Answered step by step

Verified Expert Solution

Question

1 Approved Answer

James Mbuvi started a taxi business in Nairobi March 1990. The firm had two vehicles KA and KB, which had been purchased forSh.560, 000,

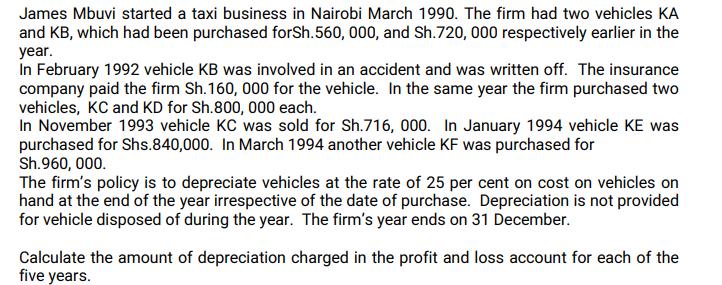

James Mbuvi started a taxi business in Nairobi March 1990. The firm had two vehicles KA and KB, which had been purchased forSh.560, 000, and Sh.720, 000 respectively earlier in the year. In February 1992 vehicle KB was involved in an accident and was written off. The insurance company paid the firm Sh.160, 000 for the vehicle. In the same year the firm purchased two vehicles, KC and KD for Sh.800, 000 each. In November 1993 vehicle KC was sold for Sh.716, 000. In January 1994 vehicle KE was purchased for Shs.840,000. In March 1994 another vehicle KF was purchased for Sh.960, 000. The firm's policy is to depreciate vehicles at the rate of 25 per cent on cost on vehicles on hand at the end of the year irrespective of the date of purchase. Depreciation is not provided for vehicle disposed of during the year. The firm's year ends on 31 December. Calculate the amount of depreciation charged in the profit and loss account for each of the five years.

Step by Step Solution

★★★★★

3.56 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the amount of depreciation charged in the profit and loss account for each of the five ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started