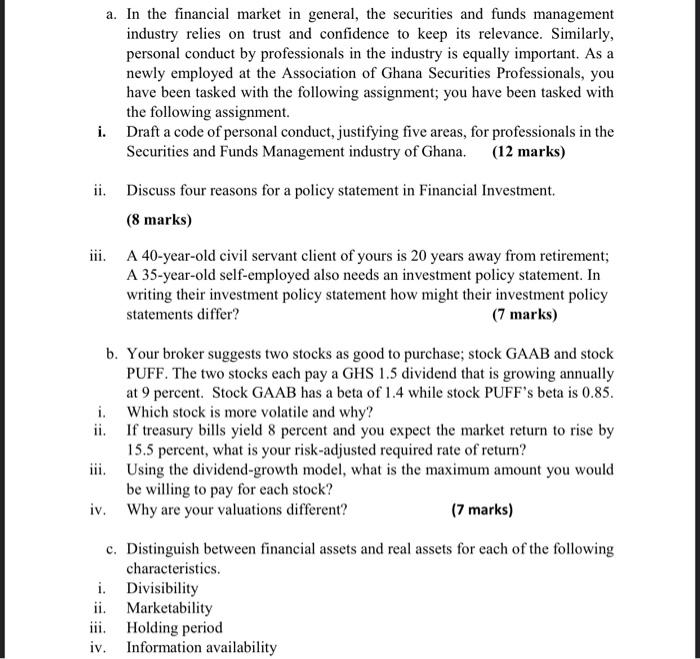

a. In the financial market in general, the securities and funds management industry relies on trust and confidence to keep its relevance. Similarly, personal conduct by professionals in the industry is equally important. As a newly employed at the Association of Ghana Securities Professionals, you have been tasked with the following assignment; you have been tasked with the following assignment. i. Draft a code of personal conduct, justifying five areas, for professionals in the Securities and Funds Management industry of Ghana. (12 marks) ii. Discuss four reasons for a policy statement in Financial Investment. (8 marks) iii. A 40-year-old civil servant client of yours is 20 years away from retirement; A 35-year-old self-employed also needs an investment policy statement. In writing their investment policy statement how might their investment policy statements differ? (7 marks) b. Your broker suggests two stocks as good to purchase; stock GAAB and stock PUFF. The two stocks each pay a GHS 1.5 dividend that is growing annually at 9 percent. Stock GAAB has a beta of 1.4 while stock PUFF's beta is 0.85. i. Which stock is more volatile and why? ii. If treasury bills yield 8 percent and you expect the market return to rise by 15.5 percent, what is your risk-adjusted required rate of return? iii. Using the dividend-growth model, what is the maximum amount you would be willing to pay for each stock? iv. Why are your valuations different? (7 marks) c. Distinguish between financial assets and real assets for each of the following characteristics. i. Divisibility ii. Marketability iii. Holding period iv. Information availability a. In the financial market in general, the securities and funds management industry relies on trust and confidence to keep its relevance. Similarly, personal conduct by professionals in the industry is equally important. As a newly employed at the Association of Ghana Securities Professionals, you have been tasked with the following assignment; you have been tasked with the following assignment. i. Draft a code of personal conduct, justifying five areas, for professionals in the Securities and Funds Management industry of Ghana. (12 marks) ii. Discuss four reasons for a policy statement in Financial Investment. (8 marks) iii. A 40-year-old civil servant client of yours is 20 years away from retirement; A 35-year-old self-employed also needs an investment policy statement. In writing their investment policy statement how might their investment policy statements differ? (7 marks) b. Your broker suggests two stocks as good to purchase; stock GAAB and stock PUFF. The two stocks each pay a GHS 1.5 dividend that is growing annually at 9 percent. Stock GAAB has a beta of 1.4 while stock PUFF's beta is 0.85. i. Which stock is more volatile and why? ii. If treasury bills yield 8 percent and you expect the market return to rise by 15.5 percent, what is your risk-adjusted required rate of return? iii. Using the dividend-growth model, what is the maximum amount you would be willing to pay for each stock? iv. Why are your valuations different? (7 marks) c. Distinguish between financial assets and real assets for each of the following characteristics. i. Divisibility ii. Marketability iii. Holding period iv. Information availability