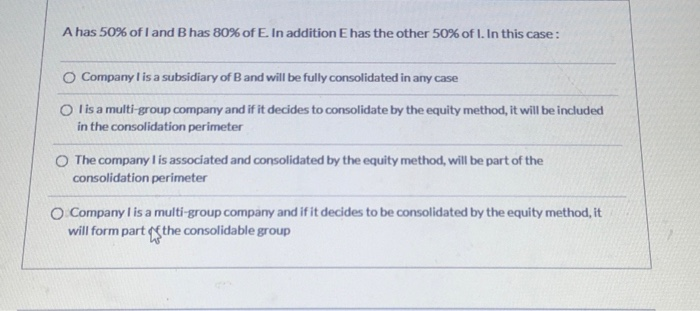

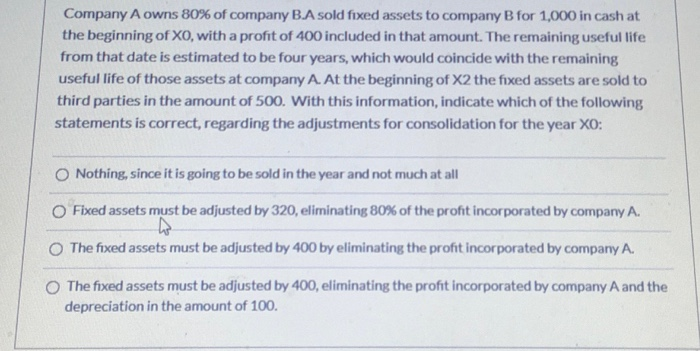

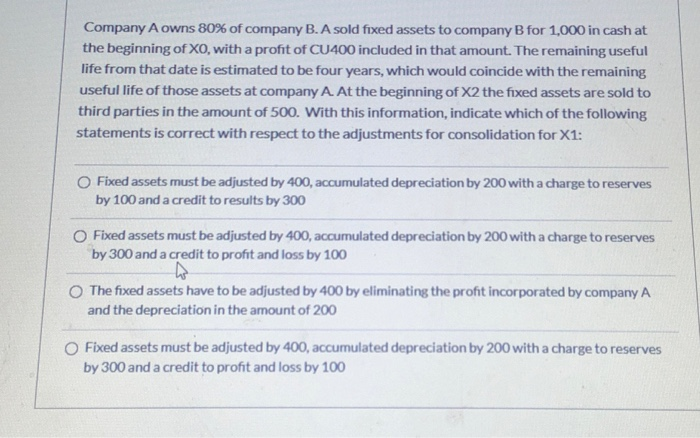

A has 50% of I and Bhas 80% of E. In addition E has the other 50% of I. In this case: Company I is a subsidiary of B and will be fully consolidated in any case I is a multi-group company and if it decides to consolidate by the equity method, it will be included in the consolidation perimeter The company I is associated and consolidated by the equity method, will be part of the consolidation perimeter Company I is a multi-group company and if it decides to be consolidated by the equity method, it will form part the consolidable group Company A owns 80% of company B A sold fixed assets to company B for 1,000 in cash at the beginning of XO, with a profit of 400 included in that amount. The remaining useful life from that date is estimated to be four years, which would coincide with the remaining useful life of those assets at company A. At the beginning of X2 the fixed assets are sold to third parties in the amount of 500. With this information, indicate which of the following statements is correct, regarding the adjustments for consolidation for the year XO: Nothing, since it is going to be sold in the year and not much at all Fixed assets must be adjusted by 320, eliminating 80% of the profit incorporated by company A. The fixed assets must be adjusted by 400 by eliminating the profit incorporated by company A. The fixed assets must be adjusted by 400, eliminating the profit incorporated by company A and the depreciation in the amount of 100. Company A owns 80% of company B. A sold fixed assets to company B for 1,000 in cash at the beginning of XO, with a profit of CU400 included in that amount. The remaining useful life from that date is estimated to be four years, which would coincide with the remaining useful life of those assets at company A. At the beginning of X2 the fixed assets are sold to third parties in the amount of 500. With this information, indicate which of the following statements is correct with respect to the adjustments for consolidation for X1: Fixed assets must be adjusted by 400, accumulated depreciation by 200 with a charge to reserves by 100 and a credit to results by 300 Fixed assets must be adjusted by 400, accumulated depreciation by 200 with a charge to reserves by 300 and a credit to profit and loss by 100 The fixed assets have to be adjusted by 400 by eliminating the profit incorporated by company A and the depreciation in the amount of 200 O Fixed assets must be adjusted by 400, accumulated depreciation by 200 with a charge to reserves by 300 and a credit to profit and loss by 100