Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. If you were a creditor of Xerox, what reaction might you have to the above information? b. If you were an investor in Xerox,

a. If you were a creditor of Xerox, what reaction might you have to the above information?

b. If you were an investor in Xerox, what reaction might you have to the above information?

c. If you were evaluating the company as either a creditor or a stockholder, what other information would you be interested in seeing?

d. Xerox decided to bay a cash dividend. This dividend was approximately equal to the amount paid in the previous year. Discuss the issues that were probably considered in making this decision.

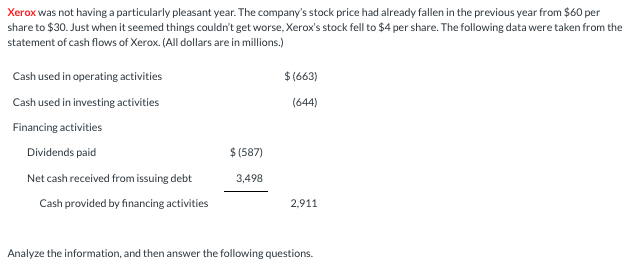

Xerox was not having a particularly pleasant year. The company's stock price had already fallen in the previous year from $60 per share to $30. Just when it seemed things couldn't get worse, Xerox's stock fell to $4 per share. The following data were taken from the statement of cash flows of Xerox. (All dollars are in millions.) Analyze the information, and then answer the following questionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started