Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A hedge fund analyst is interested in the possible losses L for a certain stock. From historical data she has calculated the values of

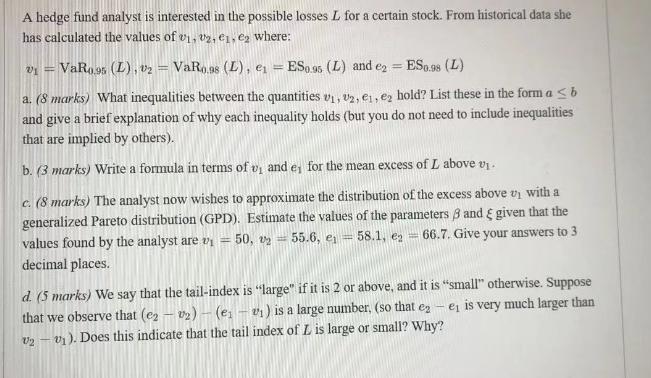

A hedge fund analyst is interested in the possible losses L for a certain stock. From historical data she has calculated the values of v1, v2, e1, e2 where: v=VaRa95 (L), v2 = VaRoss (L), e = ES0.95 (L) and e2 = ES0.98 (L) a. (8 marks) What inequalities between the quantities v1, v2, e1, e2 hold? List these in the form a b and give a brief explanation of why each inequality holds (but you do not need to include inequalities that are implied by others). b. (3 marks) Write a formula in terms of v and e for the mean excess of L above vi c. (8 marks) The analyst now wishes to approximate the distribution of the excess above v with a generalized Pareto distribution (GPD). Estimate the values of the parameters 3 and given that the values found by the analyst are vi 50, 255.6, e = 58.1, e2 = 66.7. Give your answers to 3 decimal places. d. (5 marks) We say that the tail-index is "large" if it is 2 or above, and it is "small" otherwise. Suppose v) is a large number, (so that e2 e is very much larger than that we observe that (e2-2)-(e v). Does this indicate that the tail index of L is large or small? Why? V2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Hedge Fund Analyst and Loss Distribution Analysis a Inequalities between VaR quantities VaRL VaRL This holds because a higher VaR level 98 implies a l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started