Question

(a) Instead of the current payout policy, suppose NewEquity Inc. decides to pay out all their earnings as dividends forever. What would the intrinsic value

(a) Instead of the current payout policy, suppose NewEquity Inc. decides to pay out all their earnings as dividends forever. What would the intrinsic value of NewEquity Inc's stock be now?

(b)Instead of the current payout policy, suppose NewEquity inc. decides to change its payout ratio to 30% forever.What would the intrinsic value of NewEquity Inc's stock be now? Assume your answer for this question is the forecasted price for NewEquity lnc. in one year's time. What would be your rate of return if you purchased the stock today at the current price and sold it in one year's time?

(c)Have the intrinsic values for parts (a) and (b) changed or not? Explain why or why not. lf you were a shareholder of NewEquity lnc. which payout policy would you prefer? Explain your choice.

(d) Suppose you discover leaked information that NewEquity lnc. will be changing their payout ratio to 20% forever lf the market s (i) weak-form efficient, (ii) semi-strong efficient, or (iii strong-form efficient, could you gain abnormal returns from this information? Why or why not? Explain your answer under each form of market efficiency?

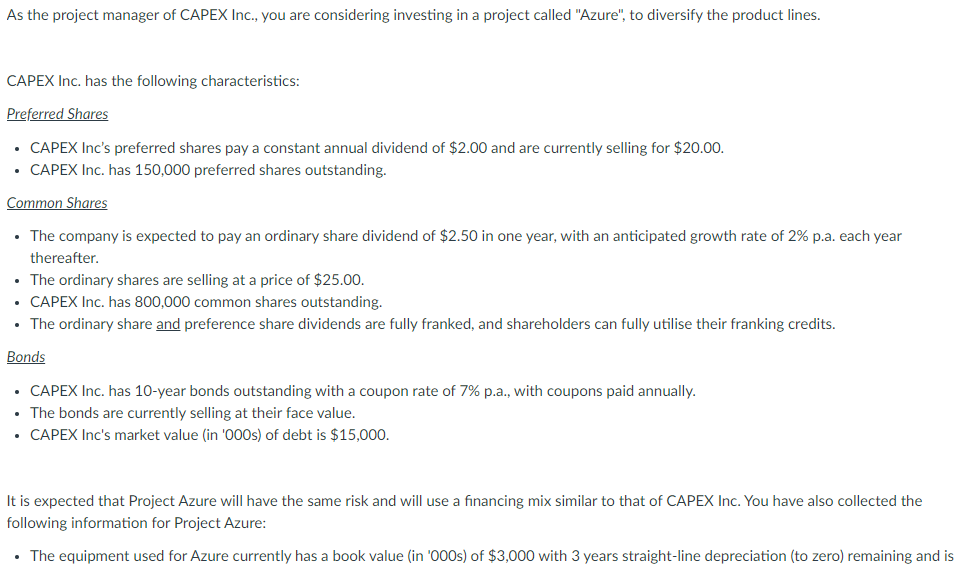

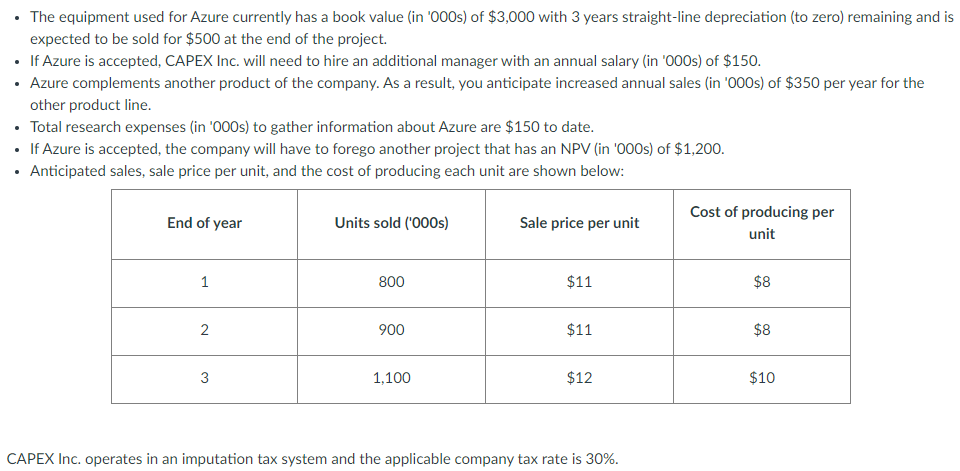

As the project manager of CAPEX Inc., you are considering investing in a project called "Azure", to diversify the product lines. CAPEX Inc. has the following characteristics: Preferred Shares CAPEX Inc's preferred shares pay a constant annual dividend of $2.00 and are currently selling for $20.00. CAPEX Inc. has 150,000 preferred shares outstanding. Common Shares The company is expected to pay an ordinary share dividend of $2.50 in one year, with an anticipated growth rate of 2% p.a. each year thereafter. The ordinary shares are selling at a price of $25.00. CAPEX Inc. has 800,000 common shares outstanding. The ordinary share and preference share dividends are fully franked, and shareholders can fully utilise their franking credits. Bonds CAPEX Inc. has 10-year bonds outstanding with a coupon rate of 7% p.a., with coupons paid annually. The bonds are currently selling at their face value. CAPEX Inc's market value in '000s) of debt is $15,000. It is expected that Project Azure will have the same risk and will use a financing mix similar to that of CAPEX Inc. You have also collected the following information for Project Azure: The equipment used for Azure currently has a book value (in '000s) of $3,000 with 3 years straight-line depreciation (to zero) remaining and is The equipment used for Azure currently has a book value (in '000s) of $3,000 with 3 years straight-line depreciation (to zero) remaining and is expected to be sold for $500 at the end of the project. If Azure is accepted, CAPEX Inc. will need to hire an additional manager with an annual salary (in '000s) of $150. Azure complements another product of the company. As a result, you anticipate increased annual sales (in '000s) of $350 per year for the other product line. Total research expenses (in '000s) to gather information about Azure are $150 to date. If Azure is accepted, the company will have to forego another project that has an NPV (in '000s) of $1,200. Anticipated sales, sale price per unit, and the cost of producing each unit are shown below: End of year Units sold ('000s) Sale price per unit Cost of producing per unit 1 800 $11 $8 2 900 $11 $8 3 1,100 $12 $10 CAPEX Inc. operates in an imputation tax system and the applicable company tax rate is 30%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started