Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a Hemandez has always been creative and has been able to foresee business trends since she was in university. She completed her CPA requirements

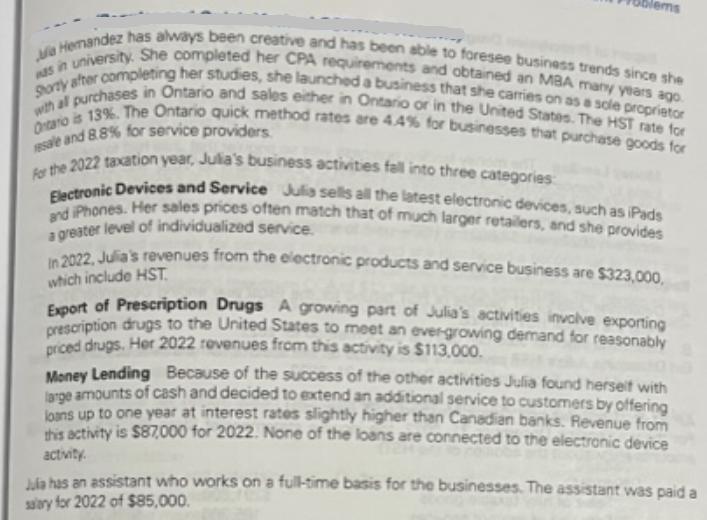

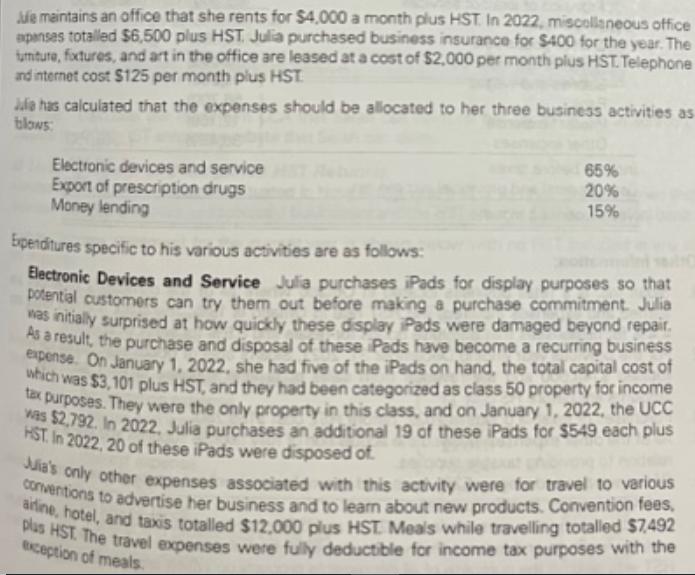

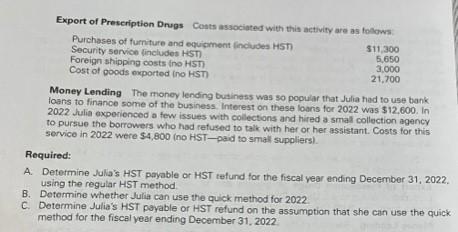

a Hemandez has always been creative and has been able to foresee business trends since she was in university. She completed her CPA requirements and obtained an MBA many years ago. with all purchases in Ontario and sales either in Ontario or in the United States. The HST rate for Shortly after completing her studies, she launched a business that she carries on as a sole proprietor Ontario is 13%. The Ontario quick method rates are 4.4% for businesses that purchase goods for sale and 8.8% for service providers. For the 2022 taxation year, Julia's business activities fall into three categories: Electronic Devices and Service Julia sells all the latest electronic devices, such as iPads and iPhones. Her sales prices often match that of much larger retailers, and she provides a greater level of individualized service. In 2022, Julia's revenues from the electronic products and service business are $323,000, which include HST. Export of Prescription Drugs A growing part of Julia's activities involve exporting prescription drugs to the United States to meet an ever-growing demand for reasonably priced drugs. Her 2022 revenues from this activity is $113,000. Money Lending Because of the success of the other activities Julia found herself with large amounts of cash and decided to extend an additional service to customers by offering loans up to one year at interest rates slightly higher than Canadian banks. Revenue from this activity is $87,000 for 2022. None of the loans are connected to the electronic device activity. Jula has an assistant who works on a full-time basis for the businesses. The assistant was paid a salary for 2022 of $85,000. Jule maintains an office that she rents for $4,000 a month plus HST. In 2022, miscellaneous office axpanses totalled $6,500 plus HST. Julia purchased business insurance for $400 for the year. The tumiture, fixtures, and art in the office are leased at a cost of $2,000 per month plus HST. Telephone and internet cost $125 per month plus HST Julia has calculated that the expenses should be allocated to her three business activities as blows: Electronic devices and service Export of prescription drugs Money lending 65% 20% 15% Expenditures specific to his various activities are as follows: Electronic Devices and Service Julia purchases iPads for display purposes so that potential customers can try them out before making a purchase commitment. Julia was initially surprised at how quickly these display iPads were damaged beyond repair. As a result, the purchase and disposal of these iPads have become a recurring business expense. On January 1, 2022, she had five of the iPads on hand, the total capital cost of which was $3,101 plus HST, and they had been categorized as class 50 property for income tax purposes. They were the only property in this class, and on January 1, 2022, the UCC a $2,792. In 2022, Julia purchases an additional 19 of these iPads for $549 each plus HST. In 2022, 20 of these iPads were disposed of. Julia's only other expenses associated with this activity were for travel to various conventions to advertise her business and to learn about new products. Convention fees. airline, hotel, and taxis totalled $12,000 plus HST Meals while travelling totalled $7,492 plus HST. The travel expenses were fully deductible for income tax purposes with the exception of meals Export of Prescription Drugs Costs associated with this activity are as follows Purchases of furniture and equipment (includes HST) Security service (includes HST) Foreign shipping costs (no HST) Cost of goods exported (no HST) $11,300 5,650 3,000 21,700 Money Lending The money lending business was so popular that Julia had to use bank loans to finance some of the business. Interest on these loans for 2022 was $12,600. In 2022 Julia experienced a few issues with collections and hired a small collection agency to pursue the borrowers who had refused to talk with her or her assistant. Costs for this service in 2022 were $4,800 (no HST-paid to small suppliers). Required: A. Determine Julia's HST payable or HST refund for the fiscal year ending December 31, 2022. using the regular HST method. B. Determine whether Julia can use the quick method for 2022 C. Determine Julia's HST payable or HST refund on the assumption that she can use the quick method for the fiscal year ending December 31, 2022 a Hemandez has always been creative and has been able to foresee business trends since she was in university. She completed her CPA requirements and obtained an MBA many years ago. with all purchases in Ontario and sales either in Ontario or in the United States. The HST rate for Shortly after completing her studies, she launched a business that she carries on as a sole proprietor Ontario is 13%. The Ontario quick method rates are 4.4% for businesses that purchase goods for sale and 8.8% for service providers. For the 2022 taxation year, Julia's business activities fall into three categories: Electronic Devices and Service Julia sells all the latest electronic devices, such as iPads and iPhones. Her sales prices often match that of much larger retailers, and she provides a greater level of individualized service. In 2022, Julia's revenues from the electronic products and service business are $323,000, which include HST. Export of Prescription Drugs A growing part of Julia's activities involve exporting prescription drugs to the United States to meet an ever-growing demand for reasonably priced drugs. Her 2022 revenues from this activity is $113,000. Money Lending Because of the success of the other activities Julia found herself with large amounts of cash and decided to extend an additional service to customers by offering loans up to one year at interest rates slightly higher than Canadian banks. Revenue from this activity is $87,000 for 2022. None of the loans are connected to the electronic device activity. Jula has an assistant who works on a full-time basis for the businesses. The assistant was paid a salary for 2022 of $85,000. Jule maintains an office that she rents for $4,000 a month plus HST. In 2022, miscellaneous office axpanses totalled $6,500 plus HST. Julia purchased business insurance for $400 for the year. The tumiture, fixtures, and art in the office are leased at a cost of $2,000 per month plus HST. Telephone and internet cost $125 per month plus HST Julia has calculated that the expenses should be allocated to her three business activities as blows: Electronic devices and service Export of prescription drugs Money lending 65% 20% 15% Expenditures specific to his various activities are as follows: Electronic Devices and Service Julia purchases iPads for display purposes so that potential customers can try them out before making a purchase commitment. Julia was initially surprised at how quickly these display iPads were damaged beyond repair. As a result, the purchase and disposal of these iPads have become a recurring business expense. On January 1, 2022, she had five of the iPads on hand, the total capital cost of which was $3,101 plus HST, and they had been categorized as class 50 property for income tax purposes. They were the only property in this class, and on January 1, 2022, the UCC a $2,792. In 2022, Julia purchases an additional 19 of these iPads for $549 each plus HST. In 2022, 20 of these iPads were disposed of. Julia's only other expenses associated with this activity were for travel to various conventions to advertise her business and to learn about new products. Convention fees. airline, hotel, and taxis totalled $12,000 plus HST Meals while travelling totalled $7,492 plus HST. The travel expenses were fully deductible for income tax purposes with the exception of meals Export of Prescription Drugs Costs associated with this activity are as follows Purchases of furniture and equipment (includes HST) Security service (includes HST) Foreign shipping costs (no HST) Cost of goods exported (no HST) $11,300 5,650 3,000 21,700 Money Lending The money lending business was so popular that Julia had to use bank loans to finance some of the business. Interest on these loans for 2022 was $12,600. In 2022 Julia experienced a few issues with collections and hired a small collection agency to pursue the borrowers who had refused to talk with her or her assistant. Costs for this service in 2022 were $4,800 (no HST-paid to small suppliers). Required: A. Determine Julia's HST payable or HST refund for the fiscal year ending December 31, 2022. using the regular HST method. B. Determine whether Julia can use the quick method for 2022 C. Determine Julia's HST payable or HST refund on the assumption that she can use the quick method for the fiscal year ending December 31, 2022

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

A Determine Julias HST payable or HST refund ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started