Question

A) Hull Consultants, a famous think tank in the Midwest, has provided probability estimates for the four potential economic states for the coming year. The

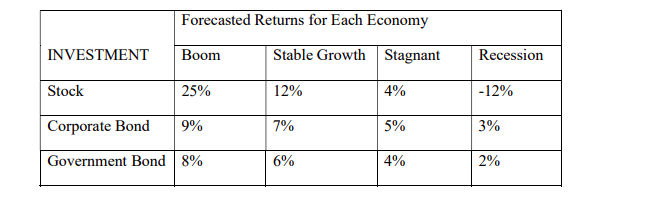

A) Hull Consultants, a famous think tank in the Midwest, has provided probability estimates for the four potential economic states for the coming year. The probability of a boom economy is 10%, the probability of a stable growth economy is 15%, the probability of a stagnant economy is 50%, and the probability of a recession is 25%. Estimate the expected returns on the following individual investments for the coming year.

B) Using the data from thetable calculate the variance and standard deviation of the three investments, stock, corporate bond, and government bond. If the estimates for both the probabilities of the economy and the returns in each state of the economy are correct, which investment would you choose, considering both risk and return? Why?

C) You have the option to buy the stock XYZ. Its systematic risk measured by its beta is equal to 1.5. If risk free rate is 4% and the expected return on the market is 7%, how much return you should require to invest in XYZ?

D) Again assume XYZ from the previous problem. Your own analysis shows that XYZs expected return is 9.5%. Is XYZ overvalued, undervalued or fairly valued?

Forecasted Returns for Each Economy INVESTMENTBoom Stock Corporate Bond | 9% Government Bond | 8% Stable Growth 12% 7% 6% Stagnant 4% 5% 4% Recession -12% 390 2% 25%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started