Answered step by step

Verified Expert Solution

Question

1 Approved Answer

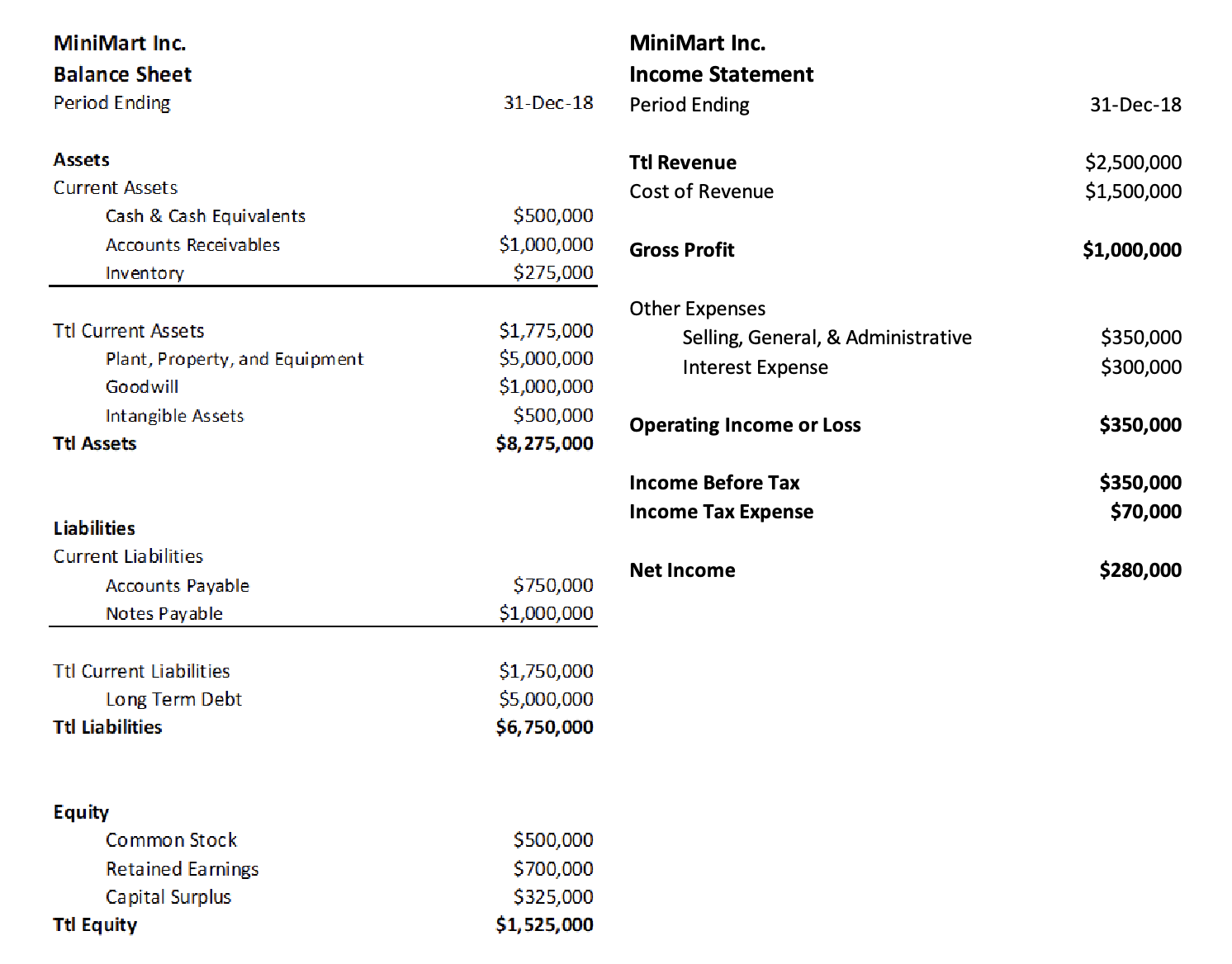

a. If MiniMart paid out a dividend of $200,000, what is its retention ratio b. What is MiniMarts expected dividend growth rate? c. What would

a. If MiniMart paid out a dividend of $200,000, what is its retention ratio

b. What is MiniMarts expected dividend growth rate?

c. What would be the value of MiniMarts stock, assuming that its current dividend is $2 and the required rate of return for the stock is 10%.

MiniMart Inc. MiniMart Inc. Balance Sheet Income Statement Period Ending 31-Dec-18 Period Ending 31-Dec-18 Assets Ttl Revenue $2,500,000 Current Assets Cost of Revenue $1,500,000 Cash \& Cash Equivalents $500,000 Accounts Receivables Gross Profit $1,000,000 \begin{tabular}{lr} Inventory & $275,000 \\ \hline \end{tabular} Other Expenses TtlCurrentAssetsPlant,Property,andEquipmentGoodwillIntangibleAssetsTtlAssetsLiabilitiesCurrentLiabilitiesAccountsPayableNotesPayableTtlCurrentLiabilities$1,775,000$5,000,000$1,000,000$500,000$8,275,000$750,000$1,000,000$1,750,000$5,000,000$6,750,000 Income Before Tax $$50,000 Income Tax Expense $70,000 Net Income $280,000 Equity CommonStockRetainedEarningsCapitalSurplusquity$500,000$700,000$325,000$1,525,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started