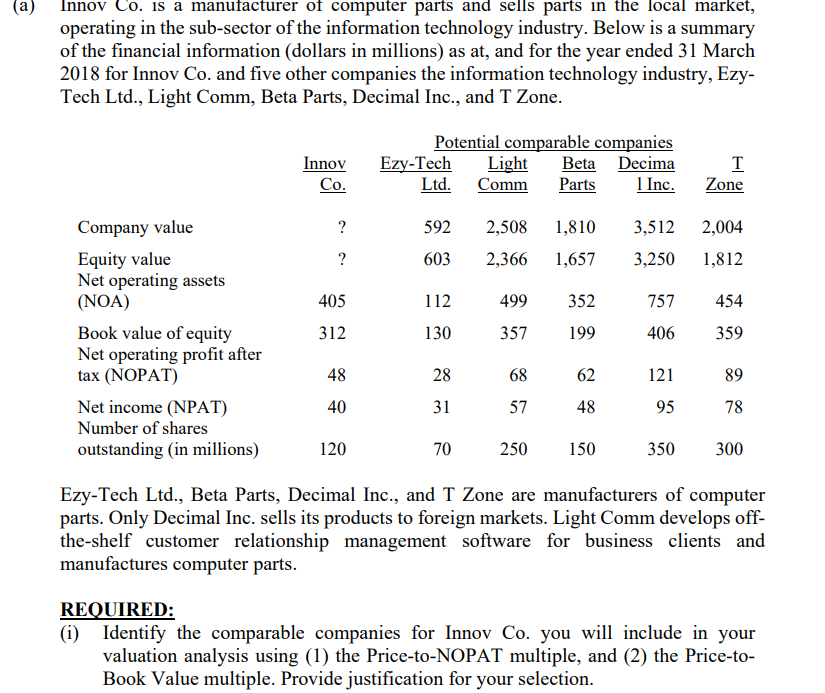

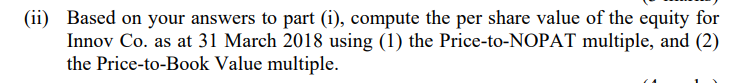

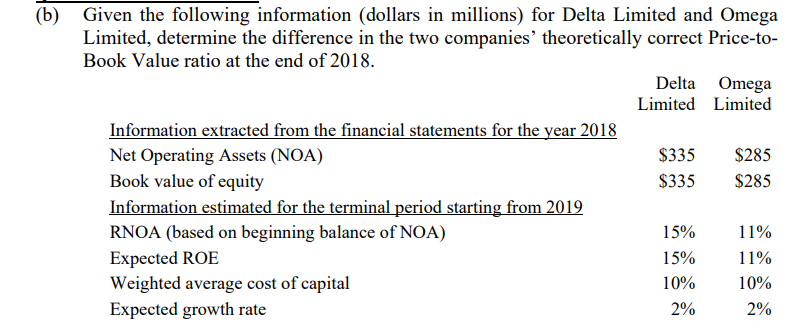

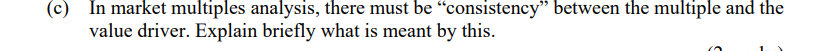

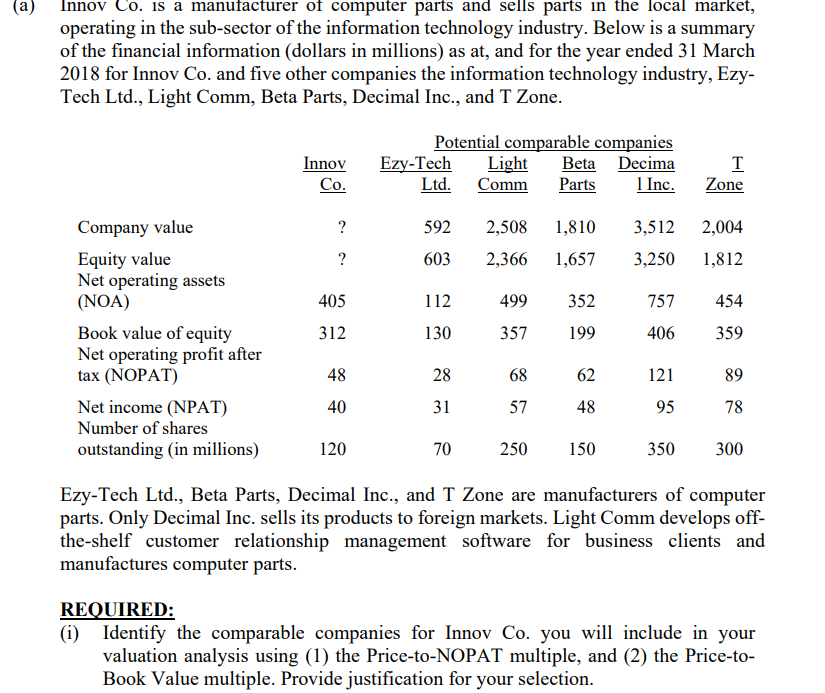

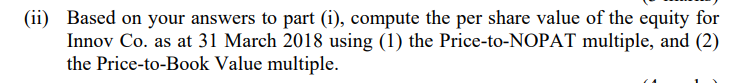

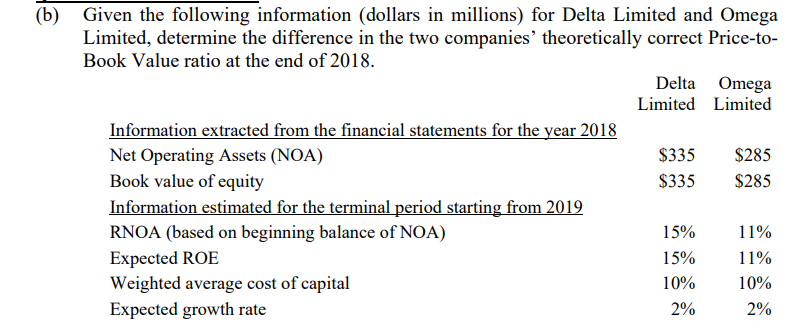

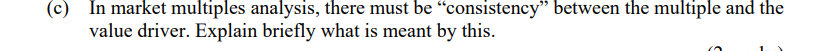

(a) Innov Co. is a manufacturer of computer parts and sells parts in the local market, operating in the sub-sector of the information technology industry. Below is a summary of the financial information (dollars in millions) as at, and for the year ended 31 March 2018 for Innov Co. and five other companies the information technology industry, Ezy- Tech Ltd., Light Comm, Beta Parts, Decimal Inc., and T Zone. Potential comparable companies Light Comm Ezy-Tech Ltd Beta Decima Inc Innov Co Parts Zone Company value 592 2,508 1,810 3,512 2,004 ? Equity value Net operating assets (NOA) 603 2,366 1,657 3,250 1,812 405 112 499 352 454 757 Book value of equity Net operating profit after tax (NOPAT) 312 130 357 199 406 359 48 28 68 62 121 89 40 31 Net income (NPAT) 57 48 95 78 Number of shares outstanding (in millions) 120 70 250 150 350 300 Ezy-Tech Ltd., Beta Parts, Decimal Inc., andT Zone are manufacturers of computer parts. Only Decimal Inc. sells its products to foreign markets. Light Comm develops off- the-shelf customer relationship management software for business clients and manufactures computer parts REQUIRED: (i) Identify the comparable companies for Innov Co. you will include in your valuation analysis using (1) the Price-to-NOPAT multiple, and (2) the Price-to- Book Value multiple. Provide justification for your selection on your answers to part (i), compute the per share value of the equity for Innov Co the Price-to-Book Value multiple. (ii) Based as at 31 March 2018 using (1) the Price-to-NOPAT multiple, and (2) (b) Given the following information (dollars in millions) for Delta Limited and Omega Limited, determine the difference in the two companies' theoretically correct Price-to- Book Value ratio at the end of 2018 Delta Omega Limited Limited Information extracted from the financial statements for the year 2018 Net Operating Assets (NOA) Book value of equity $335 $285 $335 $285 Information estimated for the terminal period starting from 2019 RNOA (based on beginning balance of NOA) 15% 11% Expected ROE Weighted average cost of capital 15% 11% 10% 10% Expected growth rate 2% 2% In market multiples analysis, there must be "consistency" between the multiple and the (c) value driver. Explain briefly what is meant by this (a) Innov Co. is a manufacturer of computer parts and sells parts in the local market, operating in the sub-sector of the information technology industry. Below is a summary of the financial information (dollars in millions) as at, and for the year ended 31 March 2018 for Innov Co. and five other companies the information technology industry, Ezy- Tech Ltd., Light Comm, Beta Parts, Decimal Inc., and T Zone. Potential comparable companies Light Comm Ezy-Tech Ltd Beta Decima Inc Innov Co Parts Zone Company value 592 2,508 1,810 3,512 2,004 ? Equity value Net operating assets (NOA) 603 2,366 1,657 3,250 1,812 405 112 499 352 454 757 Book value of equity Net operating profit after tax (NOPAT) 312 130 357 199 406 359 48 28 68 62 121 89 40 31 Net income (NPAT) 57 48 95 78 Number of shares outstanding (in millions) 120 70 250 150 350 300 Ezy-Tech Ltd., Beta Parts, Decimal Inc., andT Zone are manufacturers of computer parts. Only Decimal Inc. sells its products to foreign markets. Light Comm develops off- the-shelf customer relationship management software for business clients and manufactures computer parts REQUIRED: (i) Identify the comparable companies for Innov Co. you will include in your valuation analysis using (1) the Price-to-NOPAT multiple, and (2) the Price-to- Book Value multiple. Provide justification for your selection on your answers to part (i), compute the per share value of the equity for Innov Co the Price-to-Book Value multiple. (ii) Based as at 31 March 2018 using (1) the Price-to-NOPAT multiple, and (2) (b) Given the following information (dollars in millions) for Delta Limited and Omega Limited, determine the difference in the two companies' theoretically correct Price-to- Book Value ratio at the end of 2018 Delta Omega Limited Limited Information extracted from the financial statements for the year 2018 Net Operating Assets (NOA) Book value of equity $335 $285 $335 $285 Information estimated for the terminal period starting from 2019 RNOA (based on beginning balance of NOA) 15% 11% Expected ROE Weighted average cost of capital 15% 11% 10% 10% Expected growth rate 2% 2% In market multiples analysis, there must be "consistency" between the multiple and the (c) value driver. Explain briefly what is meant by this