Answered step by step

Verified Expert Solution

Question

1 Approved Answer

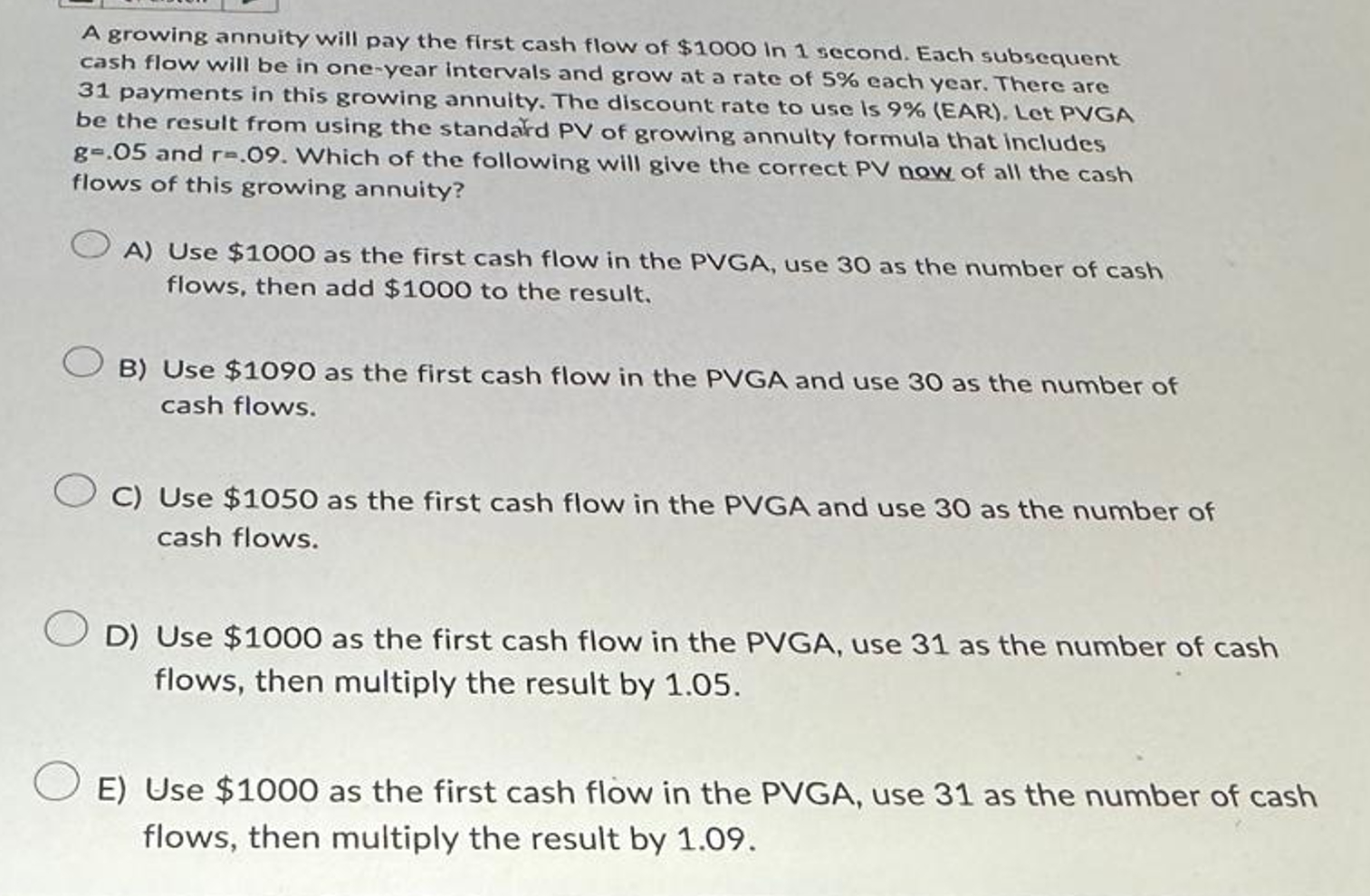

A growing annuity will pay the first cash flow of $ 1 0 0 0 in 1 second. Each subsequent cash flow will be in

A growing annuity will pay the first cash flow of $ in second. Each subsequent

cash flow will be in oneyear intervals and grow at a rate of each year. There are

payments in this growing annuity. The discount rate to use is EAR Let PVGA

be the result from using the standard PV of growing annulty formula that includes

and Which of the following will give the correct PV now of all the cash

flows of this growing annuity?

A Use $ as the first cash flow in the PVGA, use as the number of cash

flows, then add $ to the result.

B Use $ as the first cash flow in the PVGA and use as the number of

cash flows.

C Use $ as the first cash flow in the PVGA and use as the number of

cash flows.

D Use $ as the first cash flow in the PVGA, use as the number of cash

flows, then multiply the result by

E Use $ as the first cash flow in the PVGA, use as the number of cash

flows, then multiply the result by

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started