Question

(a) If Acme wants to take the smallest option position possible so that its net income for this year does not fall below $1,500,000 regardless

(a) If Acme wants to take the smallest option position possible so that its net income for this year does not fall below $1,500,000 regardless of the economic state. Based only on the information provided, what option position should Acme take? (Show all your work. Your answer must be handwritten.) (5 marks)

(b) The CEO of Acme wants to know if Acme should take this option position described above in (a). Explain why Acme may want to take this option position and why Acme may not want to take this option position. Give one reason for each. (Do not give more than one reason each. If there are multiple reasons given for and against taking the option position, only the first reasons will be graded. Your answer must be handwritten.) (5 marks)

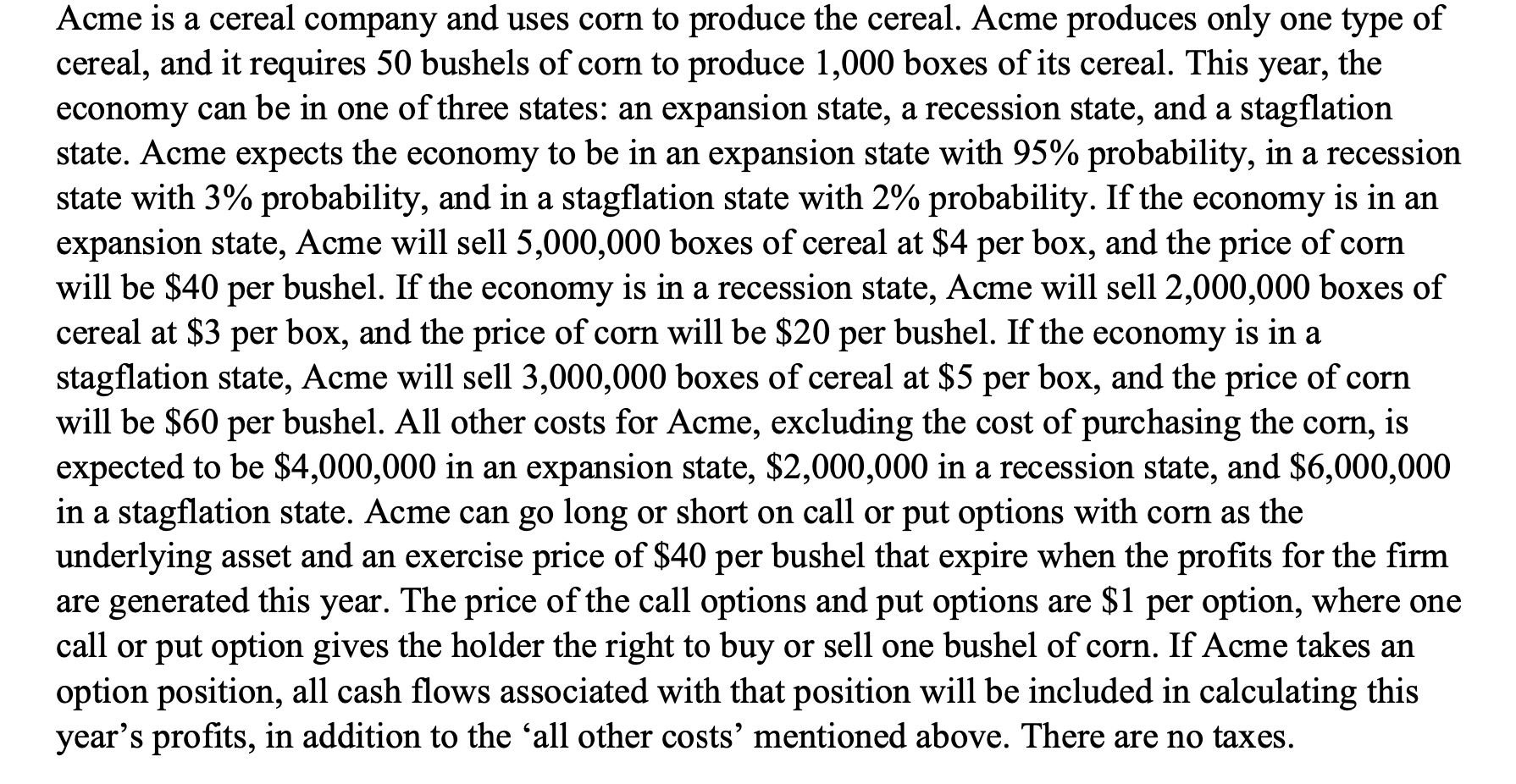

Acme is a cereal company and uses corn to produce the cereal. Acme produces only one type of cereal, and it requires 50 bushels of corn to produce 1,000 boxes of its cereal. This year, the economy can be in one of three states: an expansion state, a recession state, and a stagflation state. Acme expects the economy to be in an expansion state with 95% probability, in a recession state with 3% probability, and in a stagflation state with 2% probability. If the economy is in an expansion state, Acme will sell 5,000,000 boxes of cereal at $4 per box, and the price of corn will be $40 per bushel. If the economy is in a recession state, Acme will sell 2,000,000 boxes of cereal at $3 per box, and the price of corn will be $20 per bushel. If the economy is in a stagflation state, Acme will sell 3,000,000 boxes of cereal at $5 per box, and the price of corn will be $60 per bushel. All other costs for Acme, excluding the cost of purchasing the corn, is expected to be $4,000,000 in an expansion state, $2,000,000 in a recession state, and $6,000,000 in a stagflation state. Acme can go long or short on call or put options with corn as the underlying asset and an exercise price of $40 per bushel that expire when the profits for the firm are generated this year. The price of the call options and put options are $1 per option, where one call or put option gives the holder the right to buy or sell one bushel of corn. If Acme takes an option position, all cash flows associated with that position will be included in calculating this year's profits, in addition to the 'all other costs' mentioned above. There are no taxes. aStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started