Question

A hospital is planning to build a for-profit MRI facility to expand its imaging services to compete with other local providers. The center is expected

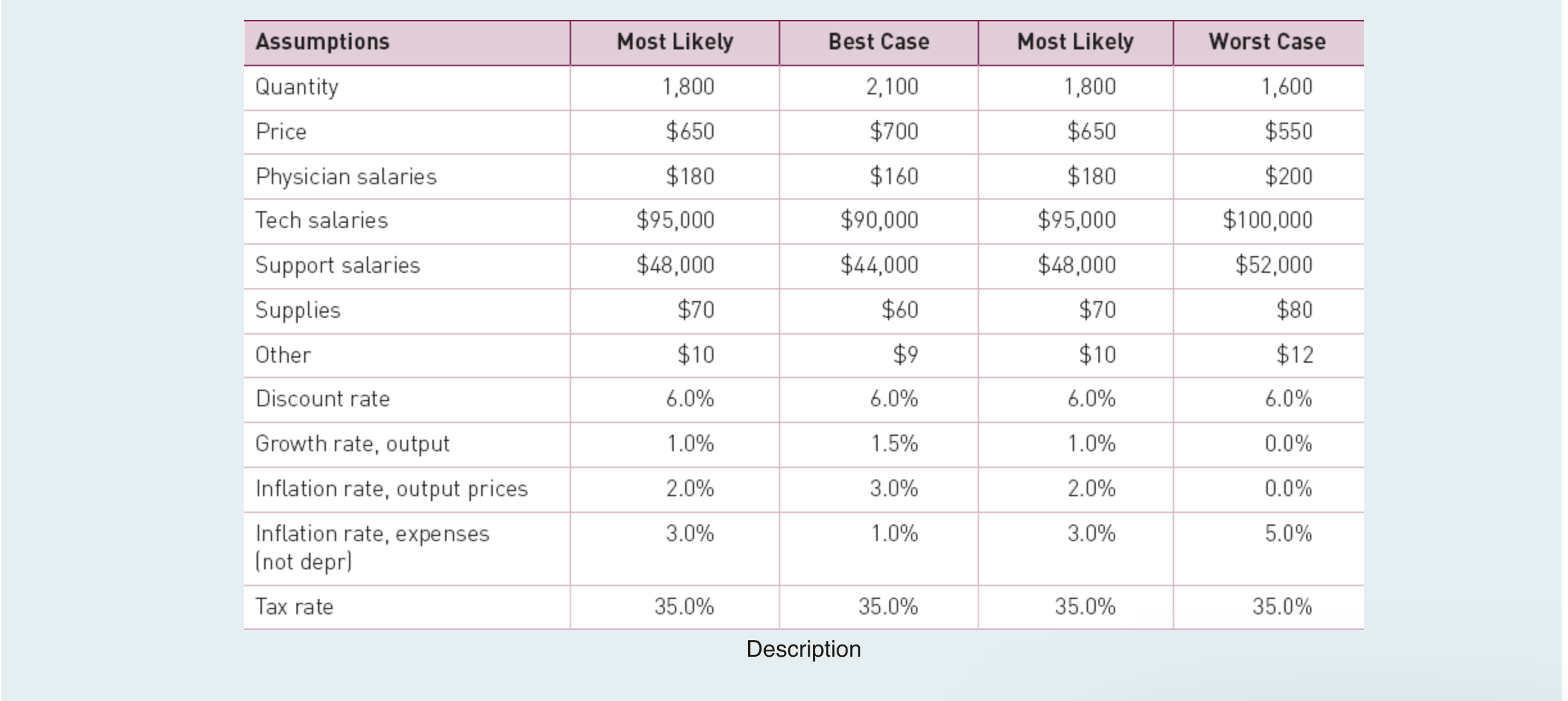

A hospital is planning to build a for-profit MRI facility to expand its imaging services to compete with other local providers. The center is expected to require a $2 million outlay in year 0 to purchase the MRI and renovate the office space. The $2 million investment should be depreciated over five years. The following table provides the best-case, most likely, and worst-case estimates for patient quantity, reimbursement, supply and other expenses per encounter, and growth rates for patient quantity, reimbursement, and expenses beginning in year 1. Physician salaries are $180 per image for reading and interpretation of images. The technician and other salaries are annual salaries and benefits.

Create a five-year capital budget analysis and calculate the net present value (NPV) and internal rate of return (IRR). In addition, calculate the NPVs and IRRs at best- and worst-case volume with all other variables at their most likely estimates.

\begin{tabular}{|l|r|r|r|r} \hline Assumptions & Most Likely & Best Case & Most Likely & Worst Case \\ \hline Quantity & 1,800 & 2,100 & 1,800 & 1,600 \\ \hline Price & $650 & $700 & $650 & $550 \\ \hline Physician salaries & $180 & $160 & $180 & $200 \\ \hline Tech salaries & $95,000 & $90,000 & $95,000 & $100,000 \\ \hline Support salaries & $48,000 & $44,000 & $48,000 & $52,000 \\ \hline Supplies & $70 & $60 & $70 & $80 \\ \hline Other & $10 & $9 & $10 & $12 \\ \hline Discount rate & 6.0% & 6.0% & 6.0% & 6.0% \\ \hline Growth rate, output & 1.0% & 1.5% & 1.0% & 0.0% \\ \hline Inflation rate, output prices & 2.0% & 3.0% & 2.0% & 0.0% \\ \hline Inflation rate, expenses & 3.0% & 1.0% & 3.0% & 5.0% \\ (not depr) & 35.0% & 35.0% & 35.0% & 35.0% \\ \hline Tax rate \end{tabular} Description

\begin{tabular}{|l|r|r|r|r} \hline Assumptions & Most Likely & Best Case & Most Likely & Worst Case \\ \hline Quantity & 1,800 & 2,100 & 1,800 & 1,600 \\ \hline Price & $650 & $700 & $650 & $550 \\ \hline Physician salaries & $180 & $160 & $180 & $200 \\ \hline Tech salaries & $95,000 & $90,000 & $95,000 & $100,000 \\ \hline Support salaries & $48,000 & $44,000 & $48,000 & $52,000 \\ \hline Supplies & $70 & $60 & $70 & $80 \\ \hline Other & $10 & $9 & $10 & $12 \\ \hline Discount rate & 6.0% & 6.0% & 6.0% & 6.0% \\ \hline Growth rate, output & 1.0% & 1.5% & 1.0% & 0.0% \\ \hline Inflation rate, output prices & 2.0% & 3.0% & 2.0% & 0.0% \\ \hline Inflation rate, expenses & 3.0% & 1.0% & 3.0% & 5.0% \\ (not depr) & 35.0% & 35.0% & 35.0% & 35.0% \\ \hline Tax rate \end{tabular} Description Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started