Answered step by step

Verified Expert Solution

Question

1 Approved Answer

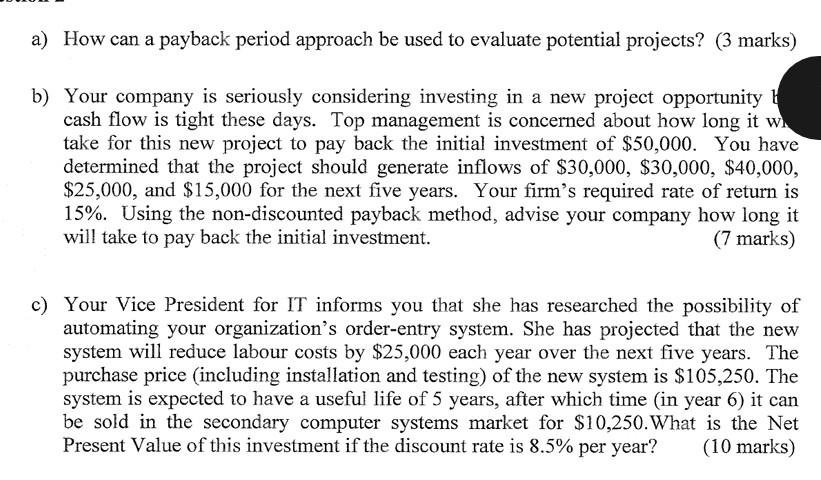

a) How can a payback period approach be used to evaluate potential projects? (3 marks) b) Your company is seriously considering investing in a new

a) How can a payback period approach be used to evaluate potential projects? (3 marks) b) Your company is seriously considering investing in a new project opportunity ! cash flow is tight these days. Top management is concerned about how long it w. take for this new project to pay back the initial investment of $50,000. You have determined that the project should generate inflows of $30,000, $30,000, $40,000, $25,000, and $15,000 for the next five years. Your firm's required rate of return is 15%. Using the non-discounted payback method, advise your company how long it will take to pay back the initial investment. (7 marks) c) Your Vice President for IT informs you that she has researched the possibility of automating your organization's order-entry system. She has projected that the new system will reduce labour costs by $25,000 each year over the next five years. The purchase price (including installation and testing) of the new system is $105,250. The system is expected to have a useful life of 5 years, after which time (in year 6) it can be sold in the secondary computer systems market for $10,250. What is the Net Present Value of this investment if the discount rate is 8.5% per year? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started