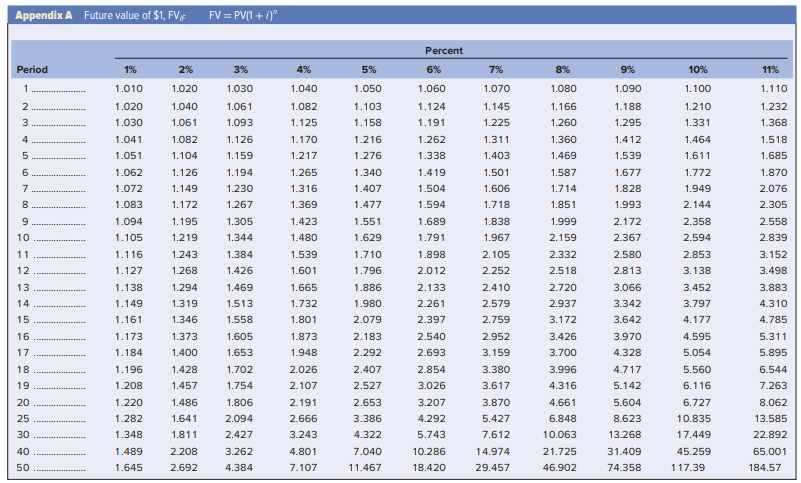

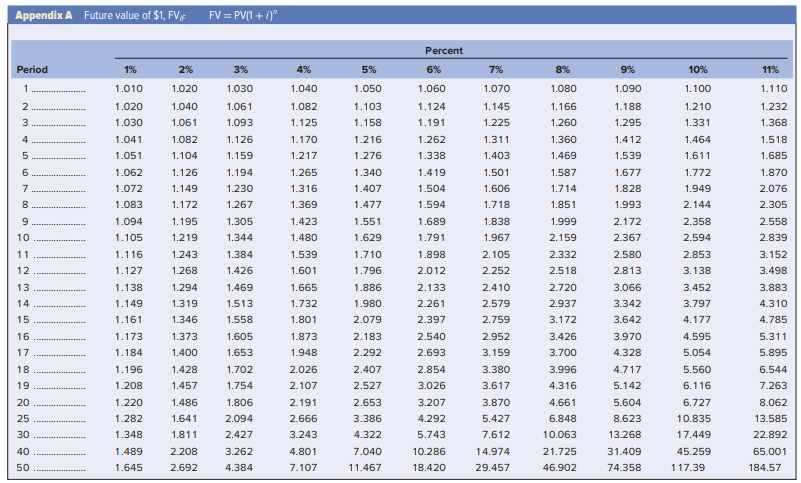

A) If you invest $30,000 at 11% interest, how much will you have in 11 years? Use Appendix A to calculate the answer.

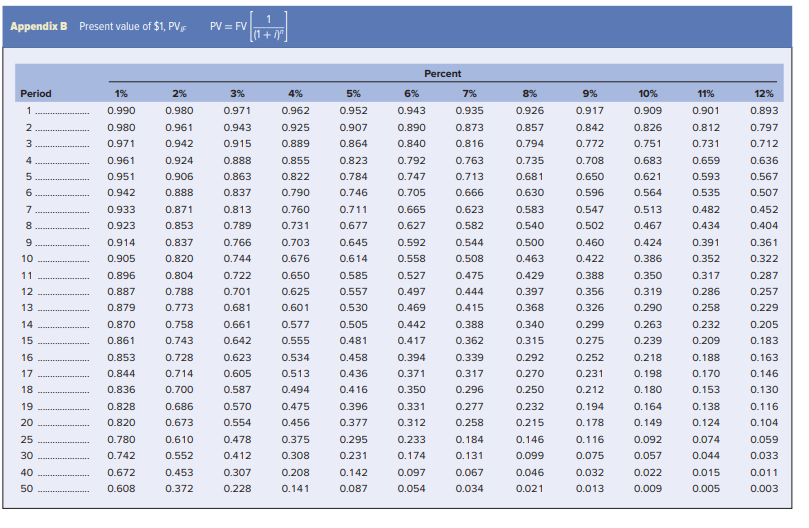

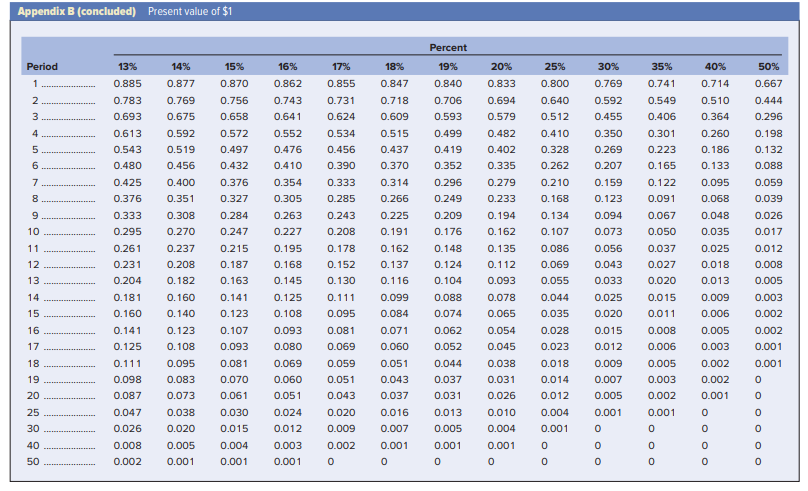

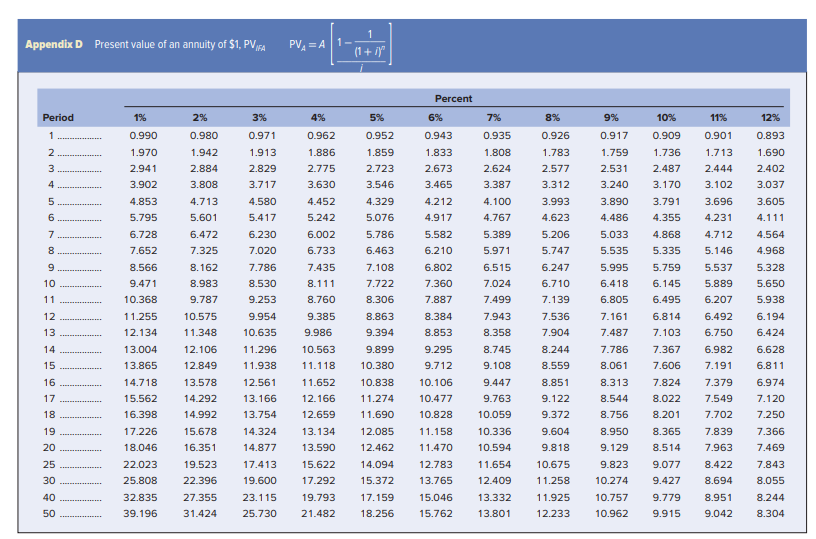

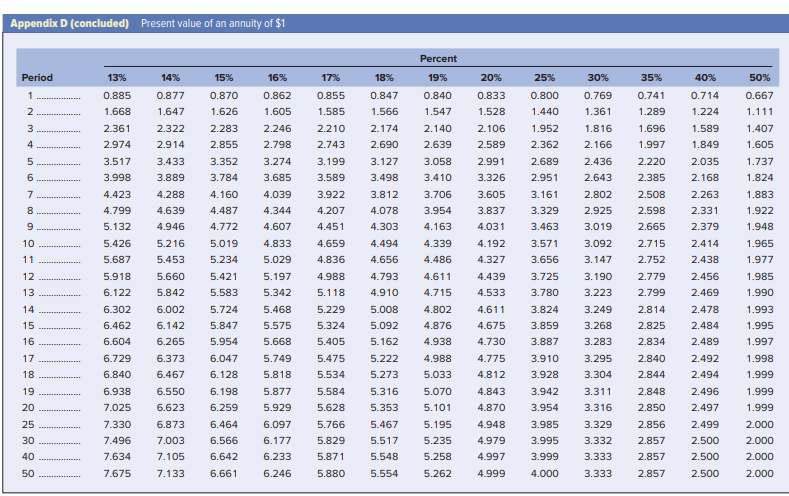

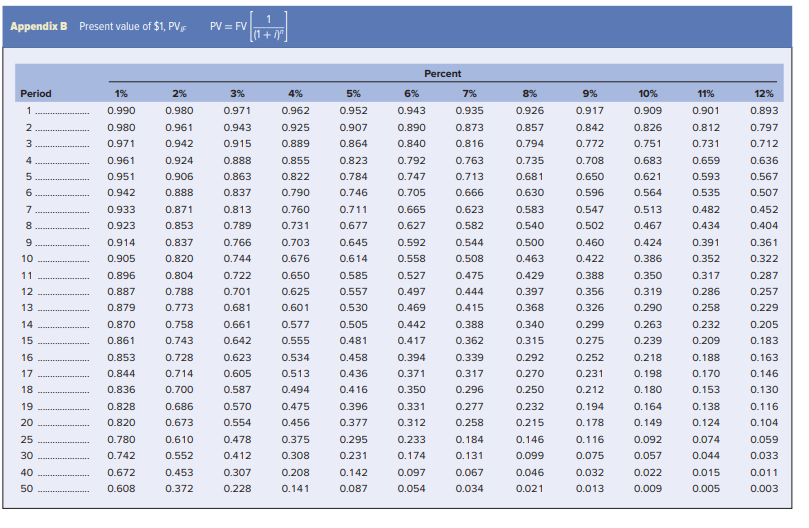

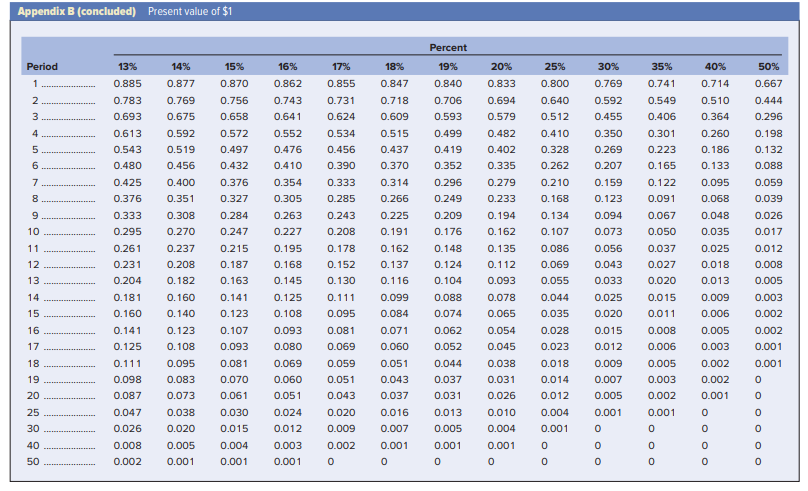

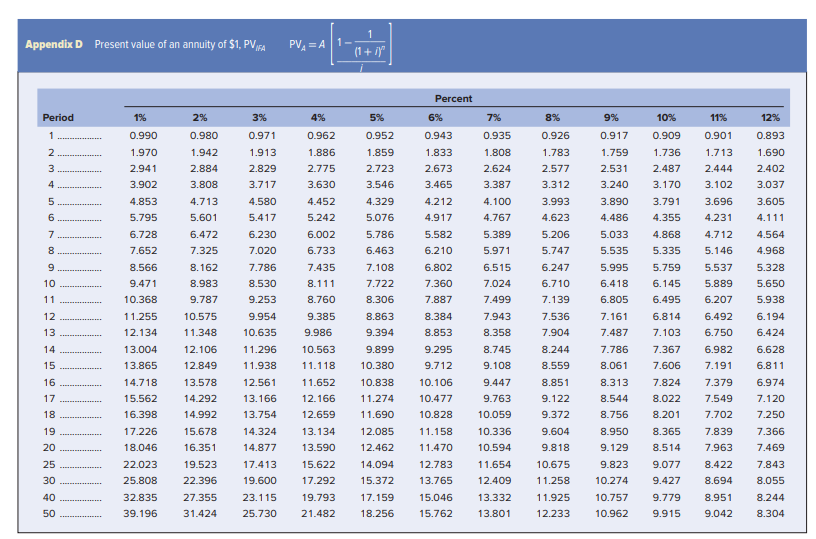

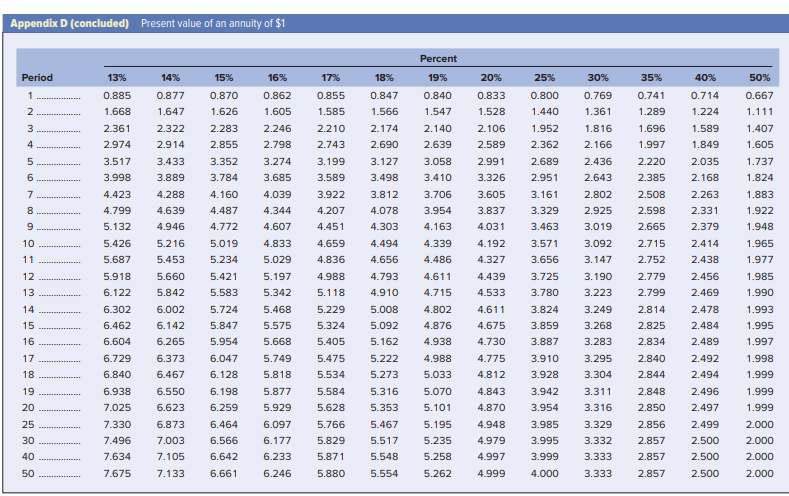

B) Mike Carlson will receive $25,000 a year from the end of the third year to the end of the 16th year (14 payments). The discount rate is 10%. The present value today of this deferred annuity is: Use Appendix B and Appendix D to calculate the answer.

Appendix A Future value of $1, FVF FV = PV[1 + 1)" Period 7% 8% 9% 11% 1.110 1.232 1.368 1.518 1.685 1.870 2.076 2.305 2.558 2.839 1% 1.010 1.020 1.030 1.041 1.051 1.062 1.072 1.083 1.094 1.105 1.116 1.127 1.138 1.149 1.161 1.173 1.184 1.196 1.208 1.220 1.282 1.348 1.489 1.645 2% 1.020 1.040 1.061 1.082 1.104 1.126 1.149 1.172 1.195 1.219 1.243 1.268 1.294 1.319 1.346 1.373 1.400 1.428 1.457 1.486 1.641 1.811 2.208 2.692 3.152 3% 1.030 1.061 1.093 1.126 1.159 1.194 1.230 1.267 1.305 1.344 1.384 1.426 1.469 1.513 1.558 1.605 1.653 1.702 1.754 1.806 2.094 2.427 3.262 4.384 4% 1.040 1.082 1.125 1.170 1.217 1.265 1.316 1.369 1.423 1.480 1.539 1.601 1.665 1.732 1.801 1.873 1.948 2.026 2.107 2.191 2.666 3.243 4.801 7.107 Percent 6% 1.060 1.124 1.191 1.262 1.338 1.419 1.504 1.594 1.689 1.791 1.898 2.012 2.133 2.261 2.397 2.540 2.693 2.854 3.026 3.207 4.292 5.743 10.286 18.420 5% 1.050 1.103 1.158 1.216 1.276 1.340 1.407 1.477 1.551 1.629 1.710 1.796 1.886 1.980 2.079 2.183 2.292 2.407 2.527 2.653 3.386 4.322 7.040 11.467 1.070 1.145 1.225 1.311 1.403 1.501 1.606 1.718 1.838 1.967 2.105 2.252 2.410 2.579 2.759 2.952 3.159 3.380 3.617 3.870 5.427 7.612 14.974 29.457 10% 1.100 1.210 1.331 1.464 1.611 1.772 1.949 2.144 2.358 2.594 2.853 3.138 3.452 3.797 4.177 4.595 5.054 1.080 1.166 1.260 1.360 1.469 1.587 1.714 1.851 1.999 2.159 2.332 2.518 2.720 2.937 3.172 3.426 3.700 3.996 4.316 4.661 6.848 10.063 21.725 46.902 1.090 1.188 1.295 1.412 1.539 1.677 1.828 1.993 2.172 2.367 2.580 2.813 3.066 3.342 3.642 3.970 4.328 4.717 5.142 5.604 8.623 13.268 31.409 74.358 3.498 3.883 4.310 4.785 5.311 5.895 5.560 6.116 6.727 10.835 17.449 45.259 117.39 6.544 7.263 8.062 13.585 22.892 65.001 184.57 Appendix B Present value of $1, PV, PV = FV Percent Period 0 1% 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.861 0.853 0.844 0.836 2% 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0.673 0.610 0.552 0.453 0.372 3% 0.971 0.943 0.915 0.888 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.642 0.623 0.605 0.587 0.570 0.554 0.478 0.412 0.307 0.228 4% 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.534 0.513 0.494 0.475 0.456 0.375 0.308 0.208 0.141 5% 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.585 0.557 0.530 0.505 0.481 0.458 0.436 0.416 0.396 0.377 0.295 0.231 0.142 0.087 6% .943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0.469 0.442 0.417 0.394 0.371 0.350 0.331 0.312 0.233 0.174 0.097 0054 0.054 7% 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0.362 0.339 0.317 0.296 0.277 0.258 0.184 0.131 0.067 0.034 8% 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.146 0.099 0.046 0.021 9% 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0.212 0.194 0.178 0.116 0.075 0.032 0.013 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 11% 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.074 0.044 0.015 0.005 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.059 0.033 0.011 0.003 0.828 0.164 0.820 0.780 0.742 0.672 0.608 0.149 0.092 0.057 0.022 0.009 Appendix B (concluded) Present value of $1 Period 13% 14% 0.885 0.877 0.783 0.769 0.693 .675 0.613 0.592 0.543 0.519 0.480 0.456 0.425 0.400 0.376 0.351 0.333 0.308 0.295 0.270 0.261 0.237 0.2310.208 0.204 0.182 0.181 0.160 0.160 0.140 0.141 0.123 0.125 0.108 0.111 0.095 0.098 0.083 0.087 0.073 0.047 0.038 0.026 0.020 0.008 0.005 0.002 0.001 15% 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 0.215 0.187 0.163 0.141 0.123 0.107 0.093 0.081 0.070 0.061 0.030 0.015 0.004 0.001 16% .862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 0.195 0.168 0.145 0.125 0.108 0.093 0.080 0.069 0.060 0.051 0.024 0.012 0.00 0.001 17% 0.855 0.731 0.624 0.534 0.456 0.390 0.333 0.285 0.243 0.208 0.178 0.152 0.130 0.111 0.095 0.081 0.069 0.059 0.051 0.043 0.020 0.009 0.002 18% 0.847 0.718 0.609 0.515 0.437 0.370 0.314 0.266 0.225 0.191 0.162 0.137 0.116 0.099 0.084 0.071 0.060 0.051 0.043 0.037 0.016 0.007 0.001 Percent 19% 0.840 0.706 0.593 0.499 0.419 0.352 . 296 0.249 0.209 0.176 0.148 0.124 0.104 0.088 0.074 0.062 0.052 0.044 0.037 0.031 0.013 0.005 0.001 20% 25% 30% 0.833 0.800 0.769 0.694 0.640 0.592 0.579 0.512 0.455 0.482 0.410 0.350 0.402 0.328 0.269 0.335 0.262 0.207 0.279 0.210 . 159 0.233 0.168 0.123 0.194 . 134 0.094 0.162 0.107 0.073 0.135 0.086 0.056 0.112 0.069 0.043 0.093 0.055 0.033 0.078 0.044 0.025 0.065 0.035 0.020 0.054 0.028 0.015 0.045 0.023 0.012 0.038 0.018 0.009 0.031 0.014 0.007 0.026 0.012 0.005 0.010 0.004 0.001 0.004 0.001 0.001 35% 0.741 0.549 0.406 0.301 0.223 0.165 0.122 0.091 0.067 0.050 0.037 0.027 0.020 0.015 0.011 0.00 0.006 0.005 0.003 0.002 0.001 40% 0.714 0.510 0.364 0.260 0.186 . 133 0.095 0.068 0.048 0.035 0.025 0.018 0.013 0.009 0.006 0.005 0.003 .002 0.002 0.001 50% 0.667 0.444 0.296 0.198 0.132 0.088 .059 0.039 0.026 0.017 0.012 0.008 0.005 0.003 0.002 0.002 0.001 0.001 Appendix D Present value of an annuity of $1, PVC PVA Period 0 1% 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9.471 10.368 11.255 12.134 13.004 13.865 14.718 15.562 16.398 17.226 18.046 22.023 25.808 32.835 39.196 2% 0.980 1.942 2.884 3.808 4.713 5.601 6.472 7.325 8.162 8.983 9.787 10.575 11.348 12.106 12.849 13.578 14.292 14.992 15.678 16.351 19.523 22.396 27.355 31.424 3% 0.971 1.913 2.829 3.717 4.580 5.417 6.230 7.020 7.786 8.530 9.253 9.954 10.635 11.296 11.938 4% 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9.385 9.986 10.563 11.118 11.652 12.166 12.659 13.134 13.590 15.622 17.292 19.793 21.482 5% 0.952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 10.380 10.838 11.274 11.690 12.085 12.462 14.094 15.372 17.159 18.256 Percent 6% 7% 0.943 0 .935 1.833 1.808 2.673 2.624 3.465 3.387 4.212 4.100 4.917 4.767 5.582 5.389 6.210 5.971 6.802 6.515 7.360 7.024 7.887 7.499 8.384 7.943 8.853 8.358 9.295 8.745 9.712 9.108 10.106 9.447 10.477 9.763 10.828 10.059 11.158 10.336 11.470 10.594 12.783 11.654 13.765 12.409 15.046 13.332 15.762 13.801 8% .926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9.604 9.818 10.675 11.258 11.925 12.233 9% 10% 11% 0.917 0.909 0.901 1.759 1.736 1.713 2.531 2.487 2.444 3.240 3.170 3.102 3.890 3.791 3.696 4.486 4.355 4.231 5.033 4.868 4.712 5.535 5.335 5.146 5.995 5.759 5.537 6.418 6.145 5.889 6.805 6.495 6.207 7.161 6.814 6.492 7.487 7.103 6.750 7.786 7.367 6.982 8.061 7.606 7.191 8.313 7.824 7.379 8.544 8.022 7.549 8.756 8.2017.702 8.950 8.365 7.839 9.129 8.514 7.963 9.823 9.077 8.422 10.274 9.427 8.694 10.757 9.7798.951 10.9629.915 9.042 12% 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 7.843 8.055 8.244 8.304 12.561 13.166 13.754 14.324 14.877 17.413 19.600 23.115 25.730 Appendix D (concluded) Present value of an annuity of $1 Period 13% 0.885 1.668 2.361 2.974 3.517 3.998 4.423 4.799 5.132 5.426 5.687 5.918 6.122 6.302 6.462 6.604 6.729 6.840 6.938 7.025 7.330 7.496 7.634 7.675 14% 0.877 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 5.453 5.660 5.842 6.002 6.142 6.265 6.373 6.467 6.550 6.623 6.873 7.003 7.105 7.133 15% 0.870 1.626 2.283 2.855 3.352 3.784 4.160 4.487 4.772 5.019 5.234 5.421 5.583 5.724 5.847 5.954 6.047 6.128 6.198 6.259 6.464 6.566 6.642 6.661 16% 0.862 1.605 2.246 2.798 3.274 3.685 4.039 4.344 4.607 4.833 5.029 5.197 5.342 5.468 5.575 5.668 5.749 5.818 5.877 5.929 6.097 6.177 6.233 6.246 Percent 17% 18% 19% 20% 25% 0.855 0.847 0.840 0.833 0.800 1.585 1.566 1.547 1.528 1.440 2.210 2.174 2.140 2.106 1.952 2.743 2.690 2.639 2.5892.362 3.199 3.127 3.058 2.991 2.689 3.589 3.498 3.410 3.326 2.951 3.922 3.812 3.706 3.605 3.161 4.207 4.078 3.954 3.837 3.329 4.451 4.303 4.163 4.031 3.463 4.659 4.494 4.339 4.192 3.571 4.836 4.656 4.486 4.327 3.656 4.988 4.793 4.611 4.439 3.725 5.118 4.910 4.715 4.533 3.780 5.229 5.008 4.802 4.611 3.824 5.324 5.092 4.876 4.675 3.859 5.405 5.162 4.938 4.730 3.887 5.475 5.222 4.988 4.775 3.910 5.534 5.273 5.033 4.812 3.928 5.584 5.316 5.070 4.843 3.942 5.628 5.3535.101 4.870 3.954 5.766 5.467 5.1954.948 3.985 5.8295.517 5.235 4.979 3.995 5.871 5.548 5.258 4.997 3.999 5.880 5.554 5.262 4.999 4.000 30% 0.769 1.361 1.816 2.166 2.436 2.643 2.802 2.925 3.019 3.092 3.147 3.190 3.223 3.249 3.268 3.283 3.295 3.304 3.311 3.316 3.329 3.332 3.333 3.333 35% 0.741 1.289 1.696 1.997 2.220 2.385 2.508 2.598 2.665 2.715 2.752 2.779 2.799 2.814 2.825 2.834 2.840 2.844 2.848 2.850 2.856 2.857 2.857 2.857 40% 0.714 1.224 1.589 1.849 2.035 2.168 2.263 2.331 2.379 2.414 2.438 2.456 2.469 2.478 2.484 2.489 2.492 2.494 2.496 2.497 2.499 2.500 2.500 2.500 50% 0.667 1.111 1.407 1.605 1.737 1.824 1.883 1.922 1.948 1.965 1.977 1.985 1.990 1.993 1.995 1.997 1.998 1.999 1.999 1.999 2.000 2.000 2.000 2.000