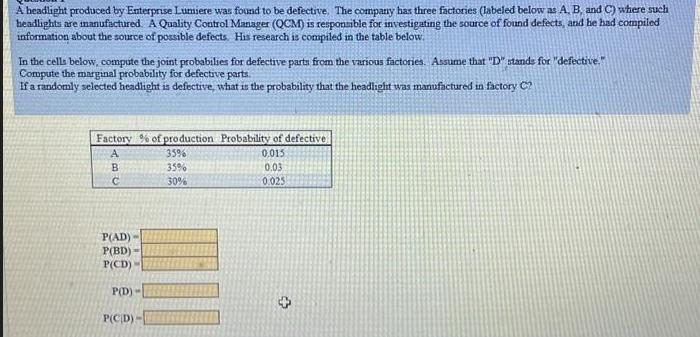

A headlight produced by Enterprise Lumiere was found to be defective. The company has three factories (labeled below as A. B, and C) where

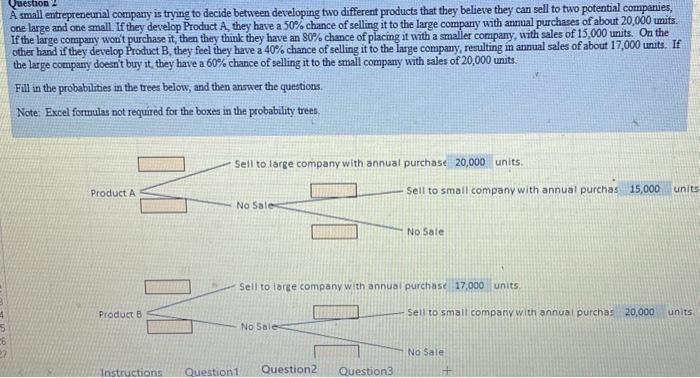

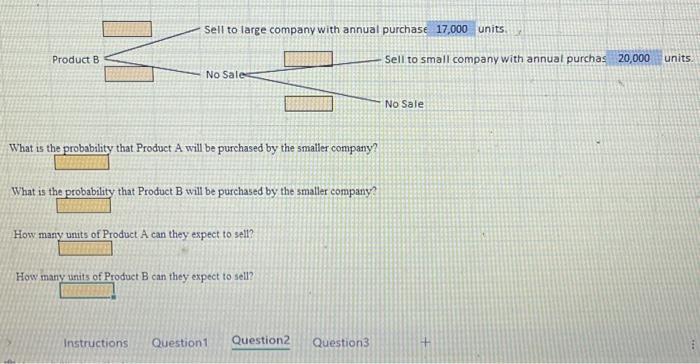

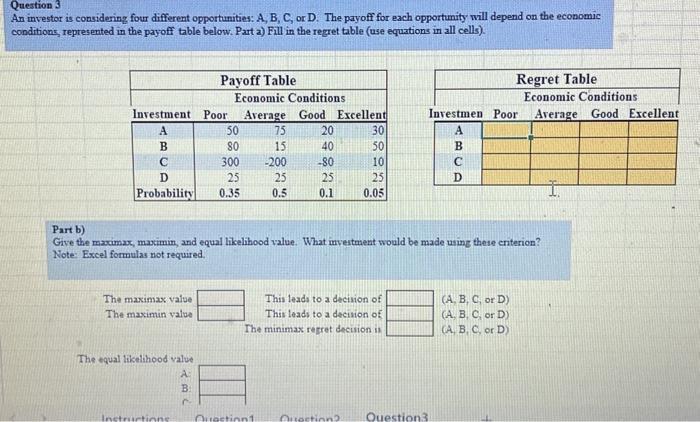

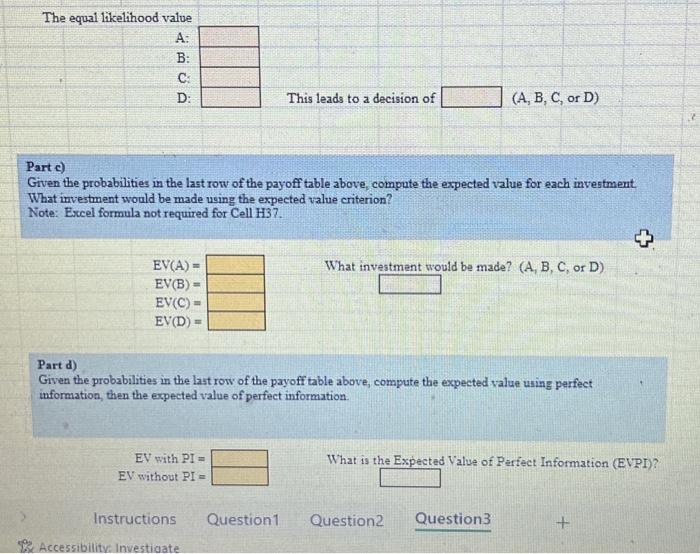

A headlight produced by Enterprise Lumiere was found to be defective. The company has three factories (labeled below as A. B, and C) where such headlights are manufactured. A Quality Control Manager (QCM) is responsible for investigating the source of found defects, and he had compiled information about the source of possible defects. His research is compiled in the table below. In the cells below, compute the joint probabilies for defective parts from the various factories. Assume that "D" stands for "defective." Compute the marginal probability for defective parts. If a randomly selected headlight is defective, what is the probability that the headlight was manufactured in factory C? Factory% of production Probability of defective 0.015 0.03 0.025 A B P(AD)- P(BD)- P(CD) P(D)- P(CD)- 35% 35% 30% 6 Question 2 A small entrepreneurial company is trying to decide between developing two different products that they believe they can sell to two potential companies, one large and one small. If they develop Product A, they have a 50% chance of selling it to the large company with annual purchases of about 20,000 units. If the large company won't purchase it, then they think they have an 80% chance of placing it with a smaller company, with sales of 15,000 units. On the other hand if they develop Product B, they feel they have a 40% chance of selling it to the large company, resulting in annual sales of about 17,000 units. If the large company doesn't buy it, they have a 60% chance of selling it to the small company with sales of 20,000 units. Fill in the probabilities in the trees below, and then answer the questions. Note: Excel formulas not required for the boxes in the probability trees. Product A Product B Sell to large company with annual purchase 20,000 units. No Sale No Sale Sell to small company with annual purchas 15,000 Sell to large company with annual purchase 17,000 units. Instructions Question1. Question2 Question3 No Sale Sell to small company with annual purchas 20,000 units No Sale units + Product B Sell to large company with annual purchase 17,000 units. No Sale What is the probability that Product A will be purchased by the smaller company? What is the probability that Product B will be purchased by the smaller company? How many units of Product A can they expect to sell? Instructions How many units of Product B can they expect to sell? Question1 Question2 Question3 Sell to small company with annual purchas 20,000 units. No Sale Question 3 An investor is considering four different opportunities: A, B, C, or D. The payoff for each opportunity will depend on the economic conditions, represented in the payoff table below. Part a) Fill in the regret table (use equations in all cells). Investment A BOE 50 80 300 D 25 Probability 0.35 The maximax value The maximin value The equal likelihood value A: Payoff Table Instructions Economic Conditions Poor Average Good Excellent 30 ABC 75 15 -200 25 0.5 Question1 20 40 -80 25 0.1 28876 50 10 Part b) Give the maximax, maximin, and equal likelihood value. What investment would be made using these criterion? Note: Excel formulas not required. 25 0.05 This leads to a decision of This leads to a decision of The minimax regret decision is Regret Table Economic Conditions Investmen Poor Average Good Excellent Question?. Question3 ABCD (A, B, C, or D) (A, B, C, or D) (A, B, C, or D) The equal likelihood value A: B: C: D: EV(A)= EV(B) = = EV(C)= EV(D) = Parte) Given the probabilities in the last row of the payoff table above, compute the expected value for each investment. What investment would be made using the expected value criterion? Note: Excel formula not required for Cell H37. EV with PI= EV without PI = This leads to a decision of Instructions Accessibility: Investigate Part d) Given the probabilities in the last row of the payoff table above, compute the expected value using perfect information, then the expected value of perfect information. Question1 (A, B, C, or D) What investment would be made? (A, B, C, or D). What is the Expected Value of Perfect Information (EVPI)? Question2 Question3 +

Step by Step Solution

3.60 Rating (178 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the regret table calculations as follows RegretAPoorMaxPoorPayoffAPoor Max50803002550 30050 250 RegretAAverageMaxAveragePayoffAAverage Max75152002575 7575 0 RegretAGoodMaxGoodPayoffAGood Max...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started