Question

A hedger knows that she will buy 1 million gallons of jet fuel in 3 months. She wants to hedge with forward contracts on

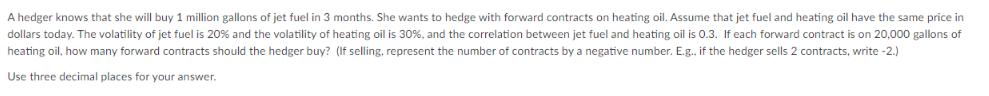

A hedger knows that she will buy 1 million gallons of jet fuel in 3 months. She wants to hedge with forward contracts on heating oil. Assume that jet fuel and heating oil have the same price in dollars today. The volatility of jet fuel is 20% and the volatility of heating oil is 30%, and the correlation between jet fuel and heating oil is 0.3. If each forward contract is on 20,000 gallons of heating oil, how many forward contracts should the hedger buy? (If selling, represent the number of contracts by a negative number. E.g., if the hedger sells 2 contracts, write -2.) Use three decimal places for your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The first step is to calculate the correlationadjusted volatility of je...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting And Analysis

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

8th Edition

1260247848, 978-1260247848

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App