Answered step by step

Verified Expert Solution

Question

1 Approved Answer

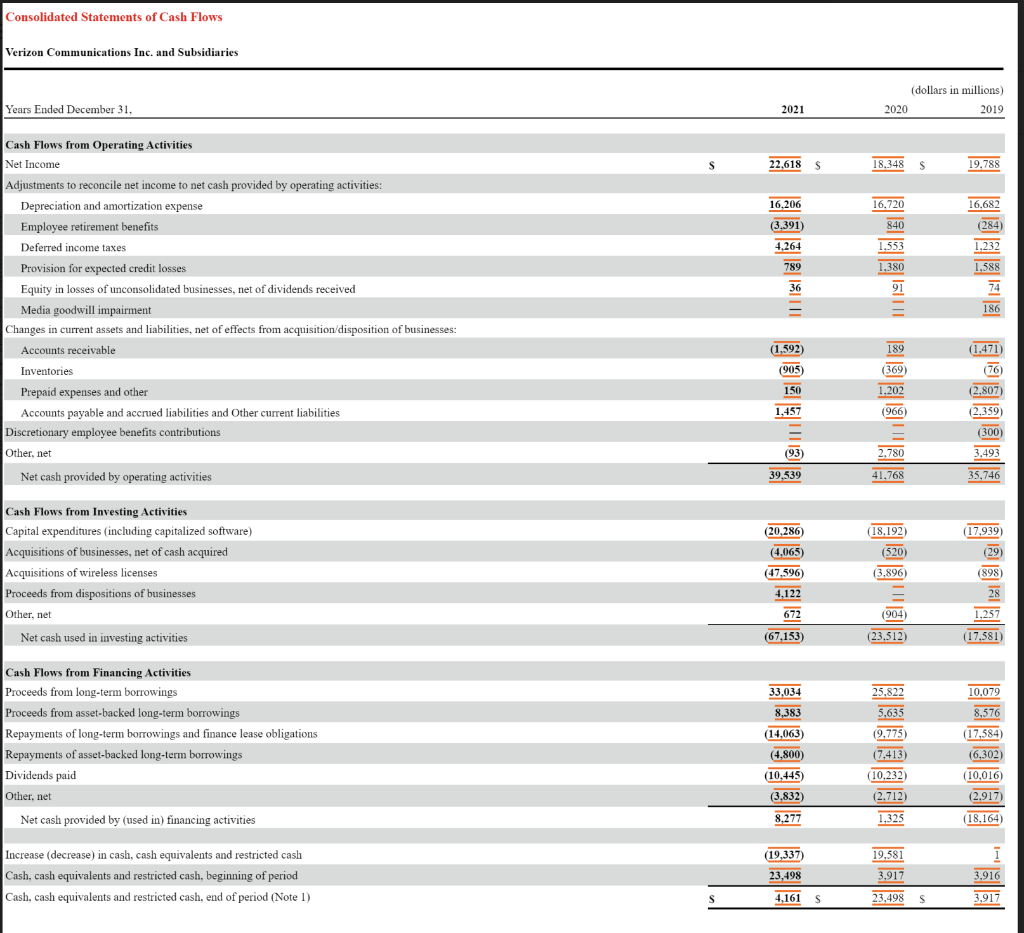

A) Identify the single largest adjustment (in absolute value) to reconcile net income to operating cash flow in the most recent year of your base

A) Identify the single largest adjustment (in absolute value) to reconcile net income to operating cash flow in the most recent year of your base companys statement of cash flows

B) Describe how and why the item arises that is, broadly describe how it creates a disconnect between income and cash flows for your company.

C) Then, assess the risk (low/medium/high) that this item adversely affects your base companys earnings quality in the most recent year. Justify your answer.

Consolidated Statements of Cash Flows Verizon Communications Inc. and Subsidiaries Years Ended December 31, (dollars in millions) Cash Flows from Operating Activities Net Income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization expense Employee retirement benefits Deferred income taxes Provision for expected credit losses Equity in losses of unconsolidated businesses, net of dividends received Media goodwill impairment Changes in current assets and liabilities, net of effects from acquisition/disposition of businesses: Cash Flows from Investing Activities Capital expenditures (including capitalized software) Acquisitions of businesses, net of cash acquired Acquisitions of wireless licenses Proceeds from dispositions of businesses Other, net Net cash used in investing activities Cash Flows from Financing Activities Proceeds from long-term borrowings Proceeds from asset-backed long-term borrowings Repayments of long-term borrowings and finance lease obligations Repayments of asset-backed long-term borrowings Dividends paid Other, net Net cash provided by (used in) financing activities Increase (decrease) in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash, beginning of period Cash, cash equivalents and restricted cash, end of period (Note 1) Consolidated Statements of Cash Flows Verizon Communications Inc. and Subsidiaries Years Ended December 31, (dollars in millions) Cash Flows from Operating Activities Net Income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization expense Employee retirement benefits Deferred income taxes Provision for expected credit losses Equity in losses of unconsolidated businesses, net of dividends received Media goodwill impairment Changes in current assets and liabilities, net of effects from acquisition/disposition of businesses: Cash Flows from Investing Activities Capital expenditures (including capitalized software) Acquisitions of businesses, net of cash acquired Acquisitions of wireless licenses Proceeds from dispositions of businesses Other, net Net cash used in investing activities Cash Flows from Financing Activities Proceeds from long-term borrowings Proceeds from asset-backed long-term borrowings Repayments of long-term borrowings and finance lease obligations Repayments of asset-backed long-term borrowings Dividends paid Other, net Net cash provided by (used in) financing activities Increase (decrease) in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash, beginning of period Cash, cash equivalents and restricted cash, end of period (Note 1)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started