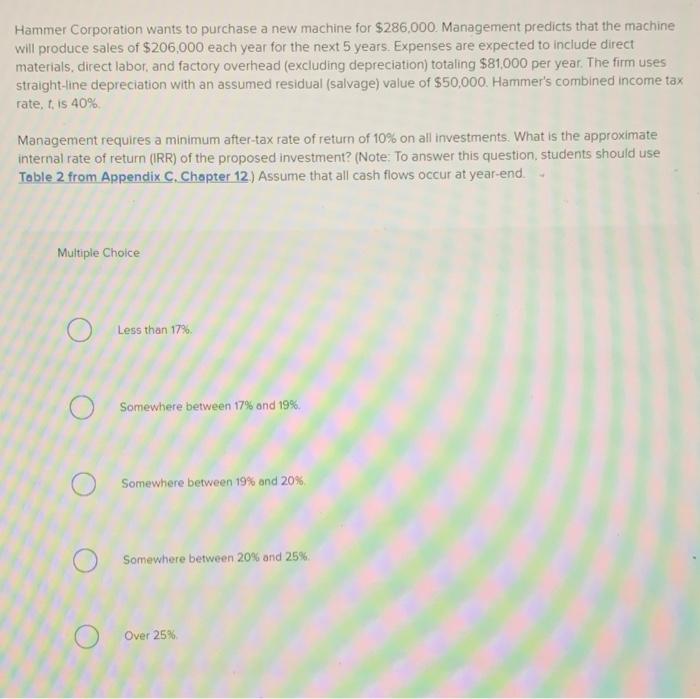

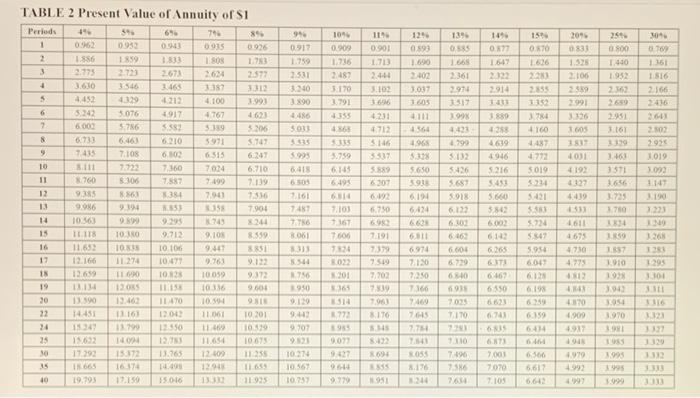

a Hammer Corporation wants to purchase a new machine for $286,000. Management predicts that the machine will produce sales of $206,000 each year for the next 5 years. Expenses are expected to include direct materials, direct labor, and factory overhead (excluding depreciation) totaling $81,000 per year. The firm uses straight-line depreciation with an assumed residual (salvage) value of $50,000. Hammer's combined income tax rate, t.is 40% Management requires a minimum after-tax rate of return of 10% on all investments. What is the approximate internal rate of return (IRR) of the proposed investment? (Note: To answer this question, students should use Table 2 from Appendix C. Chapter 12.) Assume that all cash flows occur at year-end. Multiple Choice Less than 17% Somewhere between 17% and 19%, Somewhere between 19% and 20% Somewhere between 20% and 25% Over 25% 12 109 11 12 1394 15 104 94 0911 6060 1060 30 OLO 9981 254 0.800 1.440 149 0172 1.547 2 2914 209 0831 1.525 2106 2659 69L 1961 LS 590 1.600 2:02 1017 1605 1.736 24487 3:170 1.791 CE 1974 3311 3340 3.890 4486 SOU 2355 2102 IS16 2.166 2436 CSEE 166 SSET 366 2 TRA 1160 46 3.16 2.444 3.101 16 4231 1712 SH 3517 3.889 6301 6.192 6790 16 1966 4431 4799 LET OCET 6 1353 4619 4946 5216 5451 1.GOS 181 4031 4193 1122 2302 2935 3.019 3.000 01 3.759 6145 6.95 TII 61 650 ILSE TABLE 2 Present Value of Annuity of S1 Periods T 89 1 0933 0935 0.926 2 1359 SON 1.73 3 2.773 2673 2634 2.572 3.610 3546 3.463 1157 312 S 4452 4329 212 4.100 1.993 6 5242 3.076 4917 462 6000 576 55 5.19 3206 6733 6.463 6.210 7415 THOS 6.100 6515 7.360 7014 6.710 11 8.760 8106 7587 7.99 7.139 12 384 7.94 7336 1. 9.06 194 15 7.904 14 10:56 9 9.295 15 IT ITS 10:30 9.712 9.103 8559 16 10 10.100 12.166 11.274 107 12.659 10.12 10.059 937 10:36 30 13590 13.462 1170 10.94 22 14451 13161 1200 10 201 24 1934 122550 10 25 19.03 11.64 10673 15372 13.76 12.109 11.255 15 19 19.793 12.150 35.00 11 LE SE 6 1988 5650 5191 6.194 6424 66 3019 5.24 5431 35 5724 5647 SES 747 LES! 5426 5.687 5918 6.133 6.100 6160 6.606 6.229 333 584 6003 165 3.725 70 14 12 TING 7103 7167 7.600 7824 1611 ONE 119 1908 ICE IS 5.934 604 6165 6T 6467 4.750 4773 30 016 76 201 7.191 7.379 7519 7.700 739 1963 3176 NI 61 019 CIE 19 101 11 SOCI SI 6974 7.130 7350 7160 7460 7045 90 6193 CHE 096 SINO 16 693 7035 MITO 4370 4.900 3.954 3970 IS ELLY 0743 9442 9.701 6.159 123 9 51 TRE 16 OF HOT ONE COCLI 10214 79 055 1995 7496 7.50 360 6.61 7.000 7070 7.103 OLA (667 CELE ICE 196 55 951 SCOTT 10.25 1.099