a) Indicate which interest table you referred to (i.e., Tables 1, 2, 3, 4)

b) Indicate which of the following formulas you used to solve this problem:

1) FV = S x F(i,n)

2) PV = S x F(i,n)

3) FVA = I x F(i,n)

4) PVA = I x F(i,n)

c) Show your calculations for your answers

Assume annual compounding and a 6% annual rate in the following two scenarios:

Assume Val will not retire for 7 years. Beginning with the end of year 8 she will make the first of 10 annual withdrawals from her retirement account in the amount of $75,000 (i.e., each year). How much must she have in her retirement account today in order to make these annual withdrawals as planned?

What must Val have in her account today if the scenario is the same as (1) above except each of the ten annual withdrawals occur at the beginning of each year, starting with the beginning of year 8?

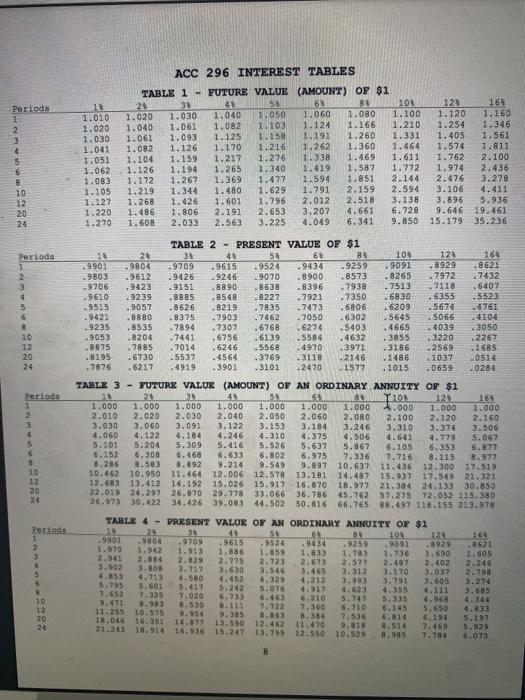

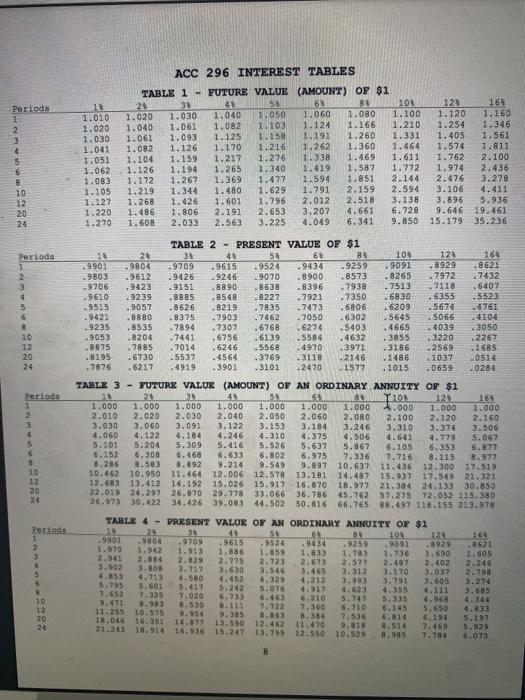

ACC 296 INTEREST TABLES Periods 1 2 3 4 5 6 8 10 12 20 24 1.010 1.020 1.030 1.041 1.051 1.062 1.083 1.105 1.127 1.220 1.270 TABLE 1 - FUTURE VALUE (AMOUNT) OF $1 23 31 40 51 6 B 101 121 1.020 1.030 1.040 1.050 1.060 1.080 1.100 1.120 1.040 1.061 1.082 1.103 1.124 1.166 1.210 1.254 1.061 1.093 1.125 1.158 1.191 1.260 1.331 1.405 1.082 1.126 1.170 1.216 1.262 1.360 1.464 1.574 1.104 1.159 1.217 1.276 1.338 1.469 1.611 1.762 1.126 1.194 1.265 1.340 1.419 1.587 1.772 1.974 1.172 1.267 1.369 1.477 1.594 1.851 2.144 2.476 1.219 1.344 1.480 1.629 1.791 2.159 2.594 3.106 1.268 1.426 1.601 1.796 2.012 2.518 3.138 3.896 1.486 1.806 2.191 2.653 3.207 4.661 6.728 9.646 1.60B 2.033 2.563 3.225 4.049 6.341 9.850 15.179 16 1.160 1.346 1.561 1.811 2.100 2.436 3.278 4.411 5.936 19.461 35.236 Periods 161 2 3 4 5 6 8 10 12 20 24 16 9901 9803 .9706 . 9610 .9515 .9421 .9235 .9053 .8875 .8195 .7876 25 +9804 .9612 .9423 .9239 . 9057 .8880 .8535 .8204 7885 .6730 -6217 TABLE 2 - PRESENT VALUE OF $1 38 48 58 65 88 .9709 .9615 9524 .9434 . 9259 -9426 9246 .9070 .8900 .8573 .9151 .8890 8638 .8396 7938 .8885 .8548 .8227 .7921 7350 .8626 .8219 .7835 7473 .6806 -8375 .7903 .7462 .7050 .6302 7894 .7307 .6768 .6274 .5403 7441 .6756 .6139 5584 4632 7014 .6246 .556 4970 3971 5537 .4564 .3769 -3118 .2146 . 4919 .3901 .3101 2470 . 1577 105 9091 8265 7513 6830 6209 5645 14665 3855 3186 . 1486 . 1015 124 8929 .7972 7118 6355 5674 5066 4039 3220 2569 . 1037 .0659 .8621 -7432 6402 .5523 .4761 4104 3050 2267 1685 0514 20284 Periods 2 3 6 TABLE 3 - FUTURE VALUE (AMOUNT) OF AN ORDINARY ANNUITY OF $1 11 21 45 50 65 21 YLON 123 169 1.000 1.000 1.000 1.000 1.000 1.000 1.000 4.000 1.000 1.000 2.010 2.020 2.030 2.040 2.050 2.060 2.080 2.100 2.120 2.169 3.030 3.060 3.091 3.122 3.153 3.184 3.246 3.310 3.374 3.506 4.060 4.122 4.184 4.246 4.310 4.375 4.506 4.6 4,779 5.067 5.101 5.204 5.309 5.416 5.526 5.637 5.867 6.105 6.353 6.877 6.152 6.300 6.468 6.633 6.802 6.975 7.336 7.716 8.115 8.977 8.286 8.583 8.892 9.214 9.549 9.897 10.637 11.436 12.300 17.519 10.462 10.950 11.464 12.006 12.528 13.181 14.482 15.937 17.549 21.321 12.683 13.412 14.192 15.026 15.917 16.870 18.972 21.384 24.133 30.850 22.019 24.297 26.870 29.778 33.066 36.786 45.762 57.275 72.052 115.380 26.973 30.422 34.426 39.083 44.502 50.816 66.765 88.497 118.155 213.578 6 8 10 12 20 24 Periods 1 2 4 TABLE 4 - PRESENT VALUE OF AN ORDINARY ANNUITY OF $1 20 41 31 61 101 123 9901 .9804 .9709 -9615 9524 9434 - 9091 18929 1.970 1.942 1.913 1.886 1.859 1.833 1.983 1.736 1.690 2.941 2.884 2.829 2.775 2.723 2.673 2.577 2.487 2.402 3.902 3.800 2.717 3.610 3.546 3.465 3.212 120 1.0.37 4.653 4.713 4.452 3.39 4.212 3.993 3.751 3.605 5.793 5.601 5.417 5.242 5.076 4.917 4.623 4.355 4.111 7.652 1.325 7.020 5.733 6.463 5.210 5.242 5.335 4.968 3.471 8.53 8.530 8.111 7.722 7.360 6.210 6.145 5.650 11.259 10.575 3.354 9.305 3.563 8.384 7:53 6.814 6.194 IR.046 16.351 16.677 13.590 12.462 11.470 9.10 8.510 7.469 21.243 18.914 16.936 15.247 13.755 12.550 10.529 8.905 7.784 16 .8621 1.605 2.246 2.798 3.274 3.685 4.344 4.833 5.197 5.929 6.073 10 12 20 24