Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A group of private investors borrowed $31,498,914 million to build 300 new luxury apartments near a large university. the money was borrowed at 7%

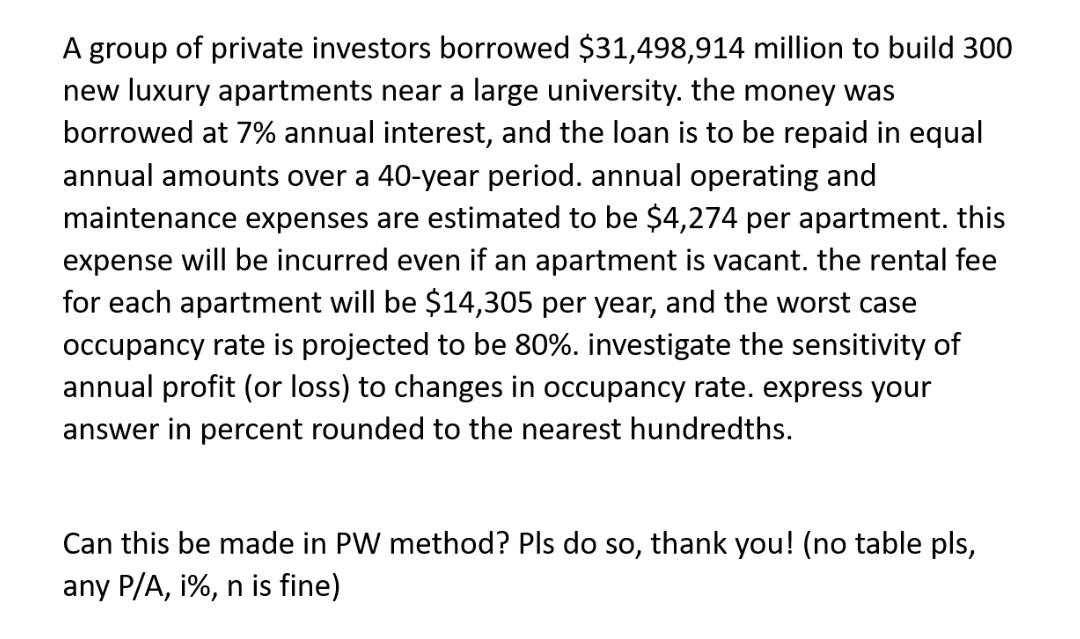

A group of private investors borrowed $31,498,914 million to build 300 new luxury apartments near a large university. the money was borrowed at 7% annual interest, and the loan is to be repaid in equal annual amounts over a 40-year period. annual operating and maintenance expenses are estimated to be $4,274 per apartment. this expense will be incurred even if an apartment is vacant. the rental fee for each apartment will be $14,305 per year, and the worst case occupancy rate is projected to be 80%. investigate the sensitivity of annual profit (or loss) to changes in occupancy rate. express your answer in percent rounded to the nearest hundredths. Can this be made in PW method? Pls do so, thank you! (no table pls, any P/A, i%, n is fine)

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

The present worth is a term relating to the capability of a project ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started