Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A highway bridge is being considered for replacement. The new bridge would cost $X and would last for 20 years. Annual maintenance costs for the

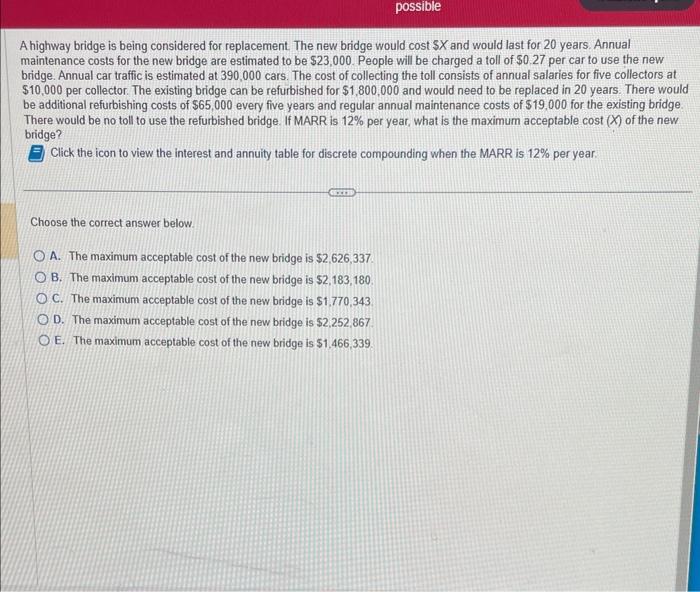

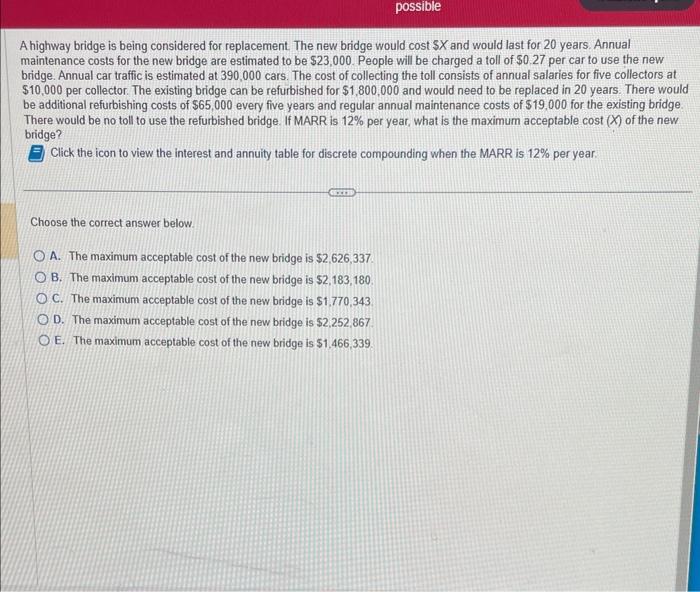

A highway bridge is being considered for replacement. The new bridge would cost $X and would last for 20 years. Annual maintenance costs for the new bridge are estimated to be $23,000. People will be charged a toll of $0.27 per car to use the new bridge. Annual car traffic is estimated at 390,000 cars. The cost of collecting the toll consists of annual salaries for five collectors at $10,000 per collector. The existing bridge can be refurbished for $1,800,000 and would need to be replaced in 20 years. There would be additional refurbishing costs of $65,000 every five years and regular annual maintenance costs of $19,000 for the existing bridge. There would be no toll to use the refurbished bridge. If MARR is 12% per year, what is the maximum acceptable cost (X) of the new bridge? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year. Choose the correct answer below. A. The maximum acceptable cost of the new bridge is $2,626,337. B. The maximum acceptable cost of the new bridge is $2,183,180. C. The maximum acceptable cost of the new bridge is $1,770,343. D. The maximum acceptable cost of the new bridge is $2,252,867. E. The maximum acceptable cost of the new bridge is $1,466,339

A highway bridge is being considered for replacement. The new bridge would cost $X and would last for 20 years. Annual maintenance costs for the new bridge are estimated to be $23,000. People will be charged a toll of $0.27 per car to use the new bridge. Annual car traffic is estimated at 390,000 cars. The cost of collecting the toll consists of annual salaries for five collectors at $10,000 per collector. The existing bridge can be refurbished for $1,800,000 and would need to be replaced in 20 years. There would be additional refurbishing costs of $65,000 every five years and regular annual maintenance costs of $19,000 for the existing bridge. There would be no toll to use the refurbished bridge. If MARR is 12% per year, what is the maximum acceptable cost (X) of the new bridge? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year. Choose the correct answer below. A. The maximum acceptable cost of the new bridge is $2,626,337. B. The maximum acceptable cost of the new bridge is $2,183,180. C. The maximum acceptable cost of the new bridge is $1,770,343. D. The maximum acceptable cost of the new bridge is $2,252,867. E. The maximum acceptable cost of the new bridge is $1,466,339

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started