Answered step by step

Verified Expert Solution

Question

1 Approved Answer

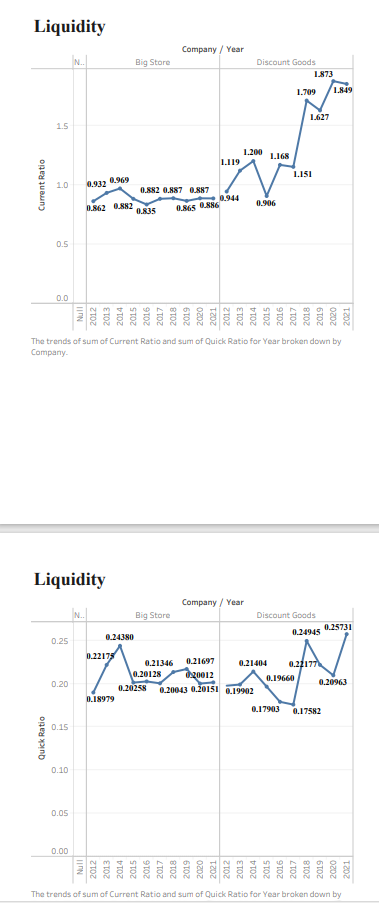

a. How do Discount Goods current ratio and quick ratio change over time? b. How do Big Stores current ratio and quick ratio change over

a. How do Discount Goods current ratio and quick ratio change over time?

b. How do Big Stores current ratio and quick ratio change over time?

c. Which company has more favorable liquidity ratios in 2021?

d. Other things being equal, which company appears to have a better liquidity position in terms of the ability of the companys current liability to be covered using its cash and cash equivalents?

e. Which company appears to offer better security for its current obligation creditors as measured by the current liabilities to net worth ratio?

Quick Ratio Current Ratio 0.0 Liquidity 1.5 Company/Year N.. Big Store Discount Goods 1.873 1.709 1.849 1.200 1.168 1.119 1.0 0.932 0.969 0.882 0.887 0.887 0.944 N 1.151 0.862 0.882 0.835 0.865 0.886 0.906 0.5 Null 2012 2013 2014 2015 2016 TOZ 2018 2019 2020 2021 2012 ETOZ 2014 2015 9102 2017 The trends of sum of Current Ratio and sum of Quick Ratio for Year broken down by Company. Liquidity Company/Year Big Store Discount Goods 0.25731 0.24945 0.24380 0.25 0.20 0.22175 A 0.18979 0.20258 0.21346 0.21697 0.21404 0.22177 0.20128 020012 0.19660 0.20963 0.20043 0.20151 0.19902 0.15 0.10 0.05 0.00 ZIOZ LON 2013 2014 2015 2016 RIOZ /TOZ 2019 2020 2021 2012 2013 +102 2015 9102 0.17903 0.17582 The trends of sum of Current Ratio and sum of Quick Ratio for Year broken down by 2017 2018 2019 2020 IZDZ 2018 2019 2020 IZDZ 1.627

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started