Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A home sold for $400,000. It was appraised for $402,000, and the assessed value was $320,000. In this jurisdiction, the real estate transfer tax of

A home sold for $400,000. It was appraised for $402,000, and the assessed value was $320,000. In this jurisdiction, the real estate transfer tax of 1% is paid by the grantee. How much will the seller owe at closing for transfer fees? OA $0 OB. $3,200 OC. $4,000 OD. $4,020

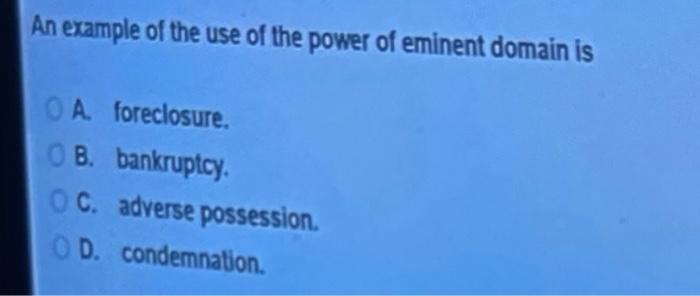

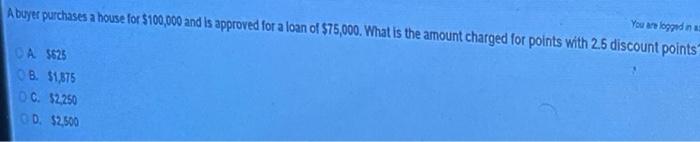

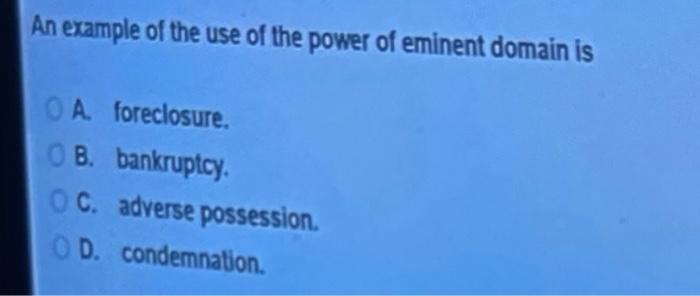

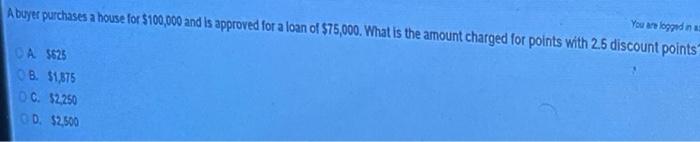

An example of the use of the power of eminent domain is OA. foreclosure OB. bankruptcy. C. adverse possession OD. condemnation. You are logged in A buyer purchases a house for $100,000 and is approved for a loan of $75,000. What is the amount charged for points with 2.6 discount points DA $625 B. 51,875 OC. 52.250 D. $2,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started