Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A growing County is planning to build a Community College. Janet viewed the plan as an investment opportunity, having canned a degree in Engineering Management

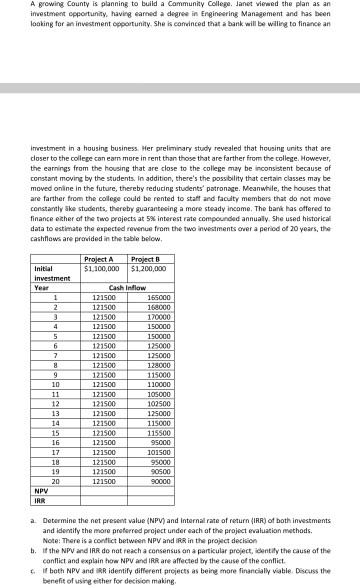

A growing County is planning to build a Community College. Janet viewed the plan as an investment opportunity, having canned a degree in Engineering Management and has been looking for an investment opportunity. She is convinced that a bank will be willing to finance an imvestment in a housing business. Her preliminary study revealed that housing units that are closer to the college can earn more in rent than those that are farther from the college. However, the earnings from the housing that are close to the college may be inconsistent because of constant moving by the students. In addition, there's the possibility that certain classes may be moved online in the future, thereby reducing students' patronage. Meanwhile, the houses that are farther from the college could be rented to staff and faculty members that do not move constantly like students, thereby guaranteeing a more steady income. The bank has offered to finance either of the two projects at 5% interest rate compounded annually. She used historical data to estimate the expected revenue from the two investments over a period of 20 years, the cashflows are provided in the table below. Project A $1,100,000 Project B $1.200,000 Initial Investment Year 1 2 3 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Cash Inflow 121500 165000 121500 168000 121500 170000 121500 150000 121500 150000 121500 125000 121500 125000 121500 128000 121500 115000 121500 110000 121500 105000 121500 102500 121500 125000 121500 115000 121500 115500 121500 95000 121500 101500 121500 95.000 121500 90500 121500 90000 NPV IRR a. Determine the net present value (NPV) and Internal rate of return (IRR) of both investments and identify the more preferred project under each of the project evaluation methods. Note: There is a conflict between NPV and IRR in the project decision b. If the NPV and IRR do not reach a consensus on a particular project, identify the cause of the conflict and explain how NPV and IRR are affected by the cause of the conflict. c. If both NPV and IRR identify different projects as being more financially viable. Discuss the benefit of using either for decision making

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started