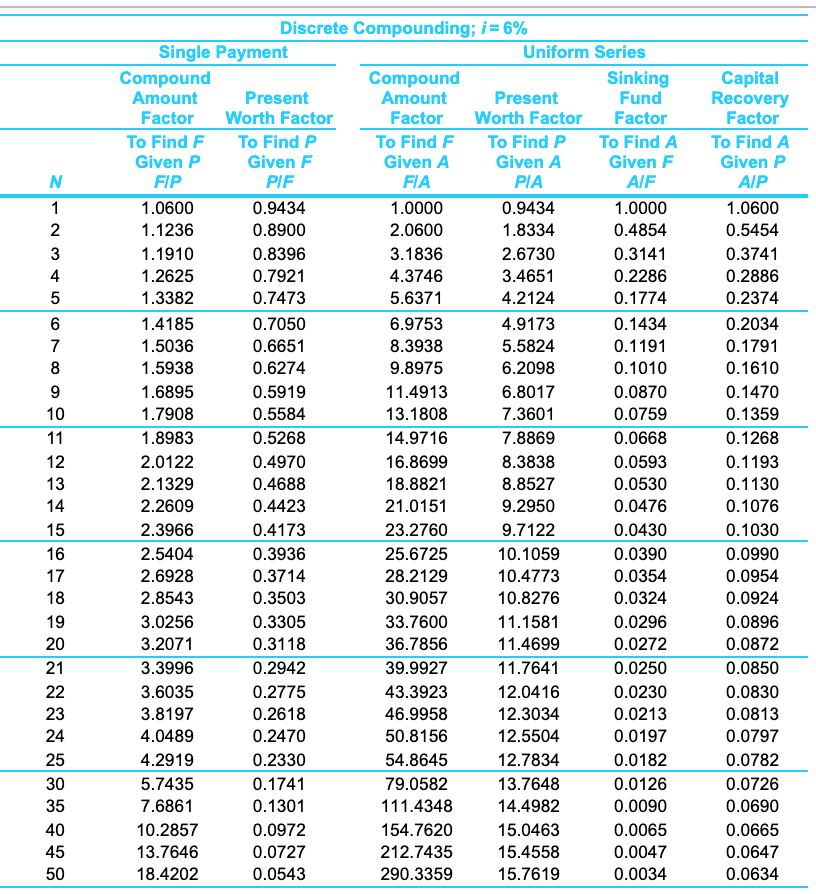

A group of private investors borrowed $29 million to build 400 new luxury apartments near a large university. The money was borrowed at 6% annual interest, and the loan is to be repaid in equal annual amounts over a 50-year period. Annual operating, maintenance, and insurance expenses are estimated to be $4,500 per apartment. This expense will be incurred even if an apartment is vacant. The rental fee for each apartment will be $10,000 per year, and the worst-case occupancy rate is projected to be 85%. Investigate the sensitivity of annual profit (or loss) to (a) changes in the occupancy rate and (b) changes in the annual rental fee. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 6% per year. Complete the table below. (Round to the nearest thousands.) Occupancy Rate, $ 85% Rental Fee 75% 80% 90% 95% 100% $4,000 22 22 22 22 22 22 | N W NZ 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Discrete Compounding; i = 6% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP PIF FIA PIA AIF 1.0600 0.9434 1.0000 0.9434 1.0000 1.1236 0.8900 2.0600 1.8334 0.4854 1.1910 0.8396 3.1836 2.6730 0.3141 1.2625 0.7921 4.3746 3.4651 0.2286 1.3382 0.7473 5.6371 4.2124 0.1774 1.4185 0.7050 6.9753 4.9173 0.1434 1.5036 0.6651 8.3938 5.5824 0.1191 1.5938 0.6274 9.8975 6.2098 0.1010 1.6895 0.5919 11.4913 6.8017 0.0870 1.7908 0.5584 13.1808 7.3601 0.0759 1.8983 0.5268 14.9716 7.8869 0.0668 2.0122 0.4970 16.8699 8.3838 0.0593 2.1329 0.4688 18.8821 8.8527 0.0530 2.2609 0.4423 21.0151 9.2950 0.0476 2.3966 0.4173 23.2760 9.7122 0.0430 2.5404 0.3936 25.6725 10.1059 0.0390 2.6928 0.3714 28.2129 10.4773 0.0354 2.8543 0.3503 30.9057 10.8276 0.0324 3.0256 0.3305 33.7600 11.1581 0.0296 3.2071 0.3118 36.7856 11.4699 0.0272 3.3996 0.2942 39.9927 11.7641 0.0250 3.6035 0.2775 43.3923 12.0416 0.0230 3.8197 0.2618 46.9958 12.3034 0.0213 4.0489 0.2470 50.8156 12.5504 0.0197 4.2919 0.2330 54.8645 12.7834 0.0182 5.7435 0.1741 79.0582 13.7648 0.0126 7.6861 0.1301 111.4348 14.4982 0.0090 10.2857 0.0972 154.7620 15.0463 0.0065 13.7646 0.0727 212.7435 15.4558 0.0047 18.4202 0.0543 290.3359 15.7619 0.0034 Capital Recovery Factor To Find A Given P AIP 1.0600 0.5454 0.3741 0.2886 0.2374 0.2034 0.1791 0.1610 0.1470 0.1359 0.1268 0.1193 0.1130 0.1076 0.1030 0.0990 0.0954 0.0924 0.0896 0.0872 0.0850 0.0830 0.0813 0.0797 0.0782 0.0726 0.0690 0.0665 0.0647 0.0634 17 18 19 20 21 22 23 24 25 30 35 40 45 50 A group of private investors borrowed $29 million to build 400 new luxury apartments near a large university. The money was borrowed at 6% annual interest, and the loan is to be repaid in equal annual amounts over a 50-year period. Annual operating, maintenance, and insurance expenses are estimated to be $4,500 per apartment. This expense will be incurred even if an apartment is vacant. The rental fee for each apartment will be $10,000 per year, and the worst-case occupancy rate is projected to be 85%. Investigate the sensitivity of annual profit (or loss) to (a) changes in the occupancy rate and (b) changes in the annual rental fee. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 6% per year. Complete the table below. (Round to the nearest thousands.) Occupancy Rate, $ 85% Rental Fee 75% 80% 90% 95% 100% $4,000 22 22 22 22 22 22 | N W NZ 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Discrete Compounding; i = 6% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP PIF FIA PIA AIF 1.0600 0.9434 1.0000 0.9434 1.0000 1.1236 0.8900 2.0600 1.8334 0.4854 1.1910 0.8396 3.1836 2.6730 0.3141 1.2625 0.7921 4.3746 3.4651 0.2286 1.3382 0.7473 5.6371 4.2124 0.1774 1.4185 0.7050 6.9753 4.9173 0.1434 1.5036 0.6651 8.3938 5.5824 0.1191 1.5938 0.6274 9.8975 6.2098 0.1010 1.6895 0.5919 11.4913 6.8017 0.0870 1.7908 0.5584 13.1808 7.3601 0.0759 1.8983 0.5268 14.9716 7.8869 0.0668 2.0122 0.4970 16.8699 8.3838 0.0593 2.1329 0.4688 18.8821 8.8527 0.0530 2.2609 0.4423 21.0151 9.2950 0.0476 2.3966 0.4173 23.2760 9.7122 0.0430 2.5404 0.3936 25.6725 10.1059 0.0390 2.6928 0.3714 28.2129 10.4773 0.0354 2.8543 0.3503 30.9057 10.8276 0.0324 3.0256 0.3305 33.7600 11.1581 0.0296 3.2071 0.3118 36.7856 11.4699 0.0272 3.3996 0.2942 39.9927 11.7641 0.0250 3.6035 0.2775 43.3923 12.0416 0.0230 3.8197 0.2618 46.9958 12.3034 0.0213 4.0489 0.2470 50.8156 12.5504 0.0197 4.2919 0.2330 54.8645 12.7834 0.0182 5.7435 0.1741 79.0582 13.7648 0.0126 7.6861 0.1301 111.4348 14.4982 0.0090 10.2857 0.0972 154.7620 15.0463 0.0065 13.7646 0.0727 212.7435 15.4558 0.0047 18.4202 0.0543 290.3359 15.7619 0.0034 Capital Recovery Factor To Find A Given P AIP 1.0600 0.5454 0.3741 0.2886 0.2374 0.2034 0.1791 0.1610 0.1470 0.1359 0.1268 0.1193 0.1130 0.1076 0.1030 0.0990 0.0954 0.0924 0.0896 0.0872 0.0850 0.0830 0.0813 0.0797 0.0782 0.0726 0.0690 0.0665 0.0647 0.0634 17 18 19 20 21 22 23 24 25 30 35 40 45 50