Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) High End Berhad has just paid its annual dividend of RM3 per share. The dividend is expected to grow at a constant rate of

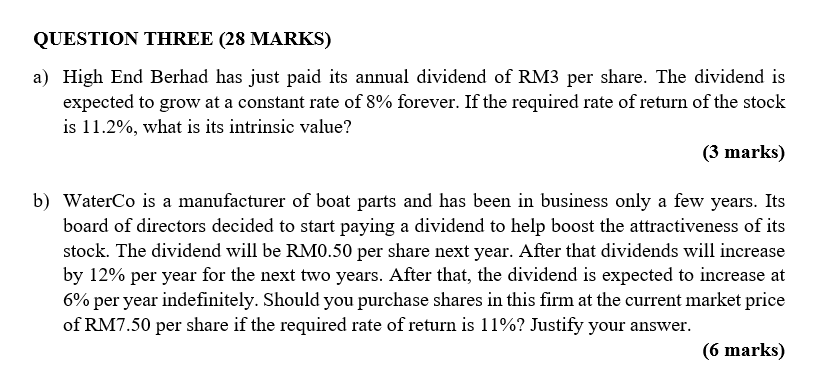

a) High End Berhad has just paid its annual dividend of RM3 per share. The dividend is expected to grow at a constant rate of \8 forever. If the required rate of return of the stock is \11.2, what is its intrinsic value? (3 marks) b) WaterCo is a manufacturer of boat parts and has been in business only a few years. Its board of directors decided to start paying a dividend to help boost the attractiveness of its stock. The dividend will be RM0.50 per share next year. After that dividends will increase by \12 per year for the next two years. After that, the dividend is expected to increase at \6 per year indefinitely. Should you purchase shares in this firm at the current market price of RM7.50 per share if the required rate of return is \11 ? Justify your

a) High End Berhad has just paid its annual dividend of RM3 per share. The dividend is expected to grow at a constant rate of \8 forever. If the required rate of return of the stock is \11.2, what is its intrinsic value? (3 marks) b) WaterCo is a manufacturer of boat parts and has been in business only a few years. Its board of directors decided to start paying a dividend to help boost the attractiveness of its stock. The dividend will be RM0.50 per share next year. After that dividends will increase by \12 per year for the next two years. After that, the dividend is expected to increase at \6 per year indefinitely. Should you purchase shares in this firm at the current market price of RM7.50 per share if the required rate of return is \11 ? Justify your Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started