Question

A group term life insurance policy for $100,000 (premium cost, $800). A cash bonus of $3,000 that was awarded to him in the previous year

- A group term life insurance policy for $100,000 (premium cost, $800).

- A cash bonus of $3,000 that was awarded to him in the previous year and that he received in the current year.

- Alans employer gives all senior executives the option to acquire a certain number of shares of the corporation at a price that is guaranteed for two years. In 2020, the employer granted Alan an option to purchase up to 5,000 of its shares for a price of $10 per share. At the time the option was granted, the shares were valued at $10.75 per share. During 2021, Alan purchased 500 shares at a cost of $10 per share. At the date of purchase, the corporations shares were trading at $14 per share.

- Alan purchased a small parcel of land (20 hectares) in 2021 and began raising goats. In 2021, he lost $1,000 from this operation.

- In 2021, Alan purchased 1,000 shares of Canadian public corporation X for $20 per share and received a stock dividend of 100 additional shares of the same class. During the year, he sold the 100 shares at $21 per share, for the same value as on their date of issue.

- Three years ago, Alan purchased three residential rental properties and has provided you with the following information:

|

| Property 1 | Property 2 | Property 3 | ||||||

| Land cost | $ | 10,000 |

| $ | 4,000 |

| $ | 8,000 |

|

| Building cost |

| 60,000 |

|

| 40,000 |

|

| 45,000 |

|

| Building UCC (December 31, 2020) |

| 52,000 |

|

| 37,000 |

|

| 40,000 |

|

| 2021 net rents (before CCA) |

| 3,000 |

|

| (5,000 | ) |

| 4,000 |

|

In 2021, Alan sold property 1 for $80,000 (land - $12,000, building - $68,000), and property 2 for $50,000 (land - $6,000, building - $44,000). Also, in 2021, he purchased property 4 for $90,000 (land - $30,000, building - $60,000). In 2021, property 4 had net rentals before capital cost allowance of $1,000.

- During the year, Alan gifted 1,000 shares of Shell Canada Ltd. (a public corporation) to his daughter. The shares had cost him $10 each and had a value at the time of the gift of $12 each. In 2021, his daughter (16 years old) received dividends of $1,000; she then sold the shares for $30 each.

- In 2021, Alan gifted 2,000 shares of Exxon Ltd. (a public corporation) to his spouse. The shares had a value of $40 each at the time of the gift. He had paid $30 per share several years before. His spouse sold the shares in 2021 for $28 per share during a market slump.

- Alans mother died in 2020 and left him her house. The house cost $40,000 at the time of purchase and had a value in 2020 of $60,000. Alan sold the house in 2021 for $66,000.

- Three years ago, Alan purchased 15% of the shares of two private corporations. Each carried on an active business. He sold the shares of both corporations in 2021. Information relating to the shares is as follows:

|

| PC 1 | PC 2 | ||||

| Cost | $ | 40,000 |

| $ | 35,000 |

|

| Proceeds of sale |

| 56,000 |

|

| 20,000 |

|

| Terms of payment | $ | 8,000 | /yr for 7 yrs | All cash | ||

- In 2021, during a market slump, Alan sold 500 shares of public corporation A for $30,000; the shares had cost him $40,000. Two weeks later, as the market began to strengthen, he purchased 500 shares of the same corporation for $29,000.

- Alan also sold the following assets in 2021:

|

| Cost | Proceeds | ||||

| Public corporation B shares | $ | 10,000 |

| $ | 12,000 |

|

| Public corporation C shares |

| 47,500 |

|

| 20,000 |

|

| Stamp collection |

| 8,000 |

|

| 12,000 |

|

| Jewellery |

| 6,000 |

|

| 1,000 |

|

| Boat |

| 5,000 |

|

| 2,000 |

|

| Stereo set |

| 800 |

|

| 900 |

|

- Alan had the following additional receipts in 2021:

| Dividends from Canadian public companies | $ | 4,000 |

| Interest on bonds |

| 1,000 |

| Lottery winnings |

| 6,000 |

13. Alan paid out the following in 2021:

| To purchase a computer for use at home when working on |

|

|

| his employers business | $ | 1,900 |

| Interest on bank loan to purchase shares of public corporation |

| 2,000 |

| Interest on house mortgage (mortgage funds of $60,000 were used |

|

|

| 40,000 for the purchase of the house, $20,000. for the |

|

|

| purchase of shares) |

| 6,000 |

| Lump-sum alimony settlement to ex-spouse |

| 9,000 |

| Tuition fees for attending university |

| 1,000 |

| Donations |

| 4,000 |

| Gift to a registered federal political party |

| 1,000 |

| Contribution to an RRSP |

| 2,800 |

| Annual dues to the provincial law society |

| 1,000 |

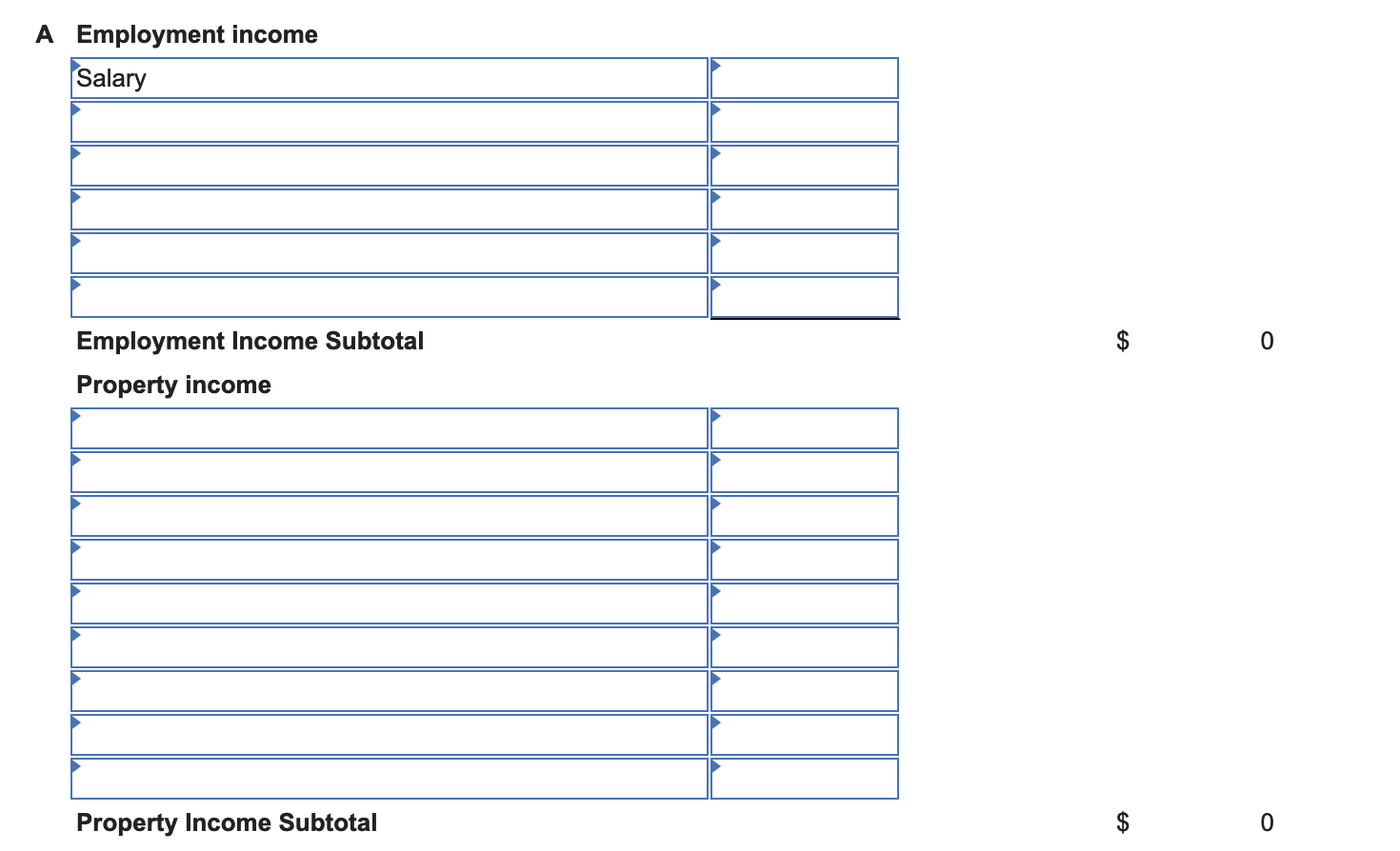

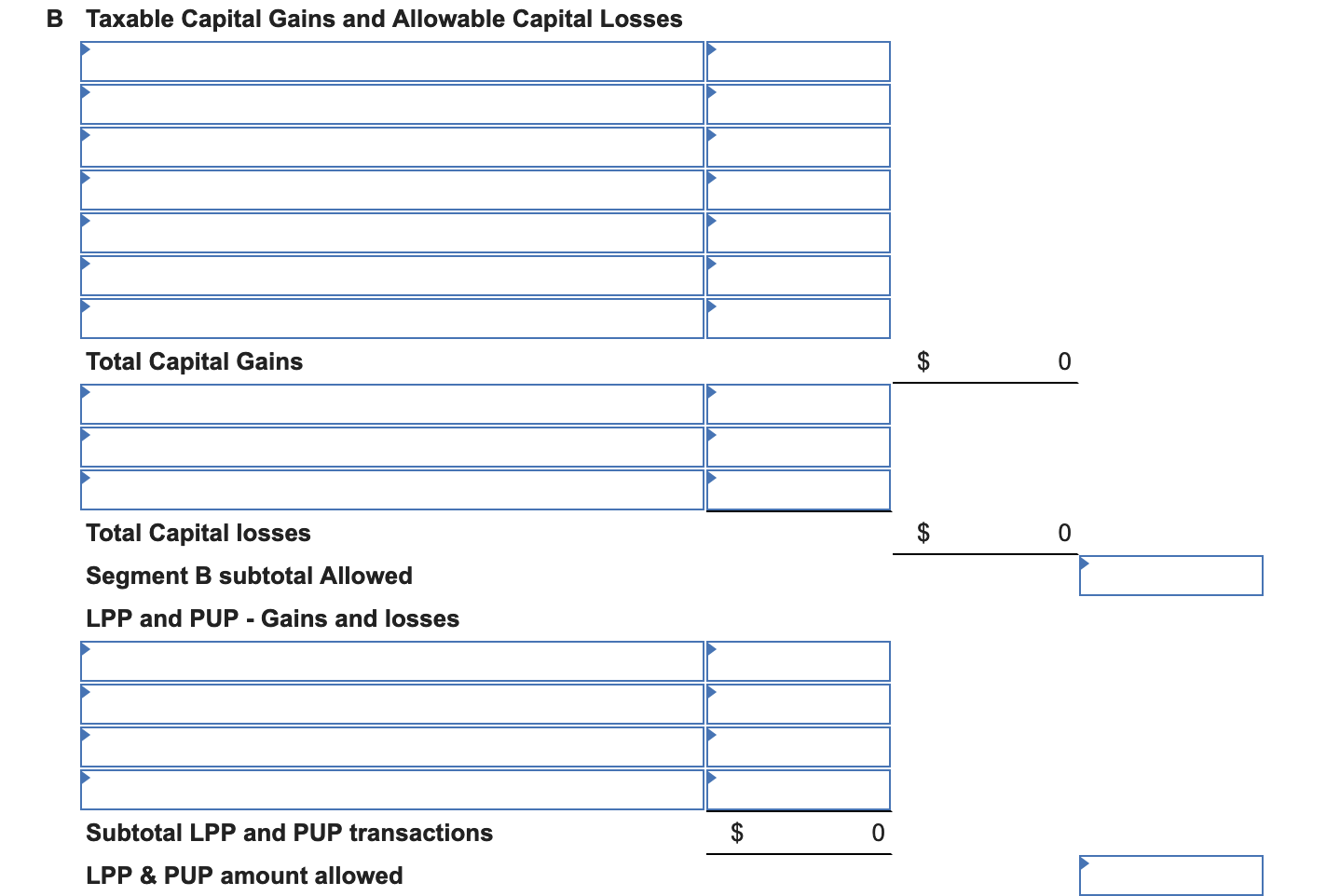

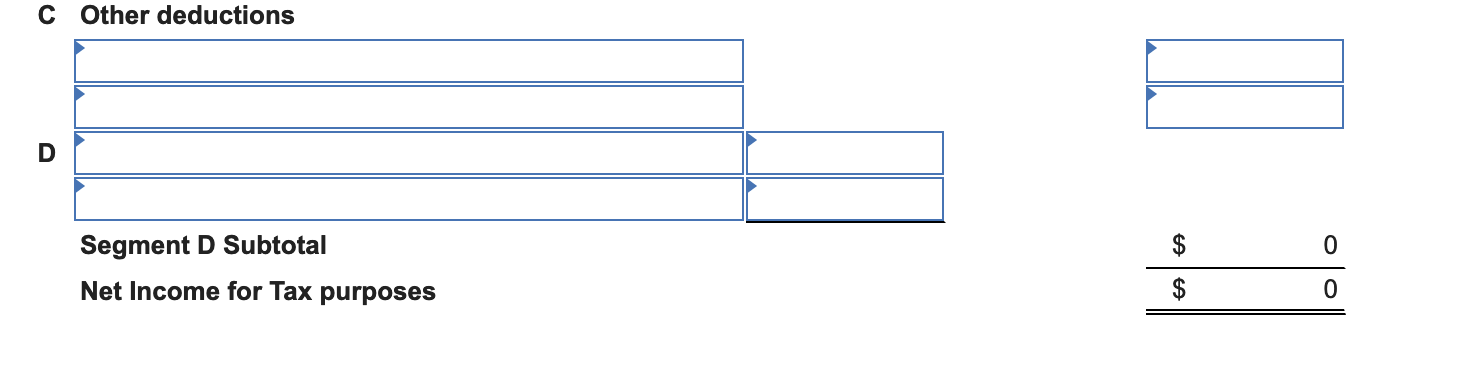

Required: Calculate Alans net income for tax purposes for 2021. (Enter deductions with a minus sign (-). If a number should be zero, enter 0.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started