Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A) In addition to the discussion of tax Incidence or who bore the burden of taxation through tax payments and price changes we can

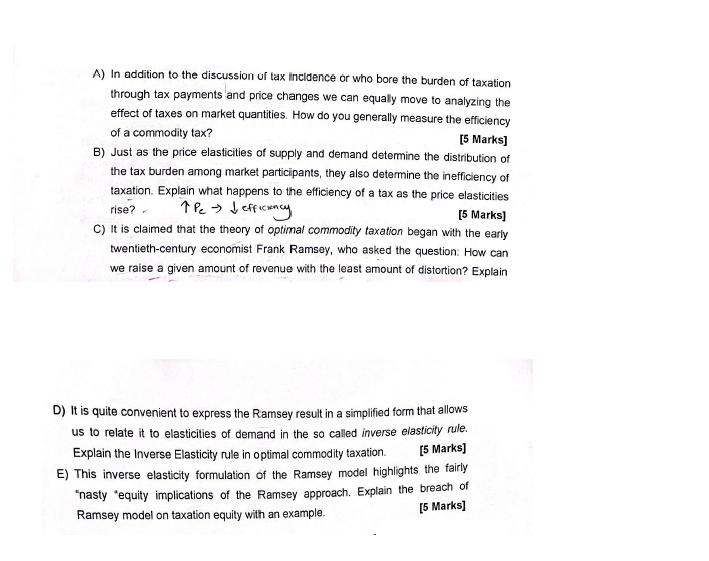

A) In addition to the discussion of tax Incidence or who bore the burden of taxation through tax payments and price changes we can equally move to analyzing the effect of taxes on market quantities. How do you generally measure the efficiency of a commodity tax? [5 Marks] B) Just as the price elasticities of supply and demand determine the distribution of the tax burden among market participants, they also determine the inefficiency of taxation. Explain what happens to the efficiency of a tax as the price elasticities Pc-> Jefficiency [5 Marks] rise? C) It is claimed that the theory of optimal commodity taxation began with the early twentieth-century economist Frank Ramsey, who asked the question: How can we raise a given amount of revenue with the least amount of distortion? Explain D) It is quite convenient to express the Ramsey result in a simplified form that allows us to relate it to elasticities of demand in the so called inverse elasticity rule. Explain the Inverse Elasticity rule in optimal commodity taxation. [5 Marks] E) This inverse elasticity formulation of the Ramsey model highlights the fairly "nasty "equity implications of the Ramsey approach. Explain the breach of [5 Marks] Ramsey model on taxation equity with an example.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started