Answered step by step

Verified Expert Solution

Question

1 Approved Answer

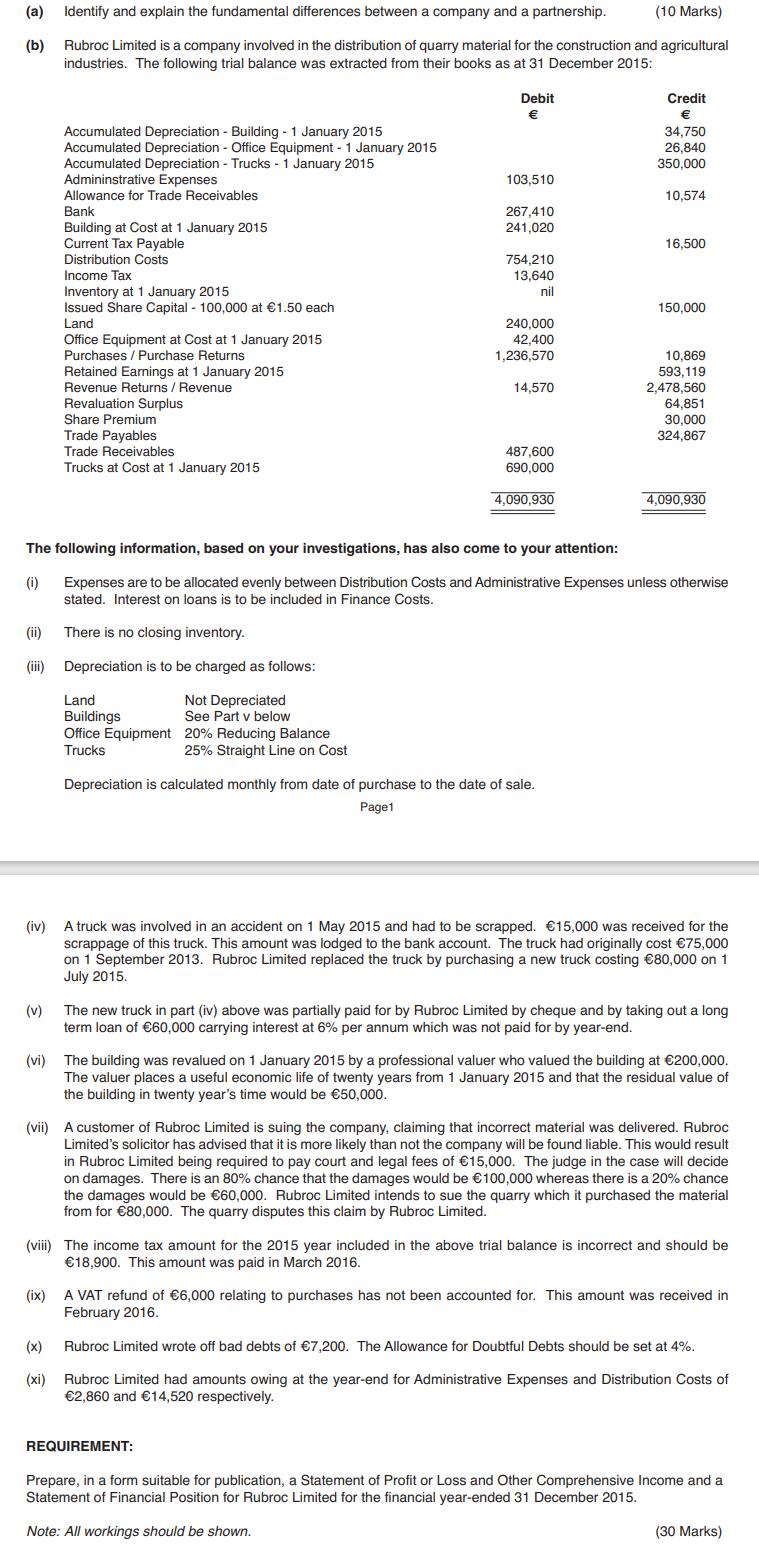

(a) Identify and explain the fundamental differences between a company and a partnership. (10 Marks) (b) Rubroc Limited is a company involved in the

(a) Identify and explain the fundamental differences between a company and a partnership. (10 Marks) (b) Rubroc Limited is a company involved in the distribution of quarry material for the construction and agricultural industries. The following trial balance was extracted from their books as at 31 December 2015: (ii) Accumulated Depreciation - Building - 1 January 2015 Accumulated Depreciation - Office Equipment - 1 January 2015 Accumulated Depreciation - Trucks - 1 January 2015 Admininstrative Expenses Allowance for Trade Receivables Bank Bank Buildi Building at Cost at 1 January 2015 (vi) Current Tax Payable Distribu Distribution Costs proces Income Tax com Inventory at 1 January 2015 Invent Issued Share Capital - 100,000 at 1.50 each Land Office Equipment at Cost at 1 January 2015 D Purchases / Purchase Returns Retained Earnings at 1 January 2015 Revenue Returns / Revenue Revaluation Surplus Share Premium Trade Payables Trade Receivables Trucks at Cost at 1 January 2015 Land Buildings Office Equipment Trucks Debit 103,510 267,410 241,020 754,210 13,640 nil 240,000 42,400 1,236,570 14,570 487,600 690,000 4,090,930 Depreciation is calculated monthly from date of purchase to the date of sale. Page1 REQUIREMENT: Credit 34,750 26,840 350,000 10,574 16,500 The following information, based on your investigations, has also come to your attention: (1) Expenses are to be allocated evenly between Distribution Costs and Administrative Expenses unless otherwise stated. Interest on loans is to be included in Finance Costs. There is no closing inventory. Depreciation is to be charged as follows: Not Depreciated See Part v below 20% Reducing Balance 25% Straight Line on Cost 150,000 10,869 593,119 2,478,560 64,851 30,000 324,867 4,090,930 (iv) A truck was involved in an accident on 1 May 2015 and had to be scrapped. 15,000 was received for the scrappage of this truck. This amount was lodged to the bank account. The truck had originally cost 75,000 on 1 September 2013. Rubroc Limited replaced the truck by purchasing a new truck costing 80,000 on 1 July 2015. (v) The new truck in part (iv) above was partially paid for by Rubroc Limited by cheque and by taking out a long term loan of 60,000 carrying interest at 6% per annum which was not paid for by year-end. The building was revalued on 1 January 2015 by a professional valuer who valued the building at 200,000. The valuer places a useful economic life of twenty years from 1 January 2015 and that the residual value of the building in twenty year's time would be 50,000. (vii) A customer of Rubroc Limited is suing the company, claiming that incorrect material was delivered. Rubroc Limited's solicitor has advised that it is more likely than not the company will be found liable. This would result in Rubroc Limited being required to pay court and legal fees of 15,000. The judge in the case will decide on damages. There is an 80% chance that the damages would be 100,000 whereas there is a 20% chance the damages would be 60,000. Rubroc Limited intends to sue the quarry which it purchased the material from for 80,000. The quarry disputes this claim by Rubroc Limited. (viii) The income tax amount for the 2015 year included in the above trial balance is incorrect and should be 18,900. This amount was paid in March 2016. (ix) A VAT refund of 6,000 relating to purchases has not been accounted for. This amount was received in February 2016. (x) Rubroc Limited wrote off bad debts of 7,200. The Allowance for Doubtful Debts should be set at 4%. (xi) Rubroc Limited had amounts owing at the year-end for Administrative Expenses and Distribution Costs of 2,860 and 14,520 respectively. Prepare, in a form suitable for publication, a Statement of Profit or Loss and Other Comprehensive Income and a Statement of Financial Position for Rubroc Limited for the financial year-ended 31 December 2015. Note: All workings should be shown. (30 Marks)

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a The fundamental differences between a Company and Partnership are as follows 1 A Company is considered a legal entity that is totally different from its shareholders owners A company operates under ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started