Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A housing developer is having trouble selling his new homes. The entire new development has space for 500 homes, but currently only one section with

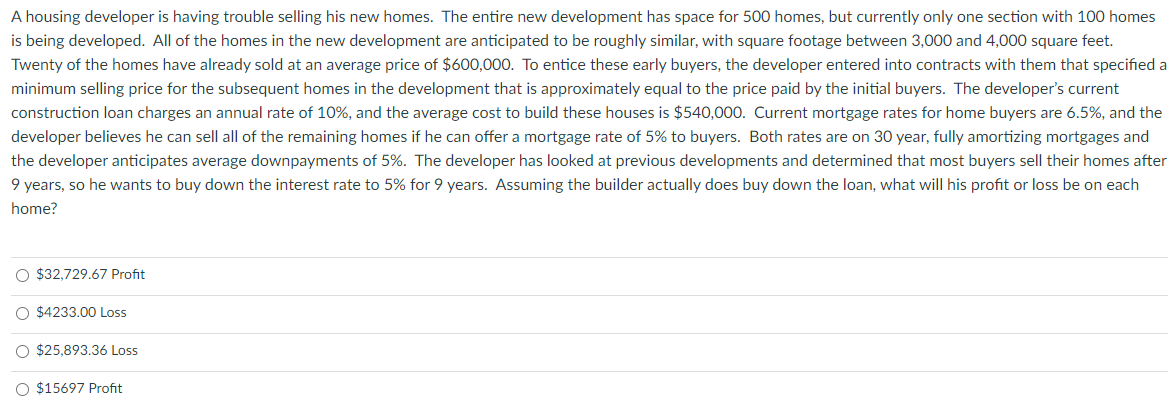

A housing developer is having trouble selling his new homes. The entire new development has space for 500 homes, but currently only one section with 100 homes is being developed. All of the homes in the new development are anticipated to be roughly similar, with square footage between 3,000 and 4,000 square feet. Twenty of the homes have already sold at an average price of \\( \\$ 600,000 \\). To entice these early buyers, the developer entered into contracts with them that specified a minimum selling price for the subsequent homes in the development that is approximately equal to the price paid by the initial buyers. The developer's current construction loan charges an annual rate of \10, and the average cost to build these houses is \\( \\$ 540,000 \\). Current mortgage rates for home buyers are \6.5, and the developer believes he can sell all of the remaining homes if he can offer a mortgage rate of \5 to buyers. Both rates are on 30 year, fully amortizing mortgages and the developer anticipates average downpayments of \5. The developer has looked at previous developments and determined that most buyers sell their homes after 9 years, so he wants to buy down the interest rate to \5 for 9 years. Assuming the builder actually does buy down the loan, what will his profit or loss be on each home? \\( \\$ 32,729.67 \\) Profit \\( \\$ 4233.00 \\) Loss \\( \\$ 25,893.36 \\) Loss \\$15697 Profit

A housing developer is having trouble selling his new homes. The entire new development has space for 500 homes, but currently only one section with 100 homes is being developed. All of the homes in the new development are anticipated to be roughly similar, with square footage between 3,000 and 4,000 square feet. Twenty of the homes have already sold at an average price of \\( \\$ 600,000 \\). To entice these early buyers, the developer entered into contracts with them that specified a minimum selling price for the subsequent homes in the development that is approximately equal to the price paid by the initial buyers. The developer's current construction loan charges an annual rate of \10, and the average cost to build these houses is \\( \\$ 540,000 \\). Current mortgage rates for home buyers are \6.5, and the developer believes he can sell all of the remaining homes if he can offer a mortgage rate of \5 to buyers. Both rates are on 30 year, fully amortizing mortgages and the developer anticipates average downpayments of \5. The developer has looked at previous developments and determined that most buyers sell their homes after 9 years, so he wants to buy down the interest rate to \5 for 9 years. Assuming the builder actually does buy down the loan, what will his profit or loss be on each home? \\( \\$ 32,729.67 \\) Profit \\( \\$ 4233.00 \\) Loss \\( \\$ 25,893.36 \\) Loss \\$15697 Profit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started