Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) How do you interpret in the CEOs utility function? (2 points) b) Calculate firm value, the present value of CEO compensation, CEO utility and

a) How do you interpret in the CEOs utility function? (2 points)

b) Calculate firm value, the present value of CEO compensation, CEO utility and shareholder utility all at time 0. Show all working and summarise your answers in following table: (8 points)

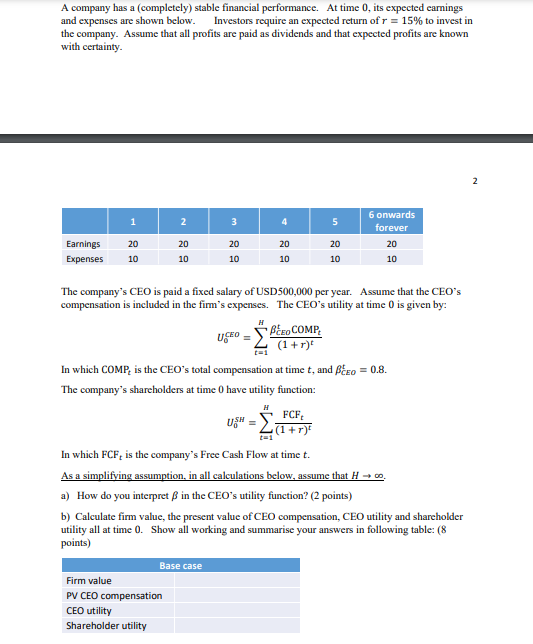

A company has a completely) stable financial performance. At time 0, its expected earnings and expenses are shown below. Investors require an expected return of r = 15% to invest in the company. Assume that all profits are paid as dividends and that expected profits are known with certainty. 2 1 2 3 4 5 6 onwards forever 20 10 20 20 Earnings Expenses 20 10 20 10 20 10 10 10 H - The company's CEO is paid a fixed salary of USD500,000 per year. Assume that the CEO's compensation is included in the firm's expenses. The CEO's utility at time 0 is given by: USEO = BERO COMP (1+r) In which COMP, is the CEO's total compensation at time t, and Beso = 0.8. The company's shareholders at time 0 have utility function: FCF USM (1 + r)! In which FCF, is the company's Free Cash Flow at time t. As a simplifying assumption, in all calculations below, assume that H a) How do you interpret in the CEO's utility function? (2 points) b) Calculate firm value, the present value of CEO compensation, CEO utility and shareholder utility all at time 0. Show all working and summarise your answers in following table: (8 points) Base case Firm value PV CEO compensation CEO utility Shareholder utility A company has a completely) stable financial performance. At time 0, its expected earnings and expenses are shown below. Investors require an expected return of r = 15% to invest in the company. Assume that all profits are paid as dividends and that expected profits are known with certainty. 2 1 2 3 4 5 6 onwards forever 20 10 20 20 Earnings Expenses 20 10 20 10 20 10 10 10 H - The company's CEO is paid a fixed salary of USD500,000 per year. Assume that the CEO's compensation is included in the firm's expenses. The CEO's utility at time 0 is given by: USEO = BERO COMP (1+r) In which COMP, is the CEO's total compensation at time t, and Beso = 0.8. The company's shareholders at time 0 have utility function: FCF USM (1 + r)! In which FCF, is the company's Free Cash Flow at time t. As a simplifying assumption, in all calculations below, assume that H a) How do you interpret in the CEO's utility function? (2 points) b) Calculate firm value, the present value of CEO compensation, CEO utility and shareholder utility all at time 0. Show all working and summarise your answers in following table: (8 points) Base case Firm value PV CEO compensation CEO utility Shareholder utilityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started