Answered step by step

Verified Expert Solution

Question

1 Approved Answer

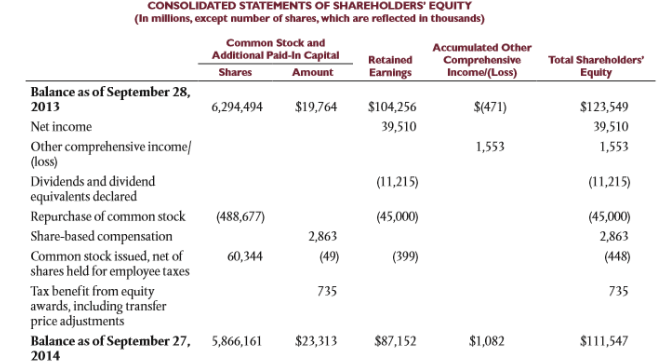

a. How would the auditor verify the balances as of September 28, 2013? b. What would the auditor do to evaluate the amount shown as

a. How would the auditor verify the balances as of September 28, 2013?

b. What would the auditor do to evaluate the amount shown as Net Income?

c. What sources of evidence might the auditor use to satisfy the occurrence objective for each of the following?

(1) Repurchase of common stock

(2) Share-based compensation

(3) Common shares issued

d. How should the amounts shown as of September 27, 2014, relate to the amounts shown in Apples balance sheet as of the same date? Show transcribed image text

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (In millions, except number of shares, which are reflected in thousands) Common Stock and Additional Paid-In Capital Retained Earnings Accumulated Other Comprehensive Incomel(Loss) Total Shareholders' Equity Shares Amount Balance as of September 28, 2013 6,294,494 $19,764 S104,256 39,510 S(471) S123,549 39,510 1,553 Net income Other comprehensive income (loss) Dividends and dividend equivalents declared 1,553 (11,215) (45,000) (399) (11,215 (45,000) 2,863 (448) Repurchase of common stock Share-based compensation Common stock issued, net of shares held for employee taxes Tax benefit from equity awards, including transfer price adjustments (488,677) 2,863 (49) 60,344 735 735 Balance as of September 27, 5,8666 $23,313$87,152 2014 $1,082 111,547 CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (In millions, except number of shares, which are reflected in thousands) Common Stock and Additional Paid-In Capital Retained Earnings Accumulated Other Comprehensive Incomel(Loss) Total Shareholders' Equity Shares Amount Balance as of September 28, 2013 6,294,494 $19,764 S104,256 39,510 S(471) S123,549 39,510 1,553 Net income Other comprehensive income (loss) Dividends and dividend equivalents declared 1,553 (11,215) (45,000) (399) (11,215 (45,000) 2,863 (448) Repurchase of common stock Share-based compensation Common stock issued, net of shares held for employee taxes Tax benefit from equity awards, including transfer price adjustments (488,677) 2,863 (49) 60,344 735 735 Balance as of September 27, 5,8666 $23,313$87,152 2014 $1,082 111,547Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started