Answered step by step

Verified Expert Solution

Question

1 Approved Answer

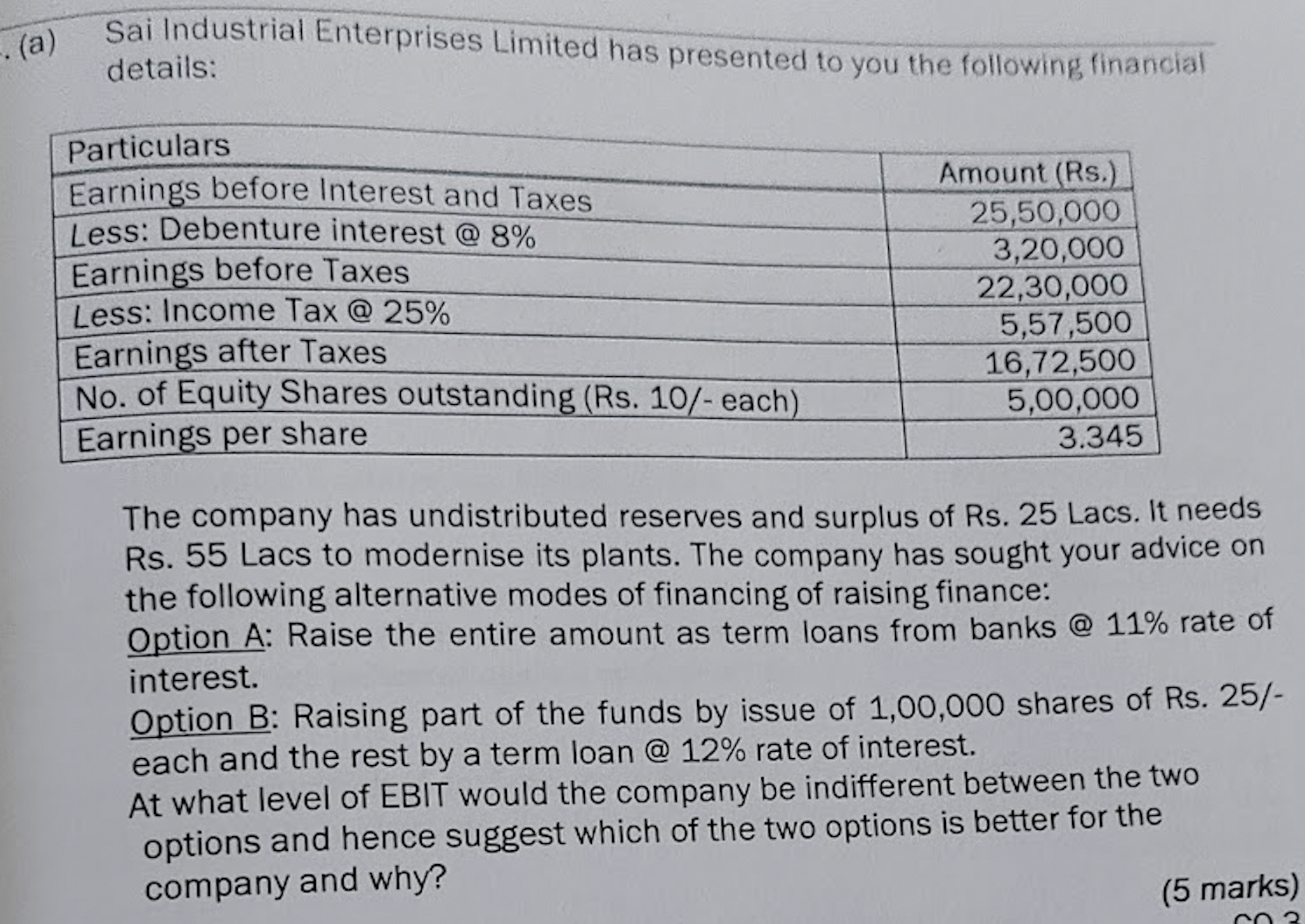

( a ) has presented to you the following financial details: The company has undistributed reserves and surplus of Rs . 2 5 Lacs. It

a has presented to you the following financial

details:

The company has undistributed reserves and surplus of Rs Lacs. It needs

Rs Lacs to modernise its plants. The company has sought your advice on

the following alternative modes of financing of raising finance:

Option A: Raise the entire amount as term loans from banks @ rate of

interest.

Option B: Raising part of the funds by issue of shares of Rs

each and the rest by a term loan @ rate of interest.

At what level of EBIT would the company be indifferent between the two

options and hence suggest which of the two options is better for the

company and why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started