Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Air Canada plans to replace its entire fleet of wide-body jets. The aircraft replacement costs about $7 billion (Canadian) on the basis of the

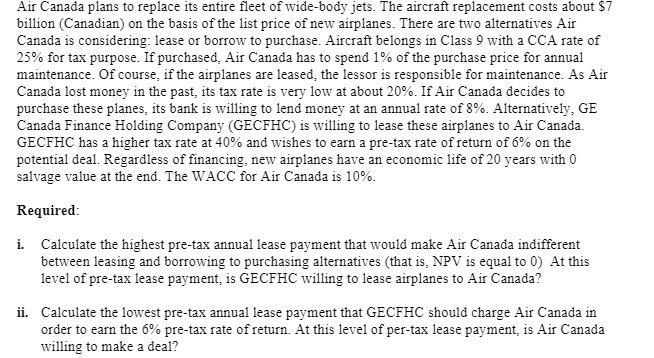

Air Canada plans to replace its entire fleet of wide-body jets. The aircraft replacement costs about $7 billion (Canadian) on the basis of the list price of new airplanes. There are two alternatives Air Canada is considering: lease or borrow to purchase. Aircraft belongs in Class 9 with a CCA rate of 25% for tax purpose. If purchased, Air Canada has to spend 1% of the purchase price for annual maintenance. Of course, if the airplanes are leased, the lessor is responsible for maintenance. As Air Canada lost money in the past, its tax rate is very low at about 20%. If Air Canada decides to purchase these planes, its bank is willing to lend money at an annual rate of 8%. Alternatively, GE Canada Finance Holding Company (GECFHC) is willing to lease these airplanes to Air Canada. GECFHC has a higher tax rate at 40% and wishes to earn a pre-tax rate of return of 6% on the potential deal. Regardless of financing, new airplanes have an economic life of 20 years with 0 salvage value at the end. The WACC for Air Canada is 10%. Required: i. Calculate the highest pre-tax annual lease payment that would make Air Canada indifferent between leasing and borrowing to purchasing alternatives (that is, NPV is equal to 0) At this level of pre-tax lease payment, is GECFHC willing to lease airplanes to Air Canada? ii. Calculate the lowest pre-tax annual lease payment that GECFHC should charge Air Canada in order to earn the 6% pre-tax rate of return. At this level of per-tax lease payment, is Air Canada willing to make a deal?

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the highest pretax annual lease payment that would make Air Canada indifferent between leasing and borrowing to purchase alternatives we need to calculate the net present value NPV for bo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started