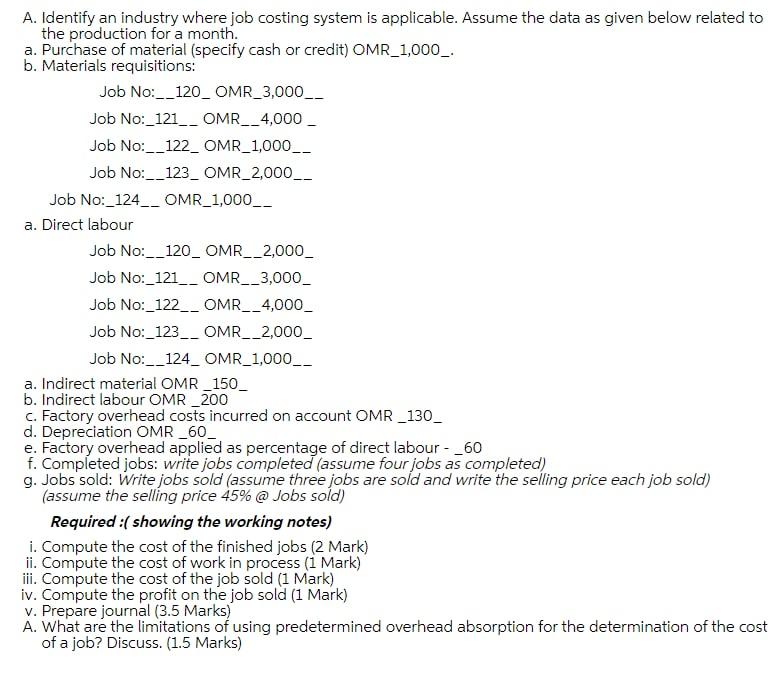

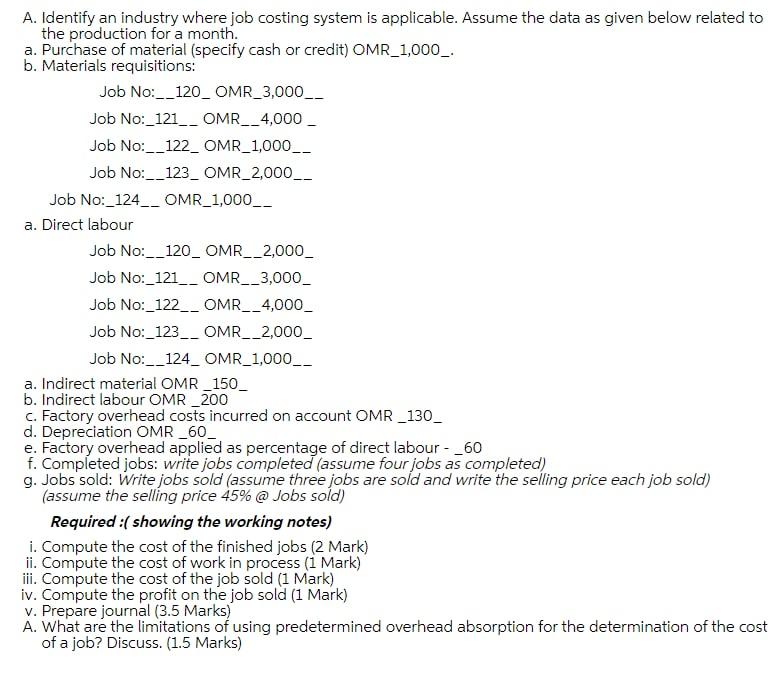

A. Identify an industry where job costing system is applicable. Assume the data as given below related to the production for a month. a. Purchase of material (specify cash or credit) OMR_1,000_. b. Materials requisitions: Job No:__120_OMR_3,000_ Job No:_121__ OMR__4,000 Job No:__122_ OMR_1,000__ Job No:__123_ OMR_2,000__ Job No:_124__ OMR_1,000__ a. Direct labour Job No:__120_ OMR__2,000_ Job No:_121__ OMR__3,000_ Job No:_122__ OMR_ _4,000_ Job No:_123__ OMR__2,000_ Job No:__124_ OMR_1,000__ a. Indirect material OMR_150_ b. Indirect labour OMR_200 C. Factory overhead costs incurred on account OMR_130_ d. Depreciation OMR_60_ e. Factory overhead applied as percentage of direct labour - _60 f. Completed jobs: write jobs completed (assume four jobs as completed) g. Jobs sold: Write jobs sold (assume three jobs are sold and write the selling price each job sold) (assume the selling price 45% @ Jobs sold) Required :( showing the working notes) 1. Compute the cost of the finished jobs (2 Mark) ii. Compute the cost of work in process (i Mark) iii. Compute the cost of the job sold (1 Mark) iv. Compute the profit on the job sold (1 Mark) v. Prepare journal (3.5 Marks) A. What are the limitations of using predetermined overhead absorption for the determination of the cost of a job? Discuss. (1.5 Marks) A. Identify an industry where job costing system is applicable. Assume the data as given below related to the production for a month. a. Purchase of material (specify cash or credit) OMR_1,000_. b. Materials requisitions: Job No:__120_OMR_3,000_ Job No:_121__ OMR__4,000 Job No:__122_ OMR_1,000__ Job No:__123_ OMR_2,000__ Job No:_124__ OMR_1,000__ a. Direct labour Job No:__120_ OMR__2,000_ Job No:_121__ OMR__3,000_ Job No:_122__ OMR_ _4,000_ Job No:_123__ OMR__2,000_ Job No:__124_ OMR_1,000__ a. Indirect material OMR_150_ b. Indirect labour OMR_200 C. Factory overhead costs incurred on account OMR_130_ d. Depreciation OMR_60_ e. Factory overhead applied as percentage of direct labour - _60 f. Completed jobs: write jobs completed (assume four jobs as completed) g. Jobs sold: Write jobs sold (assume three jobs are sold and write the selling price each job sold) (assume the selling price 45% @ Jobs sold) Required :( showing the working notes) 1. Compute the cost of the finished jobs (2 Mark) ii. Compute the cost of work in process (i Mark) iii. Compute the cost of the job sold (1 Mark) iv. Compute the profit on the job sold (1 Mark) v. Prepare journal (3.5 Marks) A. What are the limitations of using predetermined overhead absorption for the determination of the cost of a job? Discuss. (1.5 Marks)